Page 34 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 34

NSX – FSY Profile’s Stock Exchange Handbook: 2022 – Issue 1

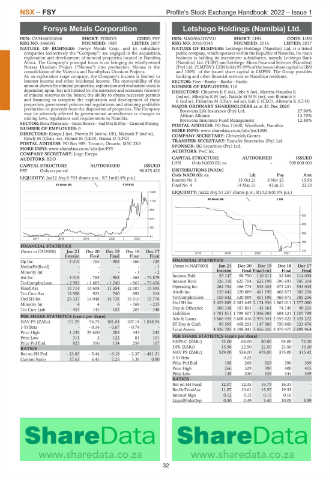

Forsys Metals Corporation Letshego Holdings (Namibia) Ltd.

FSY LHN

ISIN: CA34660G1046 SHORT: FORSYS CODE: FSY ISIN: NA000A2DVV41 SHORT: LHN CODE: LHN

REG NO: 34660G FOUNDED: 1985 LISTED: 2007 REG NO: 2016/0145 FOUNDED: 2016 LISTED: 2017

NATURE OF BUSINESS: Forsys Metals Corp. and its subsidiary NATURE OF BUSINESS: Letshego Holdings (Namibia) Ltd. is a listed

companies (collectively the “Company”) are engaged in the acquisition, public company, which operates within the Republic of Namibia. Its main

exploration and development of mineral properties located in Namibia, business is holding its investment subsidiaries, namely Letshego Bank

Africa. The Company’s principal focus is on bringing its whollyowned (Namibia) Ltd. (‘LBN') and Letshego Micro Financial Services (Namibia)

Norasa Uranium Project (“Norasa”) into production. Norasa is the (Pty) Ltd.(‘LMFSN'). LHNholds99.99% ofthe issuedsharecapitalinLBN

consolidation of the Valencia and Namibplaas Uranium Projects. and 100% of the issued share capital in LMFSN. The Group provides

As an exploration stage company, the Company’s income is limited to banking and other financial services to Namibian residents.

interest income and other incidental income. The recoverability of the SECTOR: Fins—Banks—Banks—Banks

amount shown for mineral properties, exploration and evaluation costs is NUMBER OF EMPLOYEES: 116

dependent upon, but not limited to: the existence and economic recovery DIRECTORS: ChiusiwaKE(ne), Jobe S (ne), Martins-Hausiku R

of mineral reserves in the future; the ability to obtain necessary permits (ind ne), MbetjihaRM(ne), NakaleMMN(ne), von Blottnitz S

and financing to complete the exploration and development of these B(ind ne), Palanduz M (Chair, ind ne), Kali E (CEO), Altmann K (CFO)

properties; government policies and regulations; and attaining profitable MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

production or proceeds from the disposition of properties. The Company Botswana Life Insurance (Pty) Ltd. 27.90%

may be adversely affected by governmental amendments or changes to African Alliance 13.70%

mining laws, regulations and requirements in Namibia. Botswana Insurance Fund Management 12.80%

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining POSTAL ADDRESS: PO Box 11600, Windhoek, Namibia

NUMBER OF EMPLOYEES: 0 MORE INFO: www.sharedata.co.za/sdo/jse/LHN

DIRECTORS: Estepa J (ne), Frewin M (ind ne, UK), Matysek P (ind ne), COMPANY SECRETARY: Chriszelda Gontes

Rowly M (Chair, ne), Hilmer M (CEO), Hanna D (CFO) TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

POSTAL ADDRESS: PO Box 909, Toronto, Ontario, M5C 2K3 SPONSOR: IJG Securities (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/FSY

COMPANY SECRETARY: Jorge Estepa AUDITORS: PwC Inc.

AUDITORS: BDO CAPITAL STRUCTURE AUTHORISED ISSUED

LHN Ords NAD0.02c ea - 500 000 000

CAPITAL STRUCTURE AUTHORISED ISSUED

FSY Ords no par val - 96 875 422 DISTRIBUTIONS [NADc]

Ords NAD0.02c ea Ldt Pay Amt

LIQUIDITY: Jan22 Avg 6 783 shares p.w., R7.1m(0.4% p.a.)

Interim No 5 15 Oct 21 5 Nov 21 15.96

40 Week MA FORSYS Final No 4 14 May 21 4 Jun 21 22.50

1440 LIQUIDITY: Jan22 Avg 51 257 shares p.w., R10.3m(0.5% p.a.)

40 Week MA LHN

1170

900

353

631

302

361

250

91

2017 | 2018 | 2019 | 2020 | 2021

199

FINANCIAL STATISTICS

(Amts in CAD'000) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17 2018 | 2019 | 2020 | 2021 147

Interim Final Final Final Final

Op Inc - 3 019 - 765 - 908 - 366 - 729 FINANCIAL STATISTICS

NetIntPd(Rcvd) - - - - - 1 (Amts in NAD'000) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17

Minority Int - - - - 1 - 2 Interim Final Final(rst) Final Final

Att Inc - 3 019 - 765 - 908 - 365 - 74 879 Interest Paid 55 147 98 750 110 011 32 866 114 038

TotCompIncLoss - 2 983 - 1 683 - 1 240 - 867 - 73 476 Interest Rcvd 326 318 625 704 625 198 596 693 585 304

Fixed Ass 10 714 10 698 11 354 12 007 15 595 Operating Inc 262 754 466 775 533 445 673 231 553 045

Attrib Inc 159 642 320 889 401 198 468 873 385 256

Tot Curr Ass 12 508 923 740 692 314

Ord SH Int 25 337 14 048 14 738 15 610 15 776 TotCompIncLoss 159 642 320 889 401 198 468 873 385 256

Minority Int 4 4 6 - 169 - 215 Ord SH Int 2 429 889 2 383 449 2 174 936 1 865 011 1 577 080

Tot Curr Liab 453 143 102 205 348 Dep & OtherAcc 300 338 187 893 43 361 74 749 90 205

Liabilities 1 781 811 1 799 507 1 036 005 604 121 1 107 799

PER SHARE STATISTICS (cents per share) Adv & Loans 3 868 455 3 608 616 2 935 341 2 555 622 2 424 222

NAV PS (ZARc) 151.29 96.75 101.04 107.18 1 048.94 ST Dep & Cash 90 595 468 253 147 586 750 860 323 676

3YrBeta - -0.14 - 0.67 -0.74 - Total Assets 4 426 785 4 398 041 3 426 026 3 479 475 2 899 964

Price High 1 239 29 600 283 343 245

Price Low 311 2 122 81 101 PER SHARE STATISTICS (cents per share)

Price Prd End 923 356 134 259 167 HEPS-C (ZARc) 32.00 68.00 80.00 94.00 72.00

RATIOS DPS (ZARc) 15.96 22.50 22.50 23.50 19.20

Ret on SH Fnd - 23.83 - 5.44 - 6.16 - 2.37 - 481.21 NAV PS (ZARc) 529.00 524.00 478.00 373.00 315.42

Current Ratio 27.61 6.45 7.25 3.38 0.90 3 Yr Beta - 0.22 - - -

Price Prd End 168 266 329 390 399

Price High 266 329 390 400 405

Price Low 145 230 329 344 399

RATIOS

Ret on SH Fund 12.07 12.35 16.79 16.31 -

RetOnTotalAss 11.87 10.61 15.57 19.35 -

Interest Mgn 0.12 0.12 0.15 0.16 -

LiquidFnds:Dep 0.30 2.49 3.40 10.05 3.59

32