Page 221 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 221

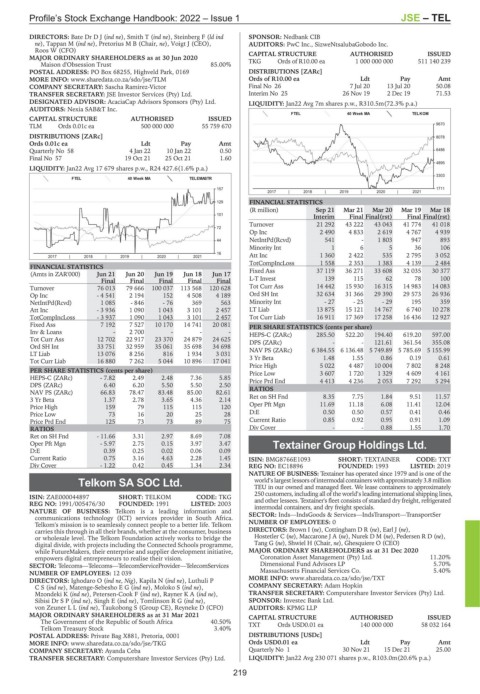

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – TEL

DIRECTORS: Bate DrDJ(ind ne), Smith T (ind ne), Steinberg F (ld ind SPONSOR: Nedbank CIB

ne), Tappan M (ind ne), Pretorius M B (Chair, ne), Voigt J (CEO), AUDITORS: PwC Inc., SizweNtsalubaGobodo Inc.

Roos W (CFO)

ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 CAPITAL STRUCTURE AUTHORISED 511 140 239

Ords of R10.00 ea

1 000 000 000

TKG

Maison d'Obsession Trust 85.00%

POSTAL ADDRESS: PO Box 68255, Highveld Park, 0169 DISTRIBUTIONS [ZARc]

MORE INFO: www.sharedata.co.za/sdo/jse/TLM Ords of R10.00 ea Ldt Pay Amt

COMPANY SECRETARY: Sascha Ramirez-Victor Final No 26 7 Jul 20 13 Jul 20 50.08

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. Interim No 25 26 Nov 19 2 Dec 19 71.53

DESIGNATED ADVISOR: AcaciaCap Advisors Sponsors (Pty) Ltd. LIQUIDITY: Jan22 Avg 7m shares p.w., R310.5m(72.3% p.a.)

AUDITORS: Nexia SAB&T Inc.

FTEL 40 Week MA TELKOM

CAPITAL STRUCTURE AUTHORISED ISSUED

TLM Ords 0.01c ea 500 000 000 55 759 670 9670

DISTRIBUTIONS [ZARc] 8078

Ords 0.01c ea Ldt Pay Amt

Quarterly No 58 4 Jan 22 10 Jan 22 0.50 6486

Final No 57 19 Oct 21 25 Oct 21 1.60

4895

LIQUIDITY: Jan22 Avg 17 679 shares p.w., R24 427.6(1.6% p.a.)

3303

FTEL 40 Week MA TELEMASTR

157 1711

2017 | 2018 | 2019 | 2020 | 2021

129 FINANCIAL STATISTICS

(R million) Sep 21 Mar 21 Mar 20 Mar 19 Mar 18

101

Interim Final Final(rst) Final Final(rst)

Turnover 21 292 43 222 43 043 41 774 41 018

72

Op Inc 2 490 4 833 2 619 4 767 4 939

44 NetIntPd(Rcvd) 541 - 1 803 947 893

Minority Int 1 6 5 36 106

16 Att Inc 1 360 2 422 535 2 795 3 052

2017 | 2018 | 2019 | 2020 | 2021

TotCompIncLoss 1 558 2 353 1 383 4 139 2 484

FINANCIAL STATISTICS

(Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 Fixed Ass 37 119 36 271 33 608 32 035 30 377

Final Final Final Final Final L-T Invest 139 115 62 78 100

Turnover 76 013 79 666 100 037 113 568 120 628 Tot Curr Ass 14 442 15 930 16 315 14 983 14 083

Op Inc - 4 541 2 194 152 4 508 4 189 Ord SH Int 32 634 31 366 29 390 29 573 26 936

NetIntPd(Rcvd) 1 085 - 846 - 76 369 563 Minority Int - 27 - 25 - 29 195 359

Att Inc - 3 936 1 090 1 043 3 101 2 457 LT Liab 13 875 15 121 14 767 6 740 10 278

TotCompIncLoss - 3 937 1 090 1 043 3 101 2 457 Tot Curr Liab 16 911 17 369 17 258 16 436 12 927

Fixed Ass 7 192 7 527 10 170 14 741 20 081 PER SHARE STATISTICS (cents per share)

Inv & Loans - 2 700 - - - HEPS-C (ZARc) 285.50 522.20 194.40 619.20 597.00

Tot Curr Ass 12 702 22 917 23 370 24 879 24 625 DPS (ZARc) - - 121.61 361.54 355.08

Ord SH Int 33 751 32 959 35 061 35 698 34 698

LT Liab 13 076 8 256 816 1 934 3 031 NAV PS (ZARc) 6 384.55 6 136.48 5 749.89 5 785.69 5 155.99

1.48

3 Yr Beta

0.19

0.61

0.86

1.55

Tot Curr Liab 16 880 7 262 5 044 10 896 17 041

Price High 5 022 4 487 10 004 7 802 8 248

PER SHARE STATISTICS (cents per share) Price Low 3 607 1 720 1 329 4 609 4 161

HEPS-C (ZARc) - 7.82 2.49 2.48 7.36 5.85 Price Prd End 4 413 4 236 2 053 7 292 5 294

DPS (ZARc) 6.40 6.20 5.50 5.50 2.50

NAV PS (ZARc) 66.83 78.47 83.48 85.00 82.61 RATIOS

3 Yr Beta 1.37 2.78 3.65 4.36 2.14 Ret on SH Fnd 8.35 7.75 1.84 9.51 11.57

Price High 159 79 115 115 120 Oper Pft Mgn 11.69 11.18 6.08 11.41 12.04

Price Low 73 16 20 25 28 D:E 0.50 0.50 0.57 0.41 0.46

Price Prd End 125 73 73 89 75 Current Ratio 0.85 0.92 0.95 0.91 1.09

RATIOS Div Cover - - 0.88 1.55 1.70

Ret on SH Fnd - 11.66 3.31 2.97 8.69 7.08

Oper Pft Mgn - 5.97 2.75 0.15 3.97 3.47 Textainer Group Holdings Ltd.

D:E 0.39 0.25 0.02 0.06 0.09

TEX

Current Ratio 0.75 3.16 4.63 2.28 1.45 ISIN: BMG8766E1093 SHORT: TEXTAINER CODE: TXT

Div Cover - 1.22 0.42 0.45 1.34 2.34 REG NO: EC18896 FOUNDED: 1993 LISTED: 2019

NATURE OF BUSINESS: Textainer has operated since 1979 and is one of the

Telkom SA SOC Ltd. world’slargestlessorsofintermodalcontainerswith approximately 3.8 million

TEU in our owned and managed fleet. We lease containers to approximately

TEL 250 customers, including all of the world’s leading international shipping lines,

ISIN: ZAE000044897 SHORT: TELKOM CODE: TKG and other lessees. Textainer's fleet consists of standard dry freight, refrigerated

REG NO: 1991/005476/30 FOUNDED: 1991 LISTED: 2003 intermodal containers, and dry freight specials.

NATURE OF BUSINESS: Telkom is a leading information and SECTOR: Inds—IndsGoods & Services—IndsTransport—TransportSer

communications technology (ICT) services provider in South Africa.

Telkom's mission is to seamlessly connect people to a better life. Telkom NUMBER OF EMPLOYEES: 0

carries this through in all their brands, whether at the consumer, business DIRECTORS: Brown I (ne), Cottingham D R (ne), EarlJ(ne),

or wholesale level. The Telkom Foundation actively works to bridge the Hostetler C (ne), Maccarone J A (ne), Nurek D M (ne), Pedersen R D (ne),

digital divide, with projects including the Connected Schools programme, Tang G (ne), Shwiel H (Chair, ne), Ghesquiere O (CEO)

while FutureMakers, their enterprise and supplier development initiative, MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

empowers digital entrepreneurs to realise their vision. Coronation Asset Management (Pty) Ltd. 11.20%

SECTOR: Telecoms—Telecoms—TelecomServiceProvider—TelecomServices Dimensional Fund Advisors LP 5.70%

NUMBER OF EMPLOYEES: 12 039 Massachusetts Financial Services Co. 5.40%

DIRECTORS: Ighodaro O (ind ne, Nig), Kapila N (ind ne), Luthuli P MORE INFO: www.sharedata.co.za/sdo/jse/TXT

CS(ind ne), Matenge-SebeshoEG(ind ne), Moloko S (ind ne), COMPANY SECRETARY: Adam Hopkin

Mzondeki K (ind ne), Petersen-Cook F (ind ne), RaynerKA(ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Sibisi DrSP(ind ne), Singh E (ind ne), TomlinsonRG(ind ne), SPONSOR: Investec Bank Ltd.

von ZeunerLL(ind ne), Taukobong S (Group CE), Reyneke D (CFO) AUDITORS: KPMG LLP

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021 CAPITAL STRUCTURE AUTHORISED ISSUED

The Government of the Republic of South Africa 40.50% TXT Ords USD0.01 ea 140 000 000 58 032 164

Telkom Treasury Stock 3.40%

POSTAL ADDRESS: Private Bag X881, Pretoria, 0001 DISTRIBUTIONS [USDc]

MORE INFO: www.sharedata.co.za/sdo/jse/TKG Ords USD0.01 ea Ldt Pay Amt

COMPANY SECRETARY: Ayanda Ceba Quarterly No 1 30 Nov 21 15 Dec 21 25.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Jan22 Avg 230 071 shares p.w., R103.0m(20.6% p.a.)

219