Page 214 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 214

JSE – SOU Profile’s Stock Exchange Handbook: 2022 – Issue 1

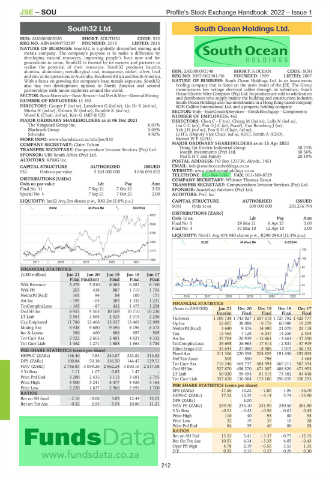

South32 Ltd. South Ocean Holdings Ltd.

SOU SOU

ISIN: AU000000S320 SHORT: SOUTH32 CODE: S32

REG NO: ABN84093732597 FOUNDED: 2015 LISTED: 2015

NATURE OF BUSINESS: South32 is a globally diversified mining and

metals company. The company's purpose is to make a difference by

developing natural resources, improving people’s lives now and for

generations to come. South32 is trusted by its owners and partners to

realise the potential of their resources. South32 produces bauxite,

alumina, aluminium, metallurgical coal, manganese, nickel, silver, lead ISIN: ZAE000092748 SHORT: S.OCEAN CODE: SOH

and zinc at its operations in Australia, Southern Africa and South America. REG NO: 2007/002381/06 FOUNDED: 1989 LISTED: 2007

With a focus on growing the company's base metals exposure, South32 NATURE OF BUSINESS: South Ocean Holdings Ltd. is an investments

also has two development options in North America and several holding company that is listed on the main board of the JSE. The Group

partnerships with junior explorers around the world. manufactures low voltage electrical cables through its subsidiary, South

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining Ocean Electric Wire Company (Pty) Ltd. Its products are sold to wholesalers

and distributors who supply mainly the building and construction industry.

NUMBER OF EMPLOYEES: 14 192 South Ocean Holdings also has investments in a Hong Kong based company

DIRECTORS: Cooper F (ind ne), Lansdown G (ind ne), Liu Dr X (ind ne), SOH Calibre International Ltd. and a property holding company.

Mtoba N (ind ne), Osborn W (ind ne), Rumble K (ind ne), SECTOR: Inds—IndsGoods&Services—Elec&ElecEquip—Components

Wood K (Chair, ind ne), Kerr G (MD & CE) NUMBER OF EMPLOYEES: 462

MAJOR ORDINARY SHAREHOLDERS as at 06 Dec 2021 DIRECTORS: ChenC-F(ne), Chong M (ind ne), Lalla N (ind ne),

The Vanguard Group Inc. 6.01% LiuCC(alt), PanDJC(alt, Brazil), Van Rensburg J (ne),

Blackrock Group 5.04% YehJH(ind ne), Pon K H (Chair, ind ne),

Schroder 4.92% Li H L (Deputy Vice Chair, ind ne, ROC), Smith A (CEO),

MORE INFO: www.sharedata.co.za/sdo/jse/S32 Basson W P (CFO)

COMPANY SECRETARY: Claire Tolcon MAJOR ORDINARY SHAREHOLDERS as at 15 Apr 2021

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Hong Tai Electric Industrial Group 30.74%

30.56%

Joseph Investments (Pty) Ltd.

SPONSOR: UBS South Africa (Pty) Ltd. PanEHTand Family 20.19%

AUDITORS: KPMG Inc. POSTAL ADDRESS: PO Box 123738, Alrode, 1451

CAPITAL STRUCTURE AUTHORISED ISSUED EMAIL: info@southoceanholdings.co.za

S32 Ords no par value 5 324 000 000 4 656 054 832 WEBSITE: www.southoceanholdings.co.za

TELEPHONE: 011-864-1606 FAX: 011-389-8729

DISTRIBUTIONS [USDc] COMPANY SECRETARY: Whitney Thomas Green

Ords no par value Ldt Pay Amt TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Final No 11 7 Sep 21 7 Oct 21 3.50 SPONSOR: AcaciaCap Advisors (Pty) Ltd.

Special No 4 7 Sep 21 7 Oct 21 2.00 AUDITORS: PwC Inc.

LIQUIDITY: Jan22 Avg 2m shares p.w., R83.2m(2.8% p.a.) CAPITAL STRUCTURE AUTHORISED ISSUED

SOH Ords 1c ea 500 000 000 203 276 794

INDM 40 Week MA SOUTH32

DISTRIBUTIONS [ZARc]

8337

Ords 1c ea Ldt Pay Amt

7046 FinalNo 5 29 Mar21 6 Apr21 3.00

Final No 4 31 Mar 10 12 Apr 10 3.00

5755

LIQUIDITY: Nov21 Avg 478 980 shares p.w., R290 299.3(12.3% p.a.)

4464 ELEE 40 Week MA S.OCEAN

129

3173

106

1882

2017 | 2018 | 2019 | 2020 | 2021

82

FINANCIAL STATISTICS

(USD million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 59

Final Final(rst) Final Final Final

Wrk Revenue 5 476 5 010 6 468 6 682 6 160 35

Wrk Pft 203 438 887 1 719 1 795

NetIntPd(Rcd) 161 94 84 100 171 2016 | 2017 | 2018 | 2019 | 2020 | 2021 12

Att Inc - 195 - 65 389 1 332 1 231

TotCompIncLoss - 165 - 87 432 1 475 1 258 FINANCIAL STATISTICS Dec 20 Dec 19 Dec 18 Dec 17

Jun 21

(Amts in ZAR’000)

Ord SH Int 8 955 9 563 10 169 10 710 10 236 Interim Final Final Final Final

LT Liab 2 561 2 565 2 525 2 315 2 236 Turnover 1 105 738 1 743 027 1 557 318 1 727 792 1 425 777

Cap Employed 11 780 12 466 13 027 13 469 12 989 Op Inc 52 807 38 088 - 8 778 60 988 19 299

Mining Ass 8 938 9 680 9 596 8 196 8 373 NetIntPd(Rcvd) 3 640 9 376 14 690 21 070 23 118

Inv & Loans 380 460 688 697 569 Tax 13 463 7 128 - 6 247 14 250 2 404

Tot Curr Ass 2 922 2 663 3 401 4 821 4 332 Att Inc 35 704 26 939 - 15 861 - 3 664 - 57 350

Tot Curr Liab 1 462 1 271 1 688 1 664 1 744 TotCompIncLoss 35 698 26 963 - 17 514 - 2 831 - 57 919

PER SHARE STATISTICS (cents per share) Hline Erngs-CO 35 644 27 080 - 8 406 7 019 - 56 193

HEPS-C (ZARc) 146.40 7.83 244.07 323.82 314.62 Fixed Ass 211 306 220 358 204 839 191 650 293 035

798

550

505

4 465

DPS (ZARc) 100.84 50.18 136.50 144.47 129.51 Def Tax Asset 716 246 464 737 484 994 667 211 - 587 394

Tot Curr Ass

NAV (ZARc) 2 746.83 3 059.26 2 862.24 3 050.16 2 517.08 Ord SH Int 527 870 498 270 471 307 488 820 471 953

3 Yr Beta 1.11 1.07 0.82 1.47 - LT Liab 50 020 59 494 61 315 73 382 84 648

Price Prd End 3 280 2 435 3 112 3 681 2 705 Tot Curr Liab 357 670 136 584 173 180 296 659 328 293

Price High 3 500 3 241 4 477 3 926 3 164

Price Low 2 220 1 637 2 966 2 692 1 700 PER SHARE STATISTICS (cents per share) - 7.80 - 1.95 - 36.70

13.25

17.56

EPS (ZARc)

RATIOS HEPS-C (ZARc) 17.53 13.32 - 4.14 3.74 - 35.90

Ret on SH fund - 2.18 - 0.68 3.83 12.44 12.03 DPS (ZARc) - 3.00 - - -

Ret on Tot Ass 0.32 2.55 5.54 10.86 11.21

NAV PS (ZARc) 259.70 245.10 231.90 240.50 301.80

3 Yr Beta - 0.01 - 0.43 - 0.56 - 0.61 0.45

Price High 110 40 93 80 55

Price Low 22 19 35 10 28

Price Prd End 84 39 40 80 28

RATIOS

Ret on SH Fnd 13.53 5.41 - 3.37 - 0.75 - 12.15

Ret On Tot Ass 10.51 4.14 - 3.33 4.65 - 0.43

Oper Pft Mgn 4.78 2.19 - 0.56 3.53 1.35

D:E 0.32 0.15 0.23 0.29 0.30

212