Page 216 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 216

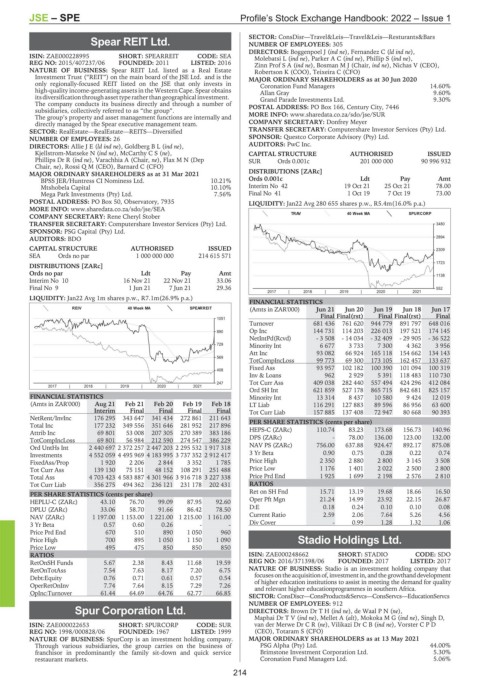

JSE – SPE Profile’s Stock Exchange Handbook: 2022 – Issue 1

SECTOR: ConsDisr—Travel&Leis—Travel&Leis—Resturants&Bars

Spear REIT Ltd. NUMBER OF EMPLOYEES: 305

SPE DIRECTORS: Boggenpoel J (ind ne), Fernandez C (ld ind ne),

ISIN: ZAE000228995 SHORT: SPEARREIT CODE: SEA Molebatsi L (ind ne), ParkerAC(ind ne), Phillip S (ind ne),

REG NO: 2015/407237/06 FOUNDED: 2011 LISTED: 2016 Zinn ProfSA(ind ne), Bosman M J (Chair, ind ne), Nichas V (CEO),

NATURE OF BUSINESS: Spear REIT Ltd. listed as a Real Estate Robertson K (COO), Teixeira C (CFO)

Investment Trust (“REIT”) on the main board of the JSE Ltd. and is the MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

only regionally-focused REIT listed on the JSE that only invests in Coronation Fund Managers 14.60%

high-quality income-generating assets in the Western Cape. Spear obtains Allan Gray 9.60%

itsdiversificationthrough assettyperatherthangeographical investment. Grand Parade Investments Ltd. 9.30%

The company conducts its business directly and through a number of POSTAL ADDRESS: PO Box 166, Century City, 7446

subsidiaries, collectively referred to as “the group”. MORE INFO: www.sharedata.co.za/sdo/jse/SUR

The group’s property and asset management functions are internally and

directly managed by the Spear executive management team. COMPANY SECRETARY: Donfrey Meyer

SECTOR: RealEstate—RealEstate—REITS—Diversified TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NUMBER OF EMPLOYEES: 26 SPONSOR: Questco Corporate Advisory (Pty) Ltd.

DIRECTORS: AllieJE(ld ind ne), GoldbergBL(ind ne), AUDITORS: PwC Inc.

Kjellstrom-Matseke N (ind ne), McCarthyCS(ne), CAPITAL STRUCTURE AUTHORISED ISSUED

Phillips Dr R (ind ne), Varachhia A (Chair, ne), Flax M N (Dep SUR Ords 0.001c 201 000 000 90 996 932

Chair, ne), Rossi Q M (CEO), Barnard C (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021 DISTRIBUTIONS [ZARc]

BPSS JER/Huntress CI Nominess Ltd. 10.21% Ords 0.001c Ldt Pay Amt

Mtshobela Capital 10.10% Interim No 42 19 Oct 21 25 Oct 21 78.00

Mega Park Investments (Pty) Ltd. 7.56% Final No 41 1 Oct 19 7 Oct 19 73.00

POSTAL ADDRESS: PO Box 50, Observatory, 7935 LIQUIDITY: Jan22 Avg 280 655 shares p.w., R5.4m(16.0% p.a.)

MORE INFO: www.sharedata.co.za/sdo/jse/SEA

TRAV 40 Week MA SPURCORP

COMPANY SECRETARY: Rene Cheryl Stober

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 3480

SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: BDO 2894

CAPITAL STRUCTURE AUTHORISED ISSUED 2309

SEA Ords no par 1 000 000 000 214 615 571

1723

DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt 1138

Interim No 10 16 Nov 21 22 Nov 21 33.06

Final No 9 1 Jun 21 7 Jun 21 29.36 552

2017 | 2018 | 2019 | 2020 | 2021

LIQUIDITY: Jan22 Avg 1m shares p.w., R7.1m(26.9% p.a.)

FINANCIAL STATISTICS

REIV 40 Week MA SPEARREIT (Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

Final Final(rst) Final Final(rst) Final

1051

Turnover 681 436 761 620 944 779 891 797 648 016

890 Op Inc 144 731 114 203 226 013 197 521 174 145

NetIntPd(Rcvd) - 3 508 - 14 034 - 32 409 - 29 905 - 36 522

729 Minority Int 6 677 3 733 7 300 4 362 3 956

Att Inc 93 082 66 924 165 118 154 662 134 143

569

TotCompIncLoss 99 773 69 300 173 105 162 457 133 637

Fixed Ass 93 957 102 182 100 390 101 094 100 319

408

Inv & Loans 962 2 929 5 391 118 483 110 730

247 Tot Curr Ass 409 038 282 440 557 494 424 296 412 084

2017 | 2018 | 2019 | 2020 | 2021

Ord SH Int 621 859 527 178 865 715 842 681 825 157

FINANCIAL STATISTICS Minority Int 13 314 8 437 10 580 9 424 12 019

(Amts in ZAR'000) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18 LT Liab 116 291 127 883 89 596 86 956 63 600

Interim Final Final Final Final Tot Curr Liab 157 885 137 408 72 947 80 668 90 393

NetRent/InvInc 176 295 343 647 341 434 272 861 211 643 PER SHARE STATISTICS (cents per share)

Total Inc 177 232 349 556 351 646 281 952 217 896

Attrib Inc 69 801 53 008 207 305 270 389 383 186 HEPS-C (ZARc) 110.74 83.23 173.68 156.73 140.96

TotCompIncLoss 69 801 56 984 212 590 274 547 386 229 DPS (ZARc) - 78.00 136.00 123.00 132.00

Ord UntHs Int 2 440 697 2 372 257 2 447 203 2 295 532 1 917 318 NAV PS (ZARc) 756.00 637.88 924.47 892.17 875.08

Investments 4 552 059 4 495 969 4 183 995 3 737 352 2 912 417 3 Yr Beta 0.90 0.75 0.28 0.22 0.74

FixedAss/Prop 1 920 2 206 2 844 3 352 1 785 Price High 2 350 2 880 2 800 3 145 3 508

Tot Curr Ass 139 130 75 151 48 152 108 291 251 488 Price Low 1 176 1 401 2 022 2 500 2 800

Total Ass 4 703 423 4 583 887 4 301 966 3 916 718 3 227 338 Price Prd End 1 925 1 699 2 198 2 576 2 810

Tot Curr Liab 356 275 494 362 236 121 231 178 202 431 RATIOS

Ret on SH Fnd 15.71 13.19 19.68 18.66 16.50

PER SHARE STATISTICS (cents per share)

HEPLU-C (ZARc) 43.10 76.70 99.09 87.95 92.60 Oper Pft Mgn 21.24 14.99 23.92 22.15 26.87

DPLU (ZARc) 33.06 58.70 91.66 86.42 78.50 D:E 0.18 0.24 0.10 0.10 0.08

NAV (ZARc) 1 197.00 1 153.00 1 221.00 1 215.00 1 161.00 Current Ratio 2.59 2.06 7.64 5.26 4.56

3 Yr Beta 0.57 0.60 0.26 - - Div Cover - 0.99 1.28 1.32 1.06

Price Prd End 670 510 890 1 050 960

Price High 700 895 1 050 1 150 1 090 Stadio Holdings Ltd.

Price Low 495 475 850 850 850 STA

RATIOS ISIN: ZAE000248662 SHORT: STADIO CODE: SDO

RetOnSH Funds 5.67 2.38 8.43 11.68 19.59 REG NO: 2016/371398/06 FOUNDED: 2017 LISTED: 2017

RetOnTotAss 7.54 7.63 8.17 7.20 6.75 NATURE OF BUSINESS: Stadio is an investment holding company that

Debt:Equity 0.76 0.71 0.61 0.57 0.54 focuses on the acquisition of, investment in, and the growthand development

of higher education institutions to assist in meeting the demand for quality

OperRetOnInv 7.74 7.64 8.15 7.29 7.26 and relevant higher educationprogrammes in southern Africa.

OpInc:Turnover 61.44 64.69 64.76 62.77 66.85

SECTOR: ConsDiscr—ConsProducts&Servcs—ConsServcs—EducationServcs

NUMBER OF EMPLOYEES: 912

Spur Corporation Ltd. DIRECTORS: Brown DrTH(ind ne), de WaalPN(ne),

Maphai DrTV(ind ne), Mellet A (alt), MokokaMG(ind ne), Singh D,

SPU

ISIN: ZAE000022653 SHORT: SPURCORP CODE: SUR van der Merwe DrCR(ne), Vilikazi DrCB(ind ne), VorsterCPD

REG NO: 1998/000828/06 FOUNDED: 1967 LISTED: 1999 (CEO), Totaram S (CFO)

NATURE OF BUSINESS: SpurCorp is an investment holding company. MAJOR ORDINARY SHAREHOLDERS as at 13 May 2021

Through various subsidiaries, the group carries on the business of PSG Alpha (Pty) Ltd. 44.00%

franchisor in predominantly the family sit-down and quick service Brimstone Investment Corporation Ltd. 5.30%

restaurant markets. Coronation Fund Managers Ltd. 5.06%

214