Page 223 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 223

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – THU

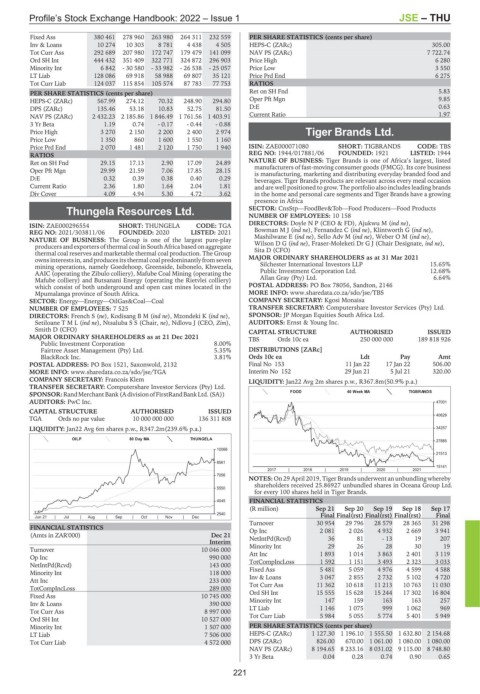

Fixed Ass 380 461 278 960 263 980 264 311 232 559 PER SHARE STATISTICS (cents per share)

Inv & Loans 10 274 10 303 8 781 4 438 4 505 HEPS-C (ZARc) 305.00

Tot Curr Ass 292 689 207 980 172 747 179 479 141 099 NAV PS (ZARc) 7 722.74

Ord SH Int 444 432 351 409 322 771 324 872 296 903 Price High 6 280

Minority Int 6 842 - 30 580 - 33 982 - 26 538 - 25 057 Price Low 3 550

LT Liab 128 086 69 918 58 988 69 807 35 121 Price Prd End 6 275

Tot Curr Liab 124 037 115 854 105 574 87 783 77 753 RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH Fnd 5.83

HEPS-C (ZARc) 567.99 274.12 70.32 248.90 294.80 Oper Pft Mgn 9.85

DPS (ZARc) 135.46 53.18 10.83 52.75 81.50 D:E 0.63

NAV PS (ZARc) 2 432.23 2 185.86 1 846.49 1 761.56 1 403.91 Current Ratio 1.97

3 Yr Beta 1.19 0.74 - 0.17 - 0.44 - 0.88

Price High 3 270 2 150 2 200 2 400 2 974 Tiger Brands Ltd.

Price Low 1 350 860 1 600 1 550 1 160 TIG

Price Prd End 2 070 1 481 2 120 1 750 1 940 ISIN: ZAE000071080 SHORT: TIGBRANDS CODE: TBS

RATIOS REG NO: 1944/017881/06 FOUNDED: 1921 LISTED: 1944

Ret on SH Fnd 29.15 17.13 2.90 17.09 24.89 NATURE OF BUSINESS: Tiger Brands is one of Africa’s largest, listed

manufacturers of fast-moving consumer goods (FMCG). Its core business

Oper Pft Mgn 29.99 21.59 7.06 17.85 28.15 is manufacturing, marketing and distributing everyday branded food and

D:E 0.32 0.39 0.38 0.40 0.29 beverages. Tiger Brands products are relevant across every meal occasion

Current Ratio 2.36 1.80 1.64 2.04 1.81 and are well positioned to grow. The portfolio also includes leading brands

Div Cover 4.09 4.94 5.30 4.72 3.62 in the home and personal care segments and Tiger Brands have a growing

presence in Africa

Thungela Resources Ltd. SECTOR: CnsStp—FoodBev&Tob—Food Producers—Food Products

NUMBER OF EMPLOYEES: 10 158

THU DIRECTORS: Doyle N P (CEO & FD), Ajukwu M (ind ne),

ISIN: ZAE000296554 SHORT: THUNGELA CODE: TGA

REG NO: 2021/303811/06 FOUNDED: 2020 LISTED: 2021 BowmanMJ(ind ne), Fernandez C (ind ne), Klintworth G (ind ne),

NATURE OF BUSINESS: The Group is one of the largest pure-play Mashilwane E (ind ne), Sello Adv M (ind ne), WeberOM(ind ne),

producers and exporters of thermal coal in South Africa based on aggregate WilsonDG(ind ne), Fraser-Moleketi Dr G J (Chair Designate, ind ne),

Sita D (CFO)

thermal coal reserves and marketable thermal coal production. The Group

owns interests in, and produces its thermal coal predominantly from seven MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021

mining operations, namely Goedehoop, Greenside, Isibonelo, Khwezela, Silchester International Investors LLP 15.65%

AAIC (operating the Zibulo colliery), Mafube Coal Mining (operating the Public Investment Corporation Ltd. 12.68%

Mafube colliery) and Butsanani Energy (operating the Rietvlei colliery) Allan Gray (Pty) Ltd. 6.64%

which consist of both underground and open cast mines located in the POSTAL ADDRESS: PO Box 78056, Sandton, 2146

Mpumalanga province of South Africa. MORE INFO: www.sharedata.co.za/sdo/jse/TBS

SECTOR: Energy—Energy—OilGas&Coal—Coal COMPANY SECRETARY: Kgosi Monaisa

NUMBER OF EMPLOYEES: 7 525 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: French S (ne), KodisangBM(ind ne), Mzondeki K (ind ne), SPONSOR: JP Morgan Equities South Africa Ltd.

SetiloaneTML(ind ne), Ntsaluba S S (Chair, ne), Ndlovu J (CEO, Zim), AUDITORS: Ernst & Young Inc.

Smith D (CFO) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 21 Dec 2021 TBS Ords 10c ea 250 000 000 189 818 926

Public Investment Corporation 8.00%

Fairtree Asset Management (Pty) Ltd. 5.35% DISTRIBUTIONS [ZARc]

BlackRock Inc. 3.81% Ords 10c ea Ldt Pay Amt

POSTAL ADDRESS: PO Box 1521, Saxonwold, 2132 Final No 153 11 Jan 22 17 Jan 22 506.00

MORE INFO: www.sharedata.co.za/sdo/jse/TGA Interim No 152 29 Jun 21 5 Jul 21 320.00

COMPANY SECRETARY: Francois Klem LIQUIDITY: Jan22 Avg 2m shares p.w., R367.8m(50.9% p.a.)

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

FOOD 40 Week MA TIGBRANDS

SPONSOR:RandMerchantBank(AdivisionofFirstRandBankLtd.(SA))

AUDITORS: PwC Inc. 47001

CAPITAL STRUCTURE AUTHORISED ISSUED

40629

TGA Ords no par value 10 000 000 000 136 311 808

LIQUIDITY: Jan22 Avg 6m shares p.w., R347.2m(239.6% p.a.) 34257

OILP 80 Day MA THUNGELA

27885

10066

21513

8561

15141

2017 | 2018 | 2019 | 2020 | 2021

7056

NOTES: On 29 April 2019, Tiger Brands underwent an unbundling whereby

shareholders received 25.86927 unbundled shares in Oceana Group Ltd.

5550

for every 100 shares held in Tiger Brands.

4045 FINANCIAL STATISTICS

(R million) Sep 21 Sep 20 Sep 19 Sep 18 Sep 17

2540 Final Final(rst) Final(rst) Final(rst) Final

Jun 21 | Jul | Aug | Sep | Oct | Nov | Dec |

Turnover 30 954 29 796 28 579 28 365 31 298

FINANCIAL STATISTICS Op Inc 2 081 2 026 4 932 2 669 3 941

(Amts in ZAR'000) Dec 21

Interim NetIntPd(Rcvd) 36 81 - 13 19 207

Turnover 10 046 000 Minority Int 29 26 28 30 19

Op Inc 990 000 Att Inc 1 893 1 014 3 863 2 401 3 119

1 592

3 493

3 033

1 151

TotCompIncLoss

2 323

NetIntPd(Rcvd) 143 000

Minority Int 118 000 Fixed Ass 5 481 5 059 4 976 4 599 4 588

Att Inc 233 000 Inv & Loans 3 047 2 855 2 732 5 102 4 720

Tot Curr Ass 11 362 10 618 11 213 10 763 11 030

TotCompIncLoss 289 000

Fixed Ass 10 745 000 Ord SH Int 15 555 15 628 15 244 17 302 16 804

163

163

159

257

Minority Int

147

Inv & Loans 390 000

Tot Curr Ass 8 997 000 LT Liab 1 146 1 075 999 1 062 969

Ord SH Int 10 527 000 Tot Curr Liab 5 984 5 055 5 774 5 401 5 949

Minority Int 1 507 000 PER SHARE STATISTICS (cents per share)

LT Liab 7 506 000 HEPS-C (ZARc) 1 127.30 1 196.10 1 555.50 1 632.80 2 154.68

Tot Curr Liab 4 572 000 DPS (ZARc) 826.00 670.00 1 061.00 1 080.00 1 080.00

NAV PS (ZARc) 8 194.65 8 233.16 8 031.02 9 115.00 8 748.80

3 Yr Beta 0.04 0.28 0.74 0.90 0.65

221