Page 39 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 39

Profile’s Stock Exchange Handbook: 2022 – Issue 1 NSX – OMJ

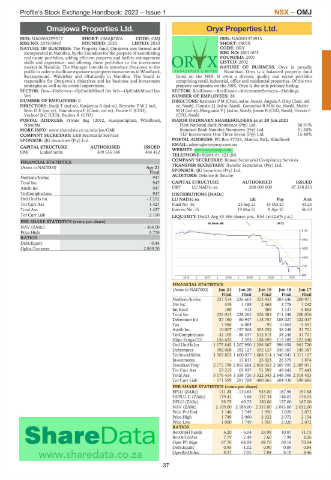

Omajowa Properties Ltd. Oryx Properties Ltd.

OMJ ORY

ISIN: NA000A2P9513 SHORT: OMAJOWA CODE: OMJ ISIN: NA0001574913

REG NO: 2019/0840 FOUNDED: 2020 LISTED: 2020 SHORT: ORYX

NATURE OF BUSINESS: The Property fund, Omajowa was formed and CODE: ORY

incorporated in Namibia, by the Founders for the purpose of assimilating REG NO: 2001/673

real estate portfolios, adding efficient property and facility management FOUNDED: 2001

skills and experience, and offering these portfolios to the investment LISTED: 2002

market in Namibia. The Manager intends to introduce Omajowa to the NATURE OF BUSINESS: Oryx is proudly

public in order to facilitate exposure to property investments in Windhoek, Namibian. Oryx is a balanced property fund

Swakopmund, Walvisbay and Okahandja in Namibia. The board is listed on the NSX. It owns a diverse, quality real estate portfolio

responsible for Omajowa’s objectives and its business and investment comprising retail, industrial, office and residential properties. Of the two

strategies as well as its overall supervision. property companies on the NSX, Oryx is the only primary listing.

SECTOR: Fins—FinServcs—OpEnd&Miscel Inv Veh—OpEnd&Miscel Inv SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

Veh NUMBER OF EMPLOYEES: 28

NUMBER OF EMPLOYEES: 0 DIRECTORS: Kazmaier P M (Chair, ind ne, Namb), Angula A (Dep Chair, ind

DIRECTORS: Iindji T (ind ne), Katjaerua B (ind ne), ReynekePWJ(ne), ne, Namb), ComalieJJ(ind ne, Namb), GomachasRMM(ne, Namb), Muller

SmitDE(ind ne), Hamukwaya F (Chair, ind ne), Fourie C (CEO), MH(ind ne), Mungunda V J (ind ne, Namb), Jooste B (CEO, Namb), Heunis F

Verhoef B C (CIO), Beukes A (CFO) (CFO, Namb)

POSTAL ADDRESS: Private Bag 12012, Ausspannplatz, Windhoek, MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021

Namibia First National Bank Nominees (Pty) Ltd. 36.91%

MORE INFO: www.sharedata.co.za/sdo/jse/OMJ Standard Bank Namibia Nominees (Pty) Ltd. 31.20%

COMPANY SECRETARY: L&B Secretarial Services TLP Investments One Three Seven (Pty) Ltd. 15.40%

SPONSOR: IJG Securities (Pty) Ltd. POSTAL ADDRESS: PO Box 97723, Maerua Park, Windhoek

EMAIL: admin@oryxprop.com.na

CAPITAL STRUCTURE AUTHORISED ISSUED

OMJ Linked units 499 555 548 444 452 WEBSITE: www.oryxprop.com

TELEPHONE: 00264-61-423-201

COMPANY SECRETARY: Bonsai Secretarial Compliance Services

FINANCIAL STATISTICS TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

(Amts in NAD'000) Apr 21

Final SPONSOR: IJG Securities (Pty) Ltd.

NetRent/InvInc 947 AUDITORS: Deloitte & Touche

Total Inc 947 CAPITAL STRUCTURE AUTHORISED ISSUED

Attrib Inc 947 ORY LU NAD1c ea 200 000 000 87 378 835

TotCompIncLoss 947 DISTRIBUTIONS [NADc]

Ord UntHs Int - 1 212 LU NAD1c ea Ldt Pay Amt

Tot Curr Ass 1 427 Final No 36 23 Sep 21 15 Oct 21 43.25

Total Ass 1 427 Interim No 35 19 Mar 21 9 Apr 21 56.50

Tot Curr Liab 2 110 LIQUIDITY: Dec21 Avg 43 586 shares p.w., R54.1m(2.6% p.a.)

PER SHARE STATISTICS (cents per share)

40 Week MA ORYX

NAV (ZARc) - 364.00

2154

Price High 5 770

RATIOS

1903

Debt:Equity - 0.44

OpInc:Turnover 2 869.70 1652

1402

1151

900

2016 | 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS

(Amts in NAD'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

Final Final Final Final Final

NetRent/InvInc 227 514 226 663 223 432 203 646 200 971

Div Inc 319 1 189 2 462 3 778 1 242

Int Recd 180 413 489 1 137 5 863

Total Inc 228 013 228 265 226 383 211 248 208 076

Debenture Int 87 160 60 947 118 757 108 027 122 047

Tax 7 586 6 084 - 95 10 864 - 5 591

Attrib Inc 10 007 - 157 568 303 052 38 248 31 701

TotCompIncLoss - 32 105 - 88 437 312 815 38 248 31 701

Hline Erngs-CO 156 655 3 393 108 699 115 189 123 440

Ord UntHs Int 1 175 845 1 207 950 1 296 387 996 658 961 720

Debentures 392 008 392 127 392 127 349 387 349 387

TotStockHldInt 1 567 853 1 600 077 1 688 514 1 346 045 1 311 107

Investments - 11 811 23 623 26 379 1 874

FixedAss/Prop 2 775 798 2 855 684 2 858 053 2 509 995 2 389 011

Tot Curr Ass 53 215 65 937 51 599 48 042 77 443

Total Ass 3 176 414 3 358 726 3 322 343 2 648 366 2 518 453

Tot Curr Liab 171 599 291 708 480 065 604 930 590 685

PER SHARE STATISTICS (cents per share)

EPLU (ZARc) 111.28 - 110.63 533.00 187.98 197.58

HEPLU-C (ZARc) 179.41 3.88 137.34 148.03 158.63

DPLU (ZARc) 99.75 69.75 150.00 157.00 167.00

NAV (ZARc) 2 109.00 2 188.00 2 337.00 2 043.00 2 032.00

Price Prd End 1 146 1 749 1 950 2 020 2 072

Price High 1 749 2 060 2 022 2 072 2 154

Price Low 1 000 1 749 1 950 2 020 2 072

RATIOS

RetOnSH Funds 6.20 - 6.04 24.98 10.87 11.73

RetOnTotAss 7.79 7.49 7.60 7.98 8.26

Oper Pft Mgn 67.76 68.59 69.70 69.16 70.04

Debt:Equity 0.95 1.02 0.90 0.89 0.84

OperRetOnInv 8.21 7.95 7.84 8.18 8.46

37