Page 222 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 222

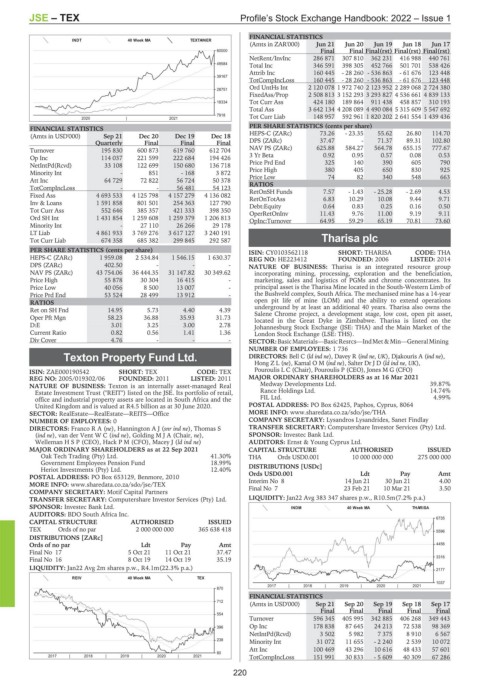

JSE – TEX Profile’s Stock Exchange Handbook: 2022 – Issue 1

FINANCIAL STATISTICS

INDT 40 Week MA TEXTAINER

(Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

60000 Final Final Final(rst) Final(rst) Final(rst)

NetRent/InvInc 286 871 307 810 362 231 416 988 440 761

Total Inc 346 591 398 305 452 766 501 701 538 426

49584

Attrib Inc 160 445 - 28 260 - 536 863 - 61 676 123 448

39167

TotCompIncLoss 160 445 - 28 260 - 536 863 - 61 676 123 448

Ord UntHs Int 2 120 078 1 972 740 2 123 952 2 289 068 2 724 380

28751

FixedAss/Prop 2 508 813 3 152 293 3 293 827 4 536 661 4 839 133

18334 Tot Curr Ass 424 180 189 864 911 438 458 857 310 193

Total Ass 3 642 134 4 208 089 4 490 084 5 315 609 5 547 692

7918 Tot Curr Liab 148 957 592 961 1 820 202 2 641 554 1 439 436

2020 | 2021

FINANCIAL STATISTICS PER SHARE STATISTICS (cents per share)

(Amts in USD'000) Sep 21 Dec 20 Dec 19 Dec 18 HEPS-C (ZARc) 73.26 - 23.35 55.62 26.80 114.70

Quarterly Final Final Final DPS (ZARc) 37.47 - 71.37 89.31 102.80

Turnover 195 830 600 873 619 760 612 704 NAV PS (ZARc) 625.88 584.27 564.78 655.15 777.67

Op Inc 114 037 221 599 222 684 194 426 3 Yr Beta 0.92 0.95 0.57 0.08 0.53

NetIntPd(Rcvd) 33 108 122 699 150 680 136 718 Price Prd End 325 140 390 605 790

Minority Int - 851 - 168 3 872 Price High 380 405 650 830 925

Att Inc 64 729 72 822 56 724 50 378 Price Low 74 82 340 548 663

RATIOS

TotCompIncLoss - - 56 481 54 123 RetOnSH Funds 7.57 - 1.43 - 25.28 - 2.69 4.53

Fixed Ass 4 693 533 4 125 798 4 157 279 4 136 082 RetOnTotAss 6.83 10.29 10.08 9.44 9.71

Inv & Loans 1 591 858 801 501 254 363 127 790 Debt:Equity 0.64 0.83 0.25 0.16 0.50

Tot Curr Ass 552 646 385 357 421 333 398 350 OperRetOnInv 11.43 9.76 11.00 9.19 9.11

Ord SH Int 1 431 854 1 259 608 1 259 379 1 206 813 OpInc:Turnover 64.95 59.29 65.19 70.81 73.60

Minority Int - 27 110 26 266 29 178

LT Liab 4 861 933 3 769 276 3 617 127 3 240 191

Tot Curr Liab 674 358 685 382 299 845 292 587 Tharisa plc

PER SHARE STATISTICS (cents per share) ISIN: CY0103562118 SHORT: THARISA CODE: THA

THA

HEPS-C (ZARc) 1 959.08 2 534.84 1 546.15 1 630.37 REG NO: HE223412 FOUNDED: 2006 LISTED: 2014

DPS (ZARc) 402.50 - - - NATURE OF BUSINESS: Tharisa is an integrated resource group

NAV PS (ZARc) 43 754.06 36 444.35 31 147.82 30 349.62 incorporating mining, processing, exploration and the beneficiation,

Price High 55 878 30 304 16 415 - marketing, sales and logistics of PGMs and chrome concentrates. Its

Price Low 40 056 8 500 13 007 - principal asset is the Tharisa Mine located in the South-Western Limb of

Price Prd End 53 524 28 499 13 912 - the Bushveld complex, South Africa. The mechanised mine has a 14-year

RATIOS open pit life of mine (LOM) and the ability to extend operations

Ret on SH Fnd 14.95 5.73 4.40 4.39 underground by at least an additional 40 years. Tharisa also owns the

Salene Chrome project, a development stage, low cost, open pit asset,

Oper Pft Mgn 58.23 36.88 35.93 31.73 located in the Great Dyke in Zimbabwe. Tharisa is listed on the

D:E 3.01 3.25 3.00 2.78 Johannesburg Stock Exchange (JSE: THA) and the Main Market of the

Current Ratio 0.82 0.56 1.41 1.36 London Stock Exchange (LSE: THS).

Div Cover 4.76 - - - SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining

NUMBER OF EMPLOYEES: 1 736

Texton Property Fund Ltd. DIRECTORS: Bell C (ld ind ne), Davey R (ind ne, UK), Djakouris A (ind ne),

Hong Z L (ne), Kamal O M (ind ne), SalterDrJD(ld ind ne, UK),

TEX

ISIN: ZAE000190542 SHORT: TEX CODE: TEX Pouroulis L C (Chair), Pouroulis P (CEO), Jones M G (CFO)

REG NO: 2005/019302/06 FOUNDED: 2011 LISTED: 2011 MAJOR ORDINARY SHAREHOLDERS as at 16 Mar 2021

NATURE OF BUSINESS: Texton is an internally asset-managed Real Medway Developments Ltd. 39.87%

Estate Investment Trust ("REIT") listed on the JSE. Its portfolio of retail, Rance Holdings Ltd. 14.74%

office and industrial property assets are located in South Africa and the FIL Ltd. 4.99%

United Kingdom and is valued at R4.5 billion as at 30 June 2020. POSTAL ADDRESS: PO Box 62425, Paphos, Cyprus, 8064

SECTOR: RealEstate—RealEstate—REITS—Office MORE INFO: www.sharedata.co.za/sdo/jse/THA

NUMBER OF EMPLOYEES: 0 COMPANY SECRETARY: Lysandros Lysandrides, Sanet Findlay

DIRECTORS: FrancoRA(ne), HanningtonAJ(snr ind ne), Thomas S TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

(ind ne), van der VentWC(ind ne), GoldingMJA (Chair, ne), SPONSOR: Investec Bank Ltd.

WellemanHSP (CEO), Hack P M (CFO), Macey J (ld ind ne) AUDITORS: Ernst & Young Cyprus Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 22 Sep 2021 CAPITAL STRUCTURE AUTHORISED ISSUED

Oak Tech Trading (Pty) Ltd. 41.30% THA Ords USD0.001 10 000 000 000 275 000 000

Government Employees Pension Fund 18.99%

Heriot Investments (Pty) Ltd. 12.40% DISTRIBUTIONS [USDc]

Pay

Ldt

POSTAL ADDRESS: PO Box 653129, Benmore, 2010 Ords USD0.001 14 Jun 21 30 Jun 21 Amt

4.00

Interim No 8

MORE INFO: www.sharedata.co.za/sdo/jse/TEX Final No 7 23 Feb 21 10 Mar 21 3.50

COMPANY SECRETARY: Motif Capital Partners

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Jan22 Avg 383 347 shares p.w., R10.5m(7.2% p.a.)

SPONSOR: Investec Bank Ltd. INDM 40 Week MA THARISA

AUDITORS: BDO South Africa Inc.

6735

CAPITAL STRUCTURE AUTHORISED ISSUED

TEX Ords of no par 2 000 000 000 365 638 418 5596

DISTRIBUTIONS [ZARc]

Ords of no par Ldt Pay Amt 4456

Final No 17 5 Oct 21 11 Oct 21 37.47

Final No 16 8 Oct 19 14 Oct 19 35.19 3316

LIQUIDITY: Jan22 Avg 2m shares p.w., R4.1m(22.3% p.a.) 2177

REIV 40 Week MA TEX

1037

2017 | 2018 | 2019 | 2020 | 2021

870

FINANCIAL STATISTICS

712

(Amts in USD'000) Sep 21 Sep 20 Sep 19 Sep 18 Sep 17

Final Final Final Final Final

554

Turnover 596 345 405 995 342 885 406 268 349 443

396 Op Inc 178 838 87 645 24 213 72 538 98 369

NetIntPd(Rcvd) 3 502 5 982 7 375 8 910 6 567

238 Minority Int 31 072 11 655 - 2 240 2 539 10 072

Att Inc 100 469 43 296 10 616 48 433 57 601

80

2017 | 2018 | 2019 | 2020 | 2021 TotCompIncLoss 151 991 30 833 - 5 609 40 309 67 286

220