Page 219 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 219

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – STO

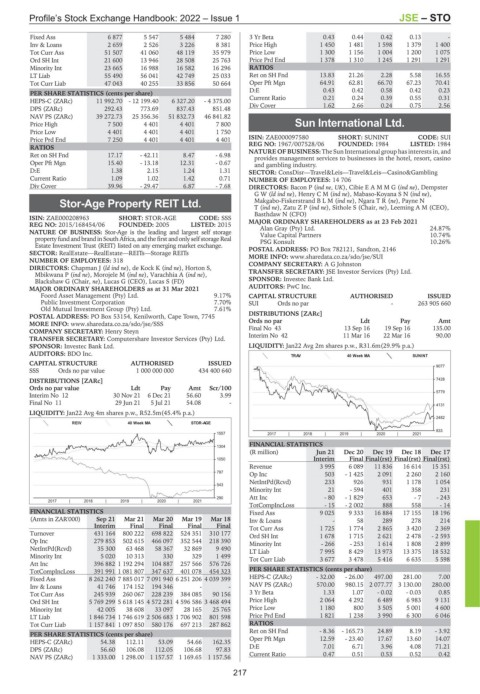

Fixed Ass 6 877 5 547 5 484 7 280 3 Yr Beta 0.43 0.44 0.42 0.13 -

Inv & Loans 2 659 2 526 3 226 8 381 Price High 1 450 1 481 1 598 1 379 1 400

Tot Curr Ass 51 507 41 060 48 119 35 979 Price Low 1 300 1 156 1 004 1 200 1 075

Ord SH Int 21 600 13 946 28 508 25 763 Price Prd End 1 378 1 310 1 245 1 291 1 291

Minority Int 23 665 16 988 16 582 16 296 RATIOS

LT Liab 55 490 56 041 42 749 25 033 Ret on SH Fnd 13.83 21.26 2.28 5.58 16.55

Tot Curr Liab 47 043 40 255 33 856 50 664 Oper Pft Mgn 64.91 62.81 66.70 67.23 70.41

D:E 0.43 0.42 0.58 0.42 0.23

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 11 992.70 - 12 199.40 6 327.20 - 4 375.00 Current Ratio 0.21 0.24 0.39 0.55 0.31

DPS (ZARc) 292.43 773.69 837.43 851.48 Div Cover 1.62 2.66 0.24 0.75 2.56

NAV PS (ZARc) 39 272.73 25 356.36 51 832.73 46 841.82

Price High 7 500 4 401 4 401 7 800 Sun International Ltd.

Price Low 4 401 4 401 4 401 1 750 SUN

CODE: SUI

Price Prd End 7 250 4 401 4 401 4 401 ISIN: ZAE000097580 SHORT: SUNINT LISTED: 1984

REG NO: 1967/007528/06

FOUNDED: 1984

RATIOS

Ret on SH Fnd 17.17 - 42.11 8.47 - 6.98 NATURE OF BUSINESS: The Sun International group has interests in, and

provides management services to businesses in the hotel, resort, casino

Oper Pft Mgn 15.40 - 13.18 12.31 - 0.67 and gambling industry.

D:E 1.38 2.15 1.24 1.31 SECTOR: ConsDisr—Travel&Leis—Travel&Leis—Casino&Gambling

Current Ratio 1.09 1.02 1.42 0.71 NUMBER OF EMPLOYEES: 14 706

Div Cover 39.96 - 29.47 6.87 - 7.68 DIRECTORS: Bacon P (ind ne, UK), CibieEAMMG(ind ne), Dempster

GW(ld ind ne), HenryCM(ind ne), Mabaso-KoyanaSN(ind ne),

Stor-Age Property REIT Ltd. Makgabo-FiskerstrandBLM(ind ne), NgaraTR(ne), Payne N

T(ind ne), ZatuZP(ind ne), Sithole S (Chair, ne), Leeming A M (CEO),

STO Basthdaw N (CFO)

ISIN: ZAE000208963 SHORT: STOR-AGE CODE: SSS

REG NO: 2015/168454/06 FOUNDED: 2005 LISTED: 2015 MAJOR ORDINARY SHAREHOLDERS as at 23 Feb 2021 24.87%

Alan Gray (Pty) Ltd.

NATURE OF BUSINESS: Stor-Age is the leading and largest self storage Value Capital Partners 10.74%

property fund and brand in South Africa, and the first and only self storage Real PSG Konsult 10.26%

Estate Investment Trust (REIT) listed on any emerging market exchange.

SECTOR: RealEstate—RealEstate—REITs—Storage REITs POSTAL ADDRESS: PO Box 782121, Sandton, 2146

MORE INFO: www.sharedata.co.za/sdo/jse/SUI

NUMBER OF EMPLOYEES: 318 COMPANY SECRETARY: A G Johnston

DIRECTORS: Chapman J (ld ind ne), de Kock K (ind ne), Horton S,

Mbikwana P (ind ne), Morojele M (ind ne), Varachhia A (ind ne), TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

Blackshaw G (Chair, ne), Lucas G (CEO), Lucas S (FD) SPONSOR: Investec Bank Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021 AUDITORS: PwC Inc.

Foord Asset Management (Pty) Ltd. 9.17% CAPITAL STRUCTURE AUTHORISED ISSUED

Public Investment Corporation 7.70% SUI Ords no par - 263 905 660

Old Mutual Investment Group (Pty) Ltd. 7.61%

POSTAL ADDRESS: PO Box 53154, Kenilworth, Cape Town, 7745 DISTRIBUTIONS [ZARc]

MORE INFO: www.sharedata.co.za/sdo/jse/SSS Ords no par Ldt Pay Amt

13 Sep 16

19 Sep 16

COMPANY SECRETARY: Henry Steyn Final No 43 11 Mar 16 22 Mar 16 135.00

Interim No 42

90.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd. LIQUIDITY: Jan22 Avg 2m shares p.w., R31.6m(29.9% p.a.)

AUDITORS: BDO Inc. TRAV 40 Week MA SUNINT

CAPITAL STRUCTURE AUTHORISED ISSUED

9077

SSS Ords no par value 1 000 000 000 434 400 640

DISTRIBUTIONS [ZARc] 7428

Ords no par value Ldt Pay Amt Scr/100

5779

Interim No 12 30 Nov 21 6 Dec 21 56.60 3.99

Final No 11 29 Jun 21 5 Jul 21 54.08 - 4131

LIQUIDITY: Jan22 Avg 4m shares p.w., R52.5m(45.4% p.a.)

2482

REIV 40 Week MA STOR-AGE

833

1557 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS

1304

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17

Interim Final Final(rst) Final(rst) Final(rst)

1050

Revenue 3 995 6 089 11 836 16 614 15 351

797

Op Inc 503 - 1 425 2 091 2 260 2 160

NetIntPd(Rcvd) 233 926 931 1 178 1 054

543

Minority Int 21 - 594 401 358 231

290 Att Inc - 80 - 1 829 653 - 7 - 243

2017 | 2018 | 2019 | 2020 | 2021

TotCompIncLoss - 15 - 2 002 888 558 - 14

FINANCIAL STATISTICS Fixed Ass 9 025 9 333 16 884 17 155 18 196

(Amts in ZAR'000) Sep 21 Mar 21 Mar 20 Mar 19 Mar 18 Inv & Loans - 58 289 278 214

Interim Final Final Final Final Tot Curr Ass 1 725 1 774 2 865 3 420 2 369

Turnover 431 164 800 222 698 822 524 351 310 177 Ord SH Int 1 678 1 715 2 621 2 478 - 2 593

Op Inc 279 853 502 615 466 097 352 544 218 390 Minority Int - 266 - 253 1 614 1 808 2 899

NetIntPd(Rcvd) 35 300 63 468 58 367 32 869 9 490 LT Liab 7 995 8 429 13 973 13 375 18 532

Minority Int 5 020 10 313 330 329 1 499 Tot Curr Liab 3 677 3 478 5 416 6 635 5 598

Att Inc 396 882 1 192 294 104 887 257 566 576 726

TotCompIncLoss 391 991 1 081 807 347 637 401 078 454 323 PER SHARE STATISTICS (cents per share)

Fixed Ass 8 262 240 7 885 017 7 091 940 6 251 206 4 039 399 HEPS-C (ZARc) - 32.00 - 26.00 497.00 281.00 7.00

Inv & Loans 41 746 174 152 194 346 - - NAV PS (ZARc) 570.00 980.15 2 077.77 3 130.00 280.00

Tot Curr Ass 245 939 260 067 228 239 384 085 90 156 3 Yr Beta 1.33 1.07 - 0.02 - 0.03 0.85

Ord SH Int 5 769 299 5 618 145 4 572 281 4 596 586 3 468 494 Price High 2 064 4 292 6 489 6 983 9 131

Minority Int 42 005 38 608 33 097 28 165 25 765 Price Low 1 180 800 3 505 5 001 4 600

LT Liab 1 846 734 1 746 619 2 506 683 1 706 902 801 598 Price Prd End 1 821 1 238 3 990 6 300 6 046

Tot Curr Liab 1 157 841 1 097 850 580 176 697 213 287 862 RATIOS

Ret on SH Fnd - 8.36 - 165.73 24.89 8.19 - 3.92

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 54.38 112.11 53.09 54.66 162.35 Oper Pft Mgn 12.59 - 23.40 17.67 13.60 14.07

DPS (ZARc) 56.60 106.08 112.05 106.68 97.83 D:E 7.01 6.71 3.96 4.08 71.21

NAV PS (ZARc) 1 333.00 1 298.00 1 157.57 1 169.65 1 157.56 Current Ratio 0.47 0.51 0.53 0.52 0.42

217