Page 42 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 42

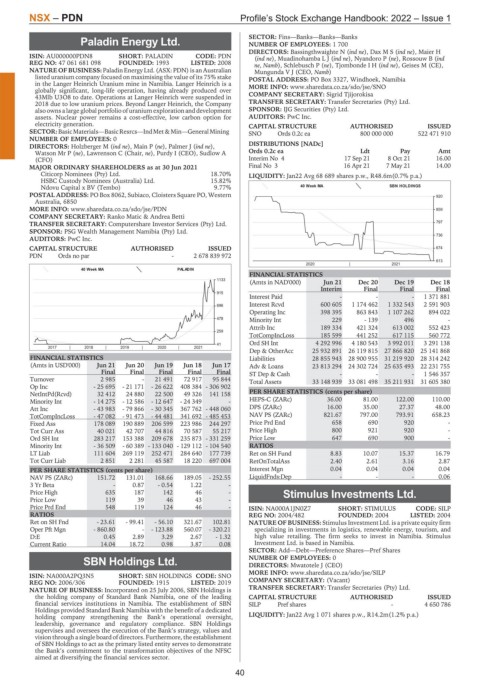

NSX – PDN Profile’s Stock Exchange Handbook: 2022 – Issue 1

SECTOR: Fins—Banks—Banks—Banks

Paladin Energy Ltd. NUMBER OF EMPLOYEES: 1 700

PDN DIRECTORS: Bassingthwaighte N (ind ne), DaxMS(ind ne), Maier H

ISIN: AU000000PDN8 SHORT: PALADIN CODE: PDN (ind ne), MuadinohambaLJ(ind ne), Nyandoro P (ne), Rossouw B (ind

REG NO: 47 061 681 098 FOUNDED: 1993 LISTED: 2008 ne, Namb), Schlebusch P (ne), TjombondeIH(ind ne), Geises M (CE),

NATURE OF BUSINESS: Paladin Energy Ltd. (ASX: PDN) is an Australian Mungunda V J (CEO, Namb)

listed uranium company focused on maximising the value of its 75% stake POSTAL ADDRESS: PO Box 3327, Windhoek, Namibia

in the Langer Heinrich Uranium mine in Namibia. Langer Heinrich is a MORE INFO: www.sharedata.co.za/sdo/jse/SNO

globally significant, long-life operation, having already produced over

43Mlb U3O8 to date. Operations at Langer Heinrich were suspended in COMPANY SECRETARY: Sigrid Tjijorokisa

2018 due to low uranium prices. Beyond Langer Heinrich, the Company TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

also owns a large global portfolio of uranium exploration and development SPONSOR: IJG Securities (Pty) Ltd.

assets. Nuclear power remains a cost-effective, low carbon option for AUDITORS: PwC Inc.

electricity generation. CAPITAL STRUCTURE AUTHORISED ISSUED

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining SNO Ords 0.2c ea 800 000 000 522 471 910

NUMBER OF EMPLOYEES: 0

DIRECTORS: Holzberger M (ind ne), Main P (ne), Palmer J (ind ne), DISTRIBUTIONS [NADc]

Watson Mr P (ne), Lawrenson C (Chair, ne), Purdy I (CEO), Sudlow A Ords 0.2c ea Ldt Pay Amt

(CFO) Interim No 4 17 Sep 21 8 Oct 21 16.00

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021 Final No 3 16 Apr 21 7 May 21 14.00

Citicorp Nominees (Pty) Ltd. 18.70% LIQUIDITY: Jan22 Avg 68 689 shares p.w., R48.6m(0.7% p.a.)

HSBC Custody Nominees (Australia) Ltd. 15.82%

Ndovu Capital x BV (Tembo) 9.77% 40 Week MA SBN HOLDINGS

POSTAL ADDRESS: PO Box 8062, Subiaco, Cloisters Square PO, Western 920

Australia, 6850

MORE INFO: www.sharedata.co.za/sdo/jse/PDN 859

COMPANY SECRETARY: Ranko Matic & Andrea Betti

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 797

SPONSOR: PSG Wealth Management Namibia (Pty) Ltd.

AUDITORS: PwC Inc. 736

CAPITAL STRUCTURE AUTHORISED ISSUED 674

PDN Ords no par - 2 678 839 972

613

2020 | 2021

40 Week MA PALADIN

FINANCIAL STATISTICS

1133

(Amts in NAD'000) Jun 21 Dec 20 Dec 19 Dec 18

Interim Final Final Final

915

Interest Paid - - - 1 371 881

696 Interest Rcvd 600 605 1 174 462 1 332 543 2 591 903

Operating Inc 398 395 863 843 1 107 262 894 022

478 Minority Int 229 - 139 496 -

Attrib Inc 189 334 421 324 613 002 552 423

259

TotCompIncLoss 185 599 441 252 617 115 560 772

41 Ord SH Int 4 292 996 4 180 543 3 992 011 3 291 138

2017 | 2018 | 2019 | 2020 | 2021

Dep & OtherAcc 25 932 891 26 119 815 27 866 820 25 141 868

FINANCIAL STATISTICS Liabilities 28 855 943 28 900 955 31 219 920 28 314 242

(Amts in USD'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 Adv & Loans 23 813 294 24 302 724 25 635 493 22 231 755

Final Final Final Final Final ST Dep & Cash - - - 1 546 357

Turnover 2 985 - 21 491 72 917 95 844 Total Assets 33 148 939 33 081 498 35 211 931 31 605 380

Op Inc - 25 695 - 21 171 - 26 622 408 384 - 306 902

NetIntPd(Rcvd) 32 412 24 880 22 500 49 326 141 158 PER SHARE STATISTICS (cents per share)

Minority Int - 14 275 - 12 586 - 12 647 - 24 349 - HEPS-C (ZARc) 36.00 81.00 122.00 110.00

Att Inc - 43 983 - 79 866 - 30 345 367 762 - 448 060 DPS (ZARc) 16.00 35.00 27.37 48.00

TotCompIncLoss - 47 082 - 91 473 - 44 481 341 692 - 485 453 NAV PS (ZARc) 821.67 797.00 793.91 658.23

Fixed Ass 178 089 190 889 206 599 223 986 244 297 Price Prd End 658 690 920 -

Tot Curr Ass 40 021 42 707 44 816 70 587 55 217 Price High 800 921 920 -

Ord SH Int 283 217 153 388 209 678 235 873 - 331 259 Price Low 647 690 900 -

Minority Int - 36 509 - 60 389 - 133 040 - 129 112 - 104 540 RATIOS

LT Liab 111 604 269 119 252 471 284 640 177 739 Ret on SH Fund 8.83 10.07 15.37 16.79

Tot Curr Liab 2 851 2 281 45 587 18 220 697 004 RetOnTotalAss 2.40 2.61 3.16 2.87

PER SHARE STATISTICS (cents per share) Interest Mgn 0.04 0.04 0.04 0.04

NAV PS (ZARc) 151.72 131.01 168.66 189.05 - 252.55 LiquidFnds:Dep - - - 0.06

3 Yr Beta - 0.87 - 0.54 1.22 -

Price High 635 187 142 46 - Stimulus Investments Ltd.

Price Low 119 39 46 43 -

SILP

Price Prd End 548 119 124 46 - ISIN: NA000A1JN0Z7 SHORT: STIMULUS CODE: SILP

RATIOS REG NO: 2004/482 FOUNDED: 2004 LISTED: 2004

Ret on SH Fnd - 23.61 - 99.41 - 56.10 321.67 102.81 NATURE OF BUSINESS: Stimulus Investment Ltd. is a private equity firm

Oper Pft Mgn - 860.80 - - 123.88 560.07 - 320.21 specializing in investments in logistics, renewable energy, tourism, and

D:E 0.45 2.89 3.29 2.67 - 1.32 high value retailing. The firm seeks to invest in Namibia. Stimulus

Current Ratio 14.04 18.72 0.98 3.87 0.08 Investment Ltd. is based in Namibia.

SECTOR: Add—Debt—Preference Shares—Pref Shares

SBN Holdings Ltd. NUMBER OF EMPLOYEES: 0

DIRECTORS: Mwatotele J (CEO)

SNO MORE INFO: www.sharedata.co.za/sdo/jse/SILP

ISIN: NA000A2PQ3N5 SHORT: SBN HOLDINGS CODE: SNO

REG NO: 2006/306 FOUNDED: 1915 LISTED: 2019 COMPANY SECRETARY: (Vacant)

NATURE OF BUSINESS: Incorporated on 25 July 2006, SBN Holdings is TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

the holding company of Standard Bank Namibia, one of the leading CAPITAL STRUCTURE AUTHORISED ISSUED

financial services institutions in Namibia. The establishment of SBN SILP Pref shares - 4 650 786

Holdings provided Standard Bank Namibia with the benefit of a dedicated

holding company strengthening the Bank’s operational oversight, LIQUIDITY: Jan22 Avg 1 071 shares p.w., R14.2m(1.2% p.a.)

leadership, governance and regulatory compliance. SBN Holdings

supervises and oversees the execution of the Bank’s strategy, values and

vision through a single board of directors. Furthermore, the establishment

of SBN Holdings to act as the primary listed entity serves to demonstrate

the Bank’s commitment to the transformation objectives of the NFSC

aimed at diversifying the financial services sector.

40