Page 224 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 224

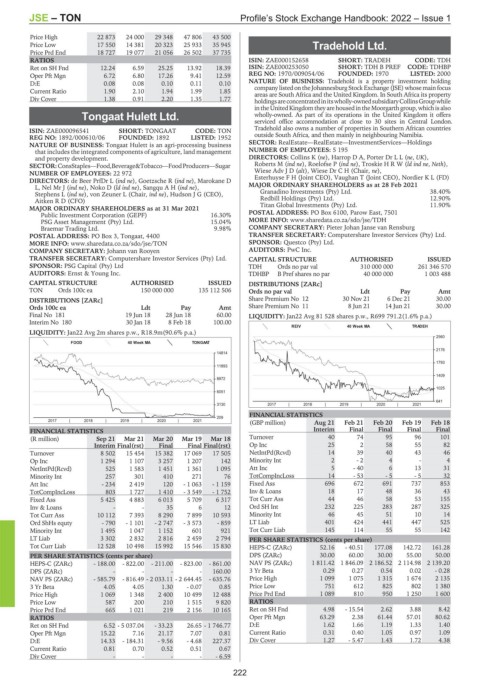

JSE – TON Profile’s Stock Exchange Handbook: 2022 – Issue 1

Price High 22 873 24 000 29 348 47 806 43 500

Price Low 17 550 14 381 20 323 25 933 35 945 Tradehold Ltd.

Price Prd End 18 727 19 077 21 056 26 502 37 735

TRA

RATIOS ISIN: ZAE000152658 SHORT: TRADEH CODE: TDH

Ret on SH Fnd 12.24 6.59 25.25 13.92 18.39 ISIN: ZAE000253050 SHORT: TDH B PREF CODE: TDHBP

Oper Pft Mgn 6.72 6.80 17.26 9.41 12.59 REG NO: 1970/009054/06 FOUNDED: 1970 LISTED: 2000

D:E 0.08 0.08 0.10 0.11 0.10 NATURE OF BUSINESS: Tradehold is a property investment holding

company listed on the Johannesburg Stock Exchange (JSE) whose main focus

Current Ratio 1.90 2.10 1.94 1.99 1.85 areas are South Africa and the United Kingdom. In South Africa its property

Div Cover 1.38 0.91 2.20 1.35 1.77 holdingsareconcentratedinitswholly-ownedsubsidiaryCollinsGroupwhile

inthe UnitedKingdom they are housedinthe Moorgarth group, which isalso

Tongaat Hulett Ltd. wholly-owned. As part of its operations in the United Kingdom it offers

serviced office accommodation at close to 30 sites in Central London.

TON

ISIN: ZAE000096541 SHORT: TONGAAT CODE: TON Tradeholdalsoownsanumberofproperties in Southern African countries

REG NO: 1892/000610/06 FOUNDED: 1892 LISTED: 1952 outside South Africa, and then mainly in neighbouring Namibia.

NATURE OF BUSINESS: Tongaat Hulett is an agri-processing business SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

that includes the integrated components of agriculture, land management NUMBER OF EMPLOYEES: 5 195

and property development. DIRECTORS: Collins K (ne), Harrop D A, Porter DrLL(ne, UK),

SECTOR:ConsStaples—Food,Beverage&Tobacco—FoodProducers—Sugar Roberts M (ind ne), Roelofse P (ind ne), TroskieHRW(ld ind ne, Neth),

NUMBER OF EMPLOYEES: 22 972 Wiese AdvJD(alt), Wiese Dr C H (Chair, ne),

DIRECTORS: de Beer PrfDr L (ind ne), Goetzsche R (ind ne), Marokane D Esterhuyse F H (Joint CEO), Vaughan T (Joint CEO), Nordier K L (FD)

L, Nel Mr J (ind ne), Noko D (ld ind ne), SangquAH(ind ne), MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021

Stephens L (ind ne), von Zeuner L (Chair, ind ne), Hudson J G (CEO), Granadino Investments (Pty) Ltd. 38.40%

Aitken R D (CFO) Redbill Holdings (Pty) Ltd. 12.90%

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021 Titan Global Investments (Pty) Ltd. 11.90%

Public Investment Corporation (GEPF) 16.30% POSTAL ADDRESS: PO Box 6100, Parow East, 7501

PSG Asset Management (Pty) Ltd. 15.04% MORE INFO: www.sharedata.co.za/sdo/jse/TDH

Braemar Trading Ltd. 9.98% COMPANY SECRETARY: Pieter Johan Janse van Rensburg

POSTAL ADDRESS: PO Box 3, Tongaat, 4400 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/TON SPONSOR: Questco (Pty) Ltd.

COMPANY SECRETARY: Johann van Rooyen AUDITORS: PwC Inc.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: PSG Capital (Pty) Ltd TDH Ords no par val 310 000 000 261 346 570

AUDITORS: Ernst & Young Inc. TDHBP B Pref shares no par 40 000 000 1 003 488

CAPITAL STRUCTURE AUTHORISED ISSUED DISTRIBUTIONS [ZARc]

TON Ords 100c ea 150 000 000 135 112 506 Ords no par val Ldt Pay Amt

DISTRIBUTIONS [ZARc] Share Premium No 12 30 Nov 21 6 Dec 21 30.00

Ords 100c ea Ldt Pay Amt Share Premium No 11 8 Jun 21 14 Jun 21 30.00

Final No 181 19 Jun 18 28 Jun 18 60.00 LIQUIDITY: Jan22 Avg 81 528 shares p.w., R699 791.2(1.6% p.a.)

Interim No 180 30 Jan 18 8 Feb 18 100.00

REIV 40 Week MA TRADEH

LIQUIDITY: Jan22 Avg 2m shares p.w., R18.9m(90.6% p.a.)

2560

FOOD 40 Week MA TONGAAT

2176

14814

1793

11893

1409

8972

1025

6051

641

3130 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS

209

2017 | 2018 | 2019 | 2020 | 2021 (GBP million) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18

FINANCIAL STATISTICS Interim Final Final Final Final

(R million) Sep 21 Mar 21 Mar 20 Mar 19 Mar 18 Turnover 40 74 95 96 101

Interim Final(rst) Final Final Final(rst) Op Inc 25 2 58 55 82

Turnover 8 502 15 454 15 382 17 069 17 505 NetIntPd(Rcvd) 14 39 40 43 46

Op Inc 1 294 1 107 3 257 1 207 142 Minority Int 2 - 2 4 - 4

NetIntPd(Rcvd) 525 1 583 1 451 1 361 1 095 Att Inc 5 - 40 6 13 31

Minority Int 257 301 410 271 76 TotCompIncLoss 14 - 53 - 5 - 5 32

Att Inc - 234 2 419 120 - 1 063 - 1 159 Fixed Ass 696 672 691 737 853

TotCompIncLoss 803 1 727 1 410 - 3 549 - 1 752 Inv & Loans 18 17 48 36 43

Fixed Ass 5 425 4 883 6 013 5 709 6 317 Tot Curr Ass 44 46 58 53 155

Inv & Loans - - 35 6 12 Ord SH Int 232 225 283 287 325

Tot Curr Ass 10 112 7 393 8 290 7 899 10 593 Minority Int 46 45 51 10 14

Ord ShHs equty - 790 - 1 101 - 2 747 - 3 573 - 859 LT Liab 401 424 441 447 525

Minority Int 1 495 1 047 1 152 601 921 Tot Curr Liab 145 114 55 55 142

LT Liab 3 302 2 832 2 816 2 459 2 794 PER SHARE STATISTICS (cents per share)

Tot Curr Liab 12 528 10 498 15 992 15 546 15 830 HEPS-C (ZARc) 52.16 - 40.51 177.08 142.72 161.28

PER SHARE STATISTICS (cents per share) DPS (ZARc) 30.00 60.00 30.00 55.00 50.00

HEPS-C (ZARc) - 188.00 - 822.00 - 211.00 - 823.00 - 861.00 NAV PS (ZARc) 1 811.42 1 846.09 2 186.52 2 114.98 2 139.20

DPS (ZARc) - - - - 160.00 3 Yr Beta 0.29 0.27 0.54 0.02 - 0.28

NAV PS (ZARc) - 585.79 - 816.49 - 2 033.11 - 2 644.45 - 635.76 Price High 1 099 1 075 1 315 1 674 2 135

3 Yr Beta 4.05 4.05 1.30 - 0.07 0.85 Price Low 751 612 825 802 1 380

Price High 1 069 1 348 2 400 10 499 12 488 Price Prd End 1 089 810 950 1 250 1 600

Price Low 587 200 210 1 515 9 820 RATIOS

Price Prd End 665 1 021 219 2 156 10 165 Ret on SH Fnd 4.98 - 15.54 2.62 3.88 8.42

RATIOS Oper Pft Mgn 63.29 2.38 61.44 57.01 80.62

Ret on SH Fnd 6.52 - 5 037.04 - 33.23 26.65 - 1 746.77 D:E 1.62 1.66 1.19 1.33 1.40

Oper Pft Mgn 15.22 7.16 21.17 7.07 0.81 Current Ratio 0.31 0.40 1.05 0.97 1.09

D:E 14.33 - 184.31 - 9.56 - 4.68 227.37 Div Cover 1.27 - 5.47 1.43 1.72 4.38

Current Ratio 0.81 0.70 0.52 0.51 0.67

Div Cover - - - - - 6.59

222