Page 218 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 218

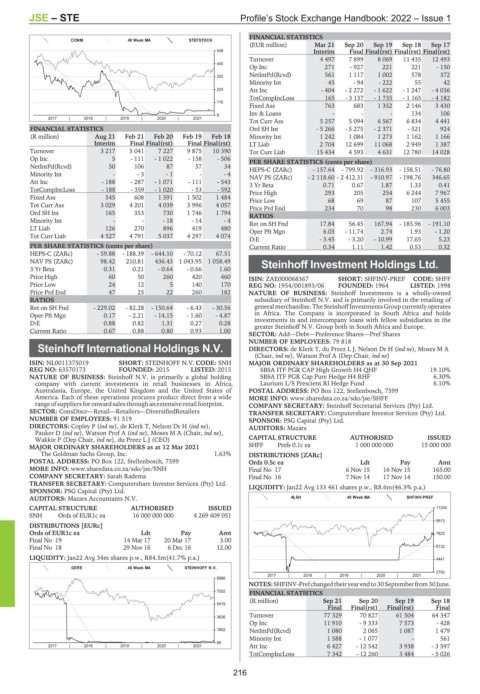

JSE – STE Profile’s Stock Exchange Handbook: 2022 – Issue 1

FINANCIAL STATISTICS

CONM 40 Week MA STEFSTOCK

(EUR million) Mar 21 Sep 20 Sep 19 Sep 18 Sep 17

548 Interim Final Final(rst) Final(rst) Final(rst)

Turnover 4 497 7 899 8 069 11 435 12 493

440

Op Inc 271 - 927 221 221 - 150

NetIntPd(Rcvd) 561 1 117 1 002 578 372

332

Minority Int 45 - 94 - 222 55 42

224 Att Inc - 404 - 2 272 - 1 622 - 1 247 - 4 036

TotCompIncLoss 165 - 3 137 - 1 735 - 1 165 - 4 182

116

Fixed Ass 763 683 1 352 2 146 3 430

Inv & Loans - - - 134 106

8

2017 | 2018 | 2019 | 2020 | 2021

Tot Curr Ass 5 257 5 094 6 567 6 834 4 441

FINANCIAL STATISTICS Ord SH Int - 5 266 - 5 275 - 2 371 - 521 924

(R million) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18 Minority Int 1 242 1 084 1 273 1 162 1 166

Interim Final Final(rst) Final Final(rst) LT Liab 2 704 12 699 11 068 2 949 1 387

Turnover 3 217 5 041 7 227 9 875 10 390 Tot Curr Liab 15 434 4 593 4 631 12 780 14 028

Op Inc 5 - 111 - 1 022 - 158 - 506 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) 50 106 87 57 34 HEPS-C (ZARc) - 157.64 - 799.92 - 316.93 - 158.51 - 76.80

Minority Int - - 3 - 1 - - 4 NAV PS (ZARc) - 2 118.60 - 2 412.31 - 910.97 - 198.76 346.65

Att Inc - 188 - 287 - 1 071 - 111 - 543 3 Yr Beta 0.71 0.67 1.87 1.33 0.41

TotCompIncLoss - 188 - 359 - 1 020 - 53 - 592 Price High 293 205 254 6 244 7 967

Fixed Ass 545 608 1 591 1 502 1 484 Price Low 68 69 87 107 5 455

Tot Curr Ass 3 029 4 201 4 039 3 996 4 057 Price Prd End 234 70 98 230 6 003

Ord SH Int 165 353 730 1 746 1 794 RATIOS

Minority Int - - - 18 - 14 - 4 Ret on SH Fnd 17.84 56.45 167.94 - 185.96 - 191.10

LT Liab 126 270 896 419 480 Oper Pft Mgn 6.03 - 11.74 2.74 1.93 - 1.20

Tot Curr Liab 4 527 4 791 5 037 4 297 4 074

D:E - 3.45 - 3.20 - 10.99 17.65 5.23

PER SHARE STATISTICS (cents per share) Current Ratio 0.34 1.11 1.42 0.53 0.32

HEPS-C (ZARc) - 59.88 - 188.39 - 644.10 - 70.12 67.51

NAV PS (ZARc) 98.42 210.81 436.43 1 043.95 1 058.49 Steinhoff Investment Holdings Ltd.

3 Yr Beta 0.31 0.21 - 0.64 - 0.66 1.60

STE

Price High 60 50 260 420 460 ISIN: ZAE000068367 SHORT: SHFINV-PREF CODE: SHFF

Price Low 24 12 5 140 170 REG NO: 1954/001893/06 FOUNDED: 1964 LISTED: 1998

Price Prd End 47 25 22 260 182 NATURE OF BUSINESS: Steinhoff Investments is a wholly-owned

RATIOS subsidiary of Steinhoff N.V. and is primarily involved in the retailing of

Ret on SH Fnd - 229.02 - 82.28 - 150.64 - 6.43 - 30.56 general merchandise. The Steinhoff Investments Group currently operates

Oper Pft Mgn 0.17 - 2.21 - 14.15 - 1.60 - 4.87 in Africa. The Company is incorporated in South Africa and holds

D:E 0.88 0.82 1.31 0.27 0.28 investments in and intercompany loans with fellow subsidiaries in the

greater Steinhoff N.V. Group both in South Africa and Europe.

Current Ratio 0.67 0.88 0.80 0.93 1.00

SECTOR: Add—Debt—Preference Shares—Pref Shares

NUMBER OF EMPLOYEES: 79 818

Steinhoff International Holdings N.V. DIRECTORS: de Klerk T, du Preez L J, Nelson Dr H (ind ne), Moses M A

(Chair, ind ne), Watson Prof A (Dep Chair, ind ne)

STE

ISIN: NL0011375019 SHORT: STEINHOFF N.V. CODE: SNH MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2021

REG NO: 63570173 FOUNDED: 2015 LISTED: 2015 SBSA ITF PGR CAP High Growth H4 QHF 19.10%

NATURE OF BUSINESS: Steinhoff N.V. is primarily a global holding SBSA ITF PGR Cap Pure Hedge H4 RHF 6.30%

company with current investments in retail businesses in Africa, Laurium L/S Prescient RI Hedge Fund 6.10%

Australasia, Europe, the United Kingdom and the United States of POSTAL ADDRESS: PO Box 122, Stellenbosch, 7599

America. Each of these operations procures product direct from a wide MORE INFO: www.sharedata.co.za/sdo/jse/SHFF

rangeofsuppliersforonwardsalesthrough anextensiveretailfootprint. COMPANY SECRETARY: Steinhoff Secretarial Services (Pty) Ltd.

SECTOR: ConsDiscr—Retail—Retailers—DiversifiedRetailers TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NUMBER OF EMPLOYEES: 91 519 SPONSOR: PSG Capital (Pty) Ltd.

DIRECTORS: Copley P (ind ne), de Klerk T, Nelson Dr H (ind ne), AUDITORS: Mazars

Pauker D (ind ne), Watson Prof A (ind ne), Moses M A (Chair, ind ne),

Wakkie P (Dep Chair, ind ne), du Preez L J (CEO) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 12 Mar 2021 SHFF Prefs 0.1c ea 1 000 000 000 15 000 000

The Goldman Sachs Group, Inc. 1.63% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: PO Box 122, Stellenbosch, 7599 Ords 0.5c ea Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/SNH Final No 17 6 Nov 15 16 Nov 15 165.00

COMPANY SECRETARY: Sarah Radema Final No 16 7 Nov 14 17 Nov 14 150.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Jan22 Avg 133 461 shares p.w., R8.6m(46.3% p.a.)

SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: Mazars Accountants N.V. ALSH 40 Week MA SHFINV-PREF

CAPITAL STRUCTURE AUTHORISED ISSUED 11204

SNH Ords of EUR1c ea 16 000 000 000 4 269 609 051

9513

DISTRIBUTIONS [EURc]

Ords of EUR1c ea Ldt Pay Amt 7822

Final No 19 14 Mar 17 20 Mar 17 3.00

Final No 18 29 Nov 16 6 Dec 16 12.00 6132

LIQUIDITY: Jan22 Avg 34m shares p.w., R84.5m(41.7% p.a.) 4441

GERE 40 Week MA STEINHOFF N.V.

2750

2017 | 2018 | 2019 | 2020 | 2021

8986

NOTES:SHFINV-Prefchangedtheiryearendto30Septemberfrom30June.

7202

FINANCIAL STATISTICS

(R million) Sep 21 Sep 20 Sep 19 Sep 18

5419

Final Final(rst) Final(rst) Final

Turnover 77 329 70 827 61 504 64 347

3636

Op Inc 11 910 - 9 333 7 573 - 428

1852 NetIntPd(Rcvd) 1 080 2 065 1 087 1 479

Minority Int 1 588 - 1 077 - 561

69

2017 | 2018 | 2019 | 2020 | 2021 Att Inc 6 427 - 12 542 3 938 - 3 597

TotCompIncLoss 7 342 - 12 260 3 484 - 5 026

216