Page 38 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 38

NSX – NHL Profile’s Stock Exchange Handbook: 2022 – Issue 1

TELEPHONE: 0026483-331-3000

Nictus Holdings Ltd. COMPANY SECRETARY: Veritas Eksekuteurskamer (Pty) Ltd.

TRANSFER SECRETARY: Veritas Eksekuteurskamer (Pty) Ltd.

NHL

SPONSOR: Simonis Storm Securities (Pty) Ltd.

AUDITORS: SGA Chartered Accountants and Auditors (Namibia)

CALENDAR Expected Status

Next Final Results Sep 2022 Unconfirmed

Annual General Meeting Nov 2022 Unconfirmed

Next Interim Results Mar 2023 Unconfirmed

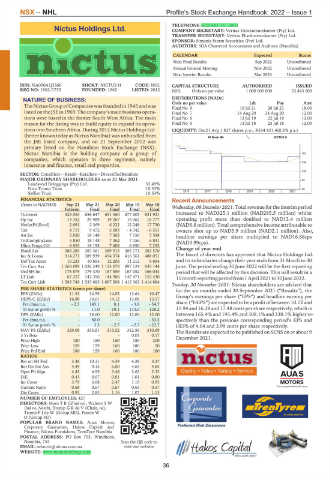

ISIN: NA000A1J2SS6 SHORT: NICTUS H CODE: NHL CAPITAL STRUCTURE AUTHORISED ISSUED

REG NO: 1962/1735 FOUNDED: 1962 LISTED: 2012 NHL Ords no par value 1 000 000 000 53 443 500

NATURE OF BUSINESS: DISTRIBUTIONS [NADc] Ldt Pay Amt

Ords no par value

The Nictus Group of Companies was founded in 1945 and was Final No 9 16 Jul 21 26 Jul 21 18.00

listed onthe JSEin1969. The company’s mainbusiness opera- Final No 7 14 Aug 20 24 Aug 20 12.00

tions were based in the former South West Africa. The main Final No 6 12 Jul 19 22 Jul 19 12.00

reason for the listing was to build equity to expand its opera- Final No 5 13 Jul 18 23 Jul 18 12.00

tions into Southern Africa. During 2012 Nictus Holdings Ltd. LIQUIDITY: Dec21 Avg 1 827 shares p.w., R334 821.4(0.2% p.a.)

(better known today as Nictus Namibia) was unbundled from 40 Week MA NICTUS H

the JSE listed company, and on 21 September 2012 was

primary listed on the Namibian Stock Exchange (NSX).

Nictus Namibia is the holding company of a group of 191

companies, which operates in three segments, namely

156

insurance and finance, retail and properties.

120

SECTOR: ConsDiscr—Retail—Retailers—DiversifiedRetailers

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021 85

Landswyd Beleggings (Pty) Ltd. 33.49%

Nico Tromp Trust 10.53% 50

Saffier Trust 10.53% 2016 | 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS Recent Announcements

(Amts in NAD'000) Sep 21 Mar 21 Mar 20 Mar 19 Mar 18

Interim Final Final Final Final Wednesday, 08 December 2021: Total revenue for the interim period

Turnover 325 053 656 647 631 060 677 603 831 921 increased to NAD325.1 million (NAD285.5 million) whilst

Op Inc 13 352 29 989 19 267 15 062 16 777 operating profit more than doubled to NAD13.4 million

NetIntPd(Rcvd) 2 691 2 369 6 222 12 248 17 730 (NAD6.6 million). Total comprehensive income attributable to

Tax 4 715 9 472 5 683 - 4 342 - 6 551 owners shot up to NAD5.9 million (NAD2.1 million). Also,

Att Inc 5 850 18 148 7 362 7 156 5 598 headline earnings per share multiplied to NAD16.88cps

TotCompIncLoss 5 850 18 148 7 362 7 156 6 841 (NAD3.99cps).

Hline Erngs-CO 8 853 18 158 7 408 6 850 7 255

Fixed Ass 386 289 387 461 389 915 385 773 383 570 Change of year end

Inv & Loans 314 271 389 939 454 374 416 561 488 051 The board of directors has approved that Nictus Holdings Ltd.

Def Tax Asset 10 235 10 693 12 206 11 212 9 894 and its subsidiaries change their year ends from 31 March to 30

Tot Curr Ass 1 069 899 1 026 249 1 133 079 897 124 835 144 June. The period ending 30 June 2022 will be the first reporting

Ord SH Int 175 875 179 470 167 559 167 052 166 044 period that will be affected by this decision. This will result in a

LT Liab 67 257 142 356 144 906 142 471 152 430 15monthreportingperiodfrom1April2021to30June2022.

Tot Curr Liab 1 583 749 1 533 685 1 697 508 1 415 363 1 414 884

Tuesday, 30 November 2021: Nictus shareholders are advised that

PER SHARE STATISTICS (cents per share) for the six months ended 30 September 2021 (“Results”), the

EPS (ZARc) 11.33 34.59 14.03 13.64 10.47

HEPS-C (ZARc) 16.88 34.61 14.12 13.06 13.57 Group’s earnings per share (“EPS”) and headline earning per

Pct chng p.a. - 2.5 145.1 8.1 - 3.8 - 54.7 share (“HEPS”) are expected to be a profit of between 10.72 and

Tr 5yr av grwth % - 11.0 - 19.1 113.0 138.2 11.94 and 16.28 and 17.48 cents per share respectively, which is

DPS (ZARc) - 18.00 12.00 12.00 12.00 between 165.4% and 195.4% and 308.1% and 338.1% higher re-

Pct chng p.a. - 50.0 - - - 33.3 spectively than the previous corresponding period’s EPS and

Tr 5yr av grwth % - 3.3 - 2.7 - 2.7 - 22.7 HEPS of 4.04 and 3.99 cents per share respectively.

NAV PS (ZARc) 329.08 335.81 313.52 312.56 310.69 The Results are expected to be published on SENS on or about 9

3 Yr Beta - - - 0.01 0.17 December 2021.

Price High 180 160 160 180 200

Price Low 159 159 160 180 50

Price Prd End 180 159 160 180 180

RATIOS

Ret on SH Fnd 3.38 10.11 4.39 4.28 3.37

Ret On Tot Ass 4.49 9.15 6.00 4.65 4.85

Oper Pft Mgn 4.45 4.95 3.48 2.63 2.32

D:E 0.41 0.67 0.81 1.01 0.80

Int Cover 3.79 6.68 2.47 1.19 0.95

Current Ratio 0.68 0.67 0.67 0.63 0.57

Div Cover 0.92 2.83 1.16 1.07 1.13

NUMBER OF EMPLOYEES: 427

DIRECTORS: HornTB(ld ind ne), Walters S W

(ind ne, Namb), TrompGRdeV (Chair, ne),

TrompPJdeW (Group MD), Fourie W

O (Group FD)

POPULAR BRAND NAMES: Auas Motors,

Corporate Guarantee, Hakos Capital and

Finance, Nictus Furnishers, TrenTyre Namibia

POSTAL ADDRESS: PO Box 755, Windhoek,

Namibia, 755 Scan the QR code to

EMAIL: wfourie@nictus.com.na visit our website

WEBSITE: www.nictusholdings.com

36