Page 40 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 40

NSX – PNH Profile’s Stock Exchange Handbook: 2022 – Issue 1

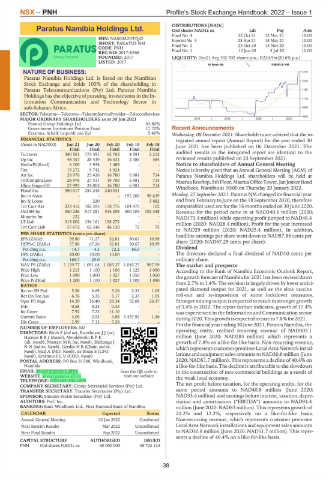

DISTRIBUTIONS [NADc]

Paratus Namibia Holdings Ltd. Ord shares NAD1c ea Ldt Pay Amt

PNH Final No 4 22 Oct 21 12 Nov 21 10.00

ISIN: NA000A2DTQ42 Interim No 3 23 Apr 21 14 May 21 10.00

SHORT: PARATUS NM Final No 2 23 Oct 20 13 Nov 20 10.00

CODE: PNH

REG NO: 2017/0558 Final No 1 12 Jun 20 3 Jul 20 10.00

FOUNDED: 2017 LIQUIDITY: Dec21 Avg 192 702 shares p.w., R224.9m(20.6% p.a.)

LISTED: 2017

40 Week MA PARATUS NM

NATURE OF BUSINESS: 1275

Paratus Namibia Holdings Ltd. is listed on the Namibian

1220

Stock Exchange and holds 100% of the shareholding in

Paratus Telecommunications (Pty) Ltd. Paratus Namibia 1165

Holdings has the objective of pursuing investments in the In-

1110

formation Communication and Technology Sector in

sub-Saharan Africa. 1055

SECTOR:Telecoms—Telecoms—TelecomServiceProvider—TelecomServices

1000

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021 2018 | 2019 | 2020 | 2021

Paratus Group Holdings Ltd. 43.80%

Government Insitutions Pension Fund 17.70% Recent Announcements

Erasmus, Schalk Leipoldt van Zyl 5.40% Wednesday, 08 December 2021: Shareholders are advised that the in-

FINANCIAL STATISTICS tegrated annual report (Annual Report) for the year ended 30

(Amts in NAD'000) Jun 21 Jun 20 Feb 20 Feb 19 Feb 18 June 2021 has been published on 06 December 2021. The

Final Final Final Final Final

Turnover 340 561 173 391 62 765 4 581 2 215 audited results in the integrated report are identical to the

Op Inc 48 357 28 439 16 531 2 386 584 reviewed results published on 23 September 2021.

NetIntPd(Rcvd) 6 109 3 934 1 489 - - Notice to shareholders of Annual General Meeting

Tax 13 272 5 742 4 924 - - Notice is hereby given that an Annual General Meeting (AGM) of

Att Inc 28 976 25 426 16 780 6 981 714 Paratus Namibia Holdings Ltd. shareholders will be held at

TotCompIncLoss 28 976 27 411 19 700 6 981 714 Maerua Rooftop, 5th Floor, Maerua Office Tower, Jan Jonker Road

Hline Erngs-CO 27 997 24 005 16 780 6 981 714 Windhoek, Namibia at 10:00 on Thursday 20 January 2022.

Fixed Ass 390 017 254 244 240 031 - -

Inv in Assoc - - - 195 206 98 639 Monday, 27 September 2021: Paratus NM changed its financial year

Inv & Loans - 220 - - 3 682 end from February to June on the 18 September 2020, therefore

Tot Curr Ass 233 412 182 395 178 776 104 970 102 comparables used are for the 16 months ended on 30 June 2020.

Ord SH Int 550 236 517 281 514 308 300 104 102 348 Revenue for the period came in at NAD340.6 million (2020:

Minority Int 222 - - - - NAD173.4 million) while operating profit jumped to NAD48.4

LT Liab 313 802 156 161 158 272 - - million (2020: NAD28.4 million). Profit for the year increased

Tot Curr Liab 57 672 62 346 46 120 72 75

to NAD29 million (2020: NAD25.4 million). In addition,

PER SHARE STATISTICS (cents per share) headline earnings per share went down to NAD57.86 cents per

EPS (ZARc) 59.80 71.27 52.81 30.67 10.99

HEPS-C (ZARc) 57.86 67.26 52.81 30.67 10.99 share (2020: NAD67.29 cents per share).

Pct chng p.a. 14.7 - 4.5 72.2 86.0 - Dividend

DPS (ZARc) 20.00 10.00 10.00 - - The directors declared a final dividend of NAD10 cents per

Pct chng p.a. 166.7 - 25.0 - - - ordinary share.

NAV PS (ZARc) 1 129.77 1 091.64 1 085.37 1 045.27 987.59 The market and prospects

Price High 1 215 1 100 1 100 1 125 1 050 According to the Bank of Namibia Economic Outlook Report,

Price Low 1 090 1 000 1 027 1 050 1 050 the growth forecast of Namibia for 2021 has been revised down

Price Prd End 1 200 1 100 1 027 1 100 1 050

RATIOS from 2.7% to 1.4%. The revision is largely driven by lower antici-

Ret on SH Fnd 5.26 3.69 3.26 2.33 1.05 pated diamond output for 2021, as well as the slow vaccine

Ret On Tot Ass 6.76 5.33 5.17 2.33 1.05 roll-out and re-imposition of some lockdown measures.

Oper Pft Mgn 14.20 16.40 26.34 52.08 26.37 Stronger mining output is expected to result in stronger growth

D:E 0.58 0.33 0.33 - - of 3.4% in 2022. The report further indicates, growth of 17.4%

Int Cover 7.92 7.23 11.10 - - was experienced in the Information and Communication sector

Current Ratio 4.05 2.93 3.88 1 457.92 1.36 during2020.Thisgrowthisexpectedtoeaseto7.8%for2021.

Div Cover 2.99 7.13 5.28 - -

Forthe financialyearending30June2021, ParatusNamibia, the

NUMBER OF EMPLOYEES: 202

DIRECTORS: Birch S (ind ne), EsterhuyseJJ(ne), operating entity, realised recurring revenue of NAD305.1

HarmseBRJ(Namb), MendelsohnRPK million (June 2020: NAD283 million) which represents a

(alt, Namb), MostertMR(ne, Namb), Shikongo J growth of 7.8% on a like-for-like basis. Non-recurring revenue,

NN(ind ne, Namb), Gerdes H B (Chair, ind ne, which represents customer premises Local Area Network instal-

Namb), Hall A (MD, Namb), de Bruin S (CFO, lations and equipment sales amounts to NAD30.8 million (June

Namb), ErasmusSLV (COO, Namb)

POSTAL ADDRESS: PO Box 81588, Windhoek, 2020: NAD51.7 million). This represents a decline of 40.4% on

Namibia a like-for-like basis. The decline is attributable to the slowdown

EMAIL: invest@paratus.africa Scan the QR code to in the construction of new commercial buildings as a result of

WEBSITE: invest.paratus.africa visit our website the weak local economy.

TELEPHONE: 0026483-300-1000 The net profit before taxation, for the operating entity, for the

COMPANY SECRETARY: Cronje Secretarial Services (Pty) Ltd.

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd. same period amounts to NAD40.8 million (June 2020:

SPONSOR: Simonis Storm Securities (Pty) Ltd. NAD33.4 million) and earnings before interest, taxation, depre-

AUDITORS: PwC Inc. ciation and amortisation (“EBITDA”) amounts to NAD94.4

BANKERS: Bank Windhoek Ltd., First National Bank of Namibia million (June 2020: NAD83 million). This represents growth of

CALENDAR Expected Status 22.2% and 12.2%, respectively on a like-for-like basis.

Annual General Meeting 20 Jan 2022 Confirmed Non-recurring revenue, which represents customer premises

Next Interim Results Mar 2022 Unconfirmed Local Area Network installations and equipment sales amounts

Next Final Results Sep 2022 Unconfirmed to NAD30.8 million (June 2020: NAD51.7 million). This repre-

sents a decline of 40.4% on a like-for-like basis.

CAPITAL STRUCTURE AUTHORISED ISSUED

PNH Ord shares NAD1c ea 60 000 000 48 723 123

38