Page 36 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 36

NSX – MOC Profile’s Stock Exchange Handbook: 2022 – Issue 1

DIRECTORS: Angula E (ind ne, Namb), Hornung S (ind ne),

Mobile Telecommunications Ltd. Kandongo E (ind ne), Rhoda A, Rossouw B (ind ne, Namb), Smith L (ne),

WaltersSW(ind ne, Namb), Young G (ind ne), Pillay A (Chair, ne),

MOC

ISIN: NA000A3CR803 SHORT: MTC LTD CODE: MOC Shaanika T (CEO, Namb), Uisso B (CFO)

REG NO: 94/458 FOUNDED: 1994 LISTED: 2021 MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020

NATURE OF BUSINESS: MTC is the largest mobile telecommunications Coronation Investment Management (Pty) Ltd. 40.05%

operator in Namibia, with 2.6 million active subscribers. For over 26 years, Orban Street Trust 21.00%

MTC has grown revenue and retained customers by providing voice and First National Bank (Namibia) Nominees 18.46%

data services and solutions to post-paid and prepaid individual and POSTAL ADDRESS: PO Box 23329, Windhoek, Namibia

business customers through its extensive telecommunications MORE INFO: www.sharedata.co.za/sdo/jse/NAM

transmission and distribution network, serviced by 35 mobile homes, 29 COMPANY SECRETARY: Ndapwa Kwedhi (Acting)

dealerships (airtime sellers and distributors), 24-hour customer contact TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

centre, digital channels and a network management and technical quality

centre (For immediate response to customer complaints). SPONSOR: IJG Securities (Pty) Ltd.

SECTOR: Telecoms-Telecoms-TelecomServiceProvider-TelecomServices AUDITORS: Ernst & Young

NUMBER OF EMPLOYEES: 568 CAPITAL STRUCTURE AUTHORISED ISSUED

DIRECTORS: GallowaySS(ind ne), GawaxabTC(ind ne), NAM Ords NAD1c ea 300 000 000 200 000 000

MutekaTNZ(ld ind ne), NashilongoEE(ind ne), Schuckmann W

(ind ne), ShipikiRDR(ne), Mberirua T (Chair, ind ne), DISTRIBUTIONS [NADc]

Erastus Dr L R (MD), Smit M J (FD) Ords NAD1c ea Ldt Pay Amt

POSTAL ADDRESS: P O Box 23051, Windhoek, Namibia Final No 20 26 Nov 21 13 Dec 21 7.00

MORE INFO: www.sharedata.co.za/sdo/jse/MOC Final No 19 27 Nov 20 11 Dec 20 7.00

COMPANY SECRETARY: Ndahambelela Haikali LIQUIDITY: Jan22 Avg 36 123 shares p.w., R2.4m(0.9% p.a.)

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

FINSA 40 Week MA NAM

SPONSOR: IJG Securities (Pty) Ltd.

AUDITORS: Deloitte 87

CAPITAL STRUCTURE AUTHORISED ISSUED

78

MOC Ords NAD3.3c ea 750 000 000 750 000 000

DISTRIBUTIONS [NADc] 69

Ords NAD3.3c ea Ldt Pay Amt

Final No 1 14 Jan 22 4 Feb 22 32.00 59

LIQUIDITY: Jan22 Avg 29 791 shares p.w., R26.3m(0.2% p.a.) 50

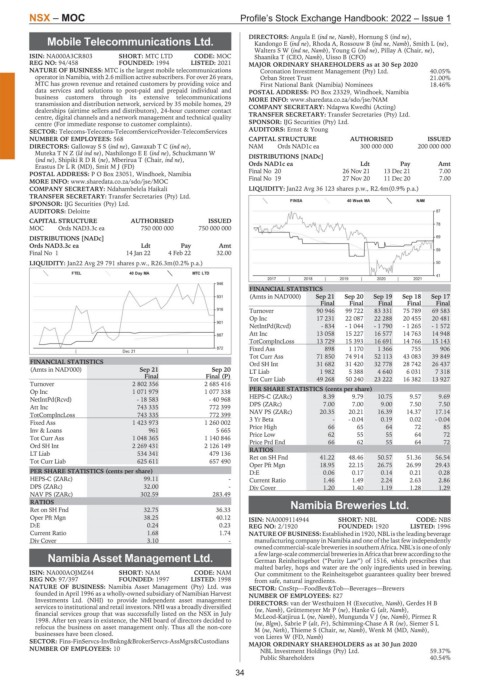

FTEL 40 Day MA MTC LTD

41

2017 | 2018 | 2019 | 2020 | 2021

946

FINANCIAL STATISTICS

931 (Amts in NAD'000) Sep 21 Sep 20 Sep 19 Sep 18 Sep 17

Final Final Final Final Final

916

Turnover 90 946 99 722 83 331 75 789 69 583

Op Inc 17 231 22 087 22 288 20 455 20 481

901

NetIntPd(Rcvd) - 834 - 1 044 - 1 790 - 1 265 - 1 572

Att Inc 13 058 15 227 16 577 14 763 14 948

887

TotCompIncLoss 13 729 15 393 16 691 14 766 15 143

872 Fixed Ass 898 1 170 1 366 755 906

| Dec 21 |

Tot Curr Ass 71 850 74 914 52 113 43 083 39 849

FINANCIAL STATISTICS Ord SH Int 31 682 31 420 32 778 28 742 26 437

(Amts in NAD'000) Sep 21 Sep 20 LT Liab 1 982 5 388 4 640 6 031 7 318

Final Final (P) Tot Curr Liab 49 268 50 240 23 222 16 382 13 927

Turnover 2 802 356 2 685 416

PER SHARE STATISTICS (cents per share)

Op Inc 1 071 979 1 077 338

NetIntPd(Rcvd) - 18 583 - 40 968 HEPS-C (ZARc) 8.39 9.79 10.75 9.57 9.69

Att Inc 743 335 772 399 DPS (ZARc) 7.00 7.00 9.00 7.50 7.50

TotCompIncLoss 743 335 772 399 NAV PS (ZARc) 20.35 20.21 16.39 14.37 17.14

Fixed Ass 1 423 973 1 260 002 3 Yr Beta - - 0.04 0.19 0.02 - 0.04

Inv & Loans 961 5 665 Price High 66 65 64 72 85

Tot Curr Ass 1 048 365 1 140 846 Price Low 62 55 55 64 72

Price Prd End

55

64

62

66

72

Ord SH Int 2 269 431 2 126 149

LT Liab 534 341 479 136 RATIOS 41.22 48.46 50.57 51.36 56.54

Ret on SH Fnd

Tot Curr Liab 625 611 657 490

Oper Pft Mgn 18.95 22.15 26.75 26.99 29.43

PER SHARE STATISTICS (cents per share) D:E 0.06 0.17 0.14 0.21 0.28

HEPS-C (ZARc) 99.11 - Current Ratio 1.46 1.49 2.24 2.63 2.86

DPS (ZARc) 32.00 - Div Cover 1.20 1.40 1.19 1.28 1.29

NAV PS (ZARc) 302.59 283.49

RATIOS Namibia Breweries Ltd.

Ret on SH Fnd 32.75 36.33

NBS

Oper Pft Mgn 38.25 40.12 ISIN: NA0009114944 SHORT: NBL CODE: NBS

D:E 0.24 0.23 REG NO: 2/1920 FOUNDED: 1920 LISTED: 1996

Current Ratio 1.68 1.74 NATURE OF BUSINESS: Established in 1920, NBL is the leading beverage

Div Cover 3.10 - manufacturing company in Namibia and one of the last few independently

owned commercial-scale breweries in southern Africa. NBL's is one of only

Namibia Asset Management Ltd. a few large-scale commercial breweries in Africa that brew according to the

German Reinheitsgebot (“Purity Law”) of 1516, which prescribes that

NAM malted barley, hops and water are the only ingredients used in brewing.

ISIN: NA000AOJMZ44 SHORT: NAM CODE: NAM Our commitment to the Reinheitsgebot guarantees quality beer brewed

REG NO: 97/397 FOUNDED: 1997 LISTED: 1998 from safe, natural ingredients.

NATURE OF BUSINESS: Namibia Asset Management (Pty) Ltd. was SECTOR: CnsStp—FoodBev&Tob—Beverages—Brewers

founded in April 1996 as a wholly-owned subsidiary of Namibian Harvest NUMBER OF EMPLOYEES: 827

Investments Ltd. (NHI) to provide independent asset management DIRECTORS: van der Westhuizen H (Executive, Namb), Gerdes H B

services to institutional and retail investors. NHI was a broadly diversified (ne, Namb), Grüttemeyer Mr P (ne), Hanke G (alt, Namb),

financial services group that was successfully listed on the NSX in July McLeod-Katjirua L (ne, Namb), MungundaVJ(ne, Namb), Pirmez R

1998. After ten years in existence, the NHI board of directors decided to (ne, Blgm), Sabrie P (alt, Fr), Schimming-ChaseAR(ne), Siemer S L

refocus the business on asset management only. Thus all the non-core M(ne, Neth), Thieme S (Chair, ne, Namb), Wenk M (MD, Namb),

businesses have been closed. von Lieres W (FD, Namb)

SECTOR: Fins-FinServcs-InvBnkng&BrokerServcs-AssMgrs&Custodians MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

NUMBER OF EMPLOYEES: 10

NBL Investment Holdings (Pty) Ltd. 59.37%

Public Shareholders 40.54%

34