Page 222 - SHB 2021 Issue 4

P. 222

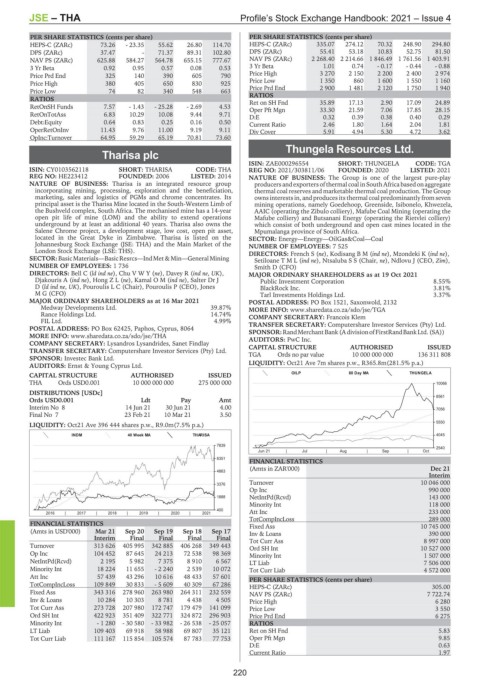

JSE – THA Profile’s Stock Exchange Handbook: 2021 – Issue 4

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 73.26 - 23.35 55.62 26.80 114.70 HEPS-C (ZARc) 335.07 274.12 70.32 248.90 294.80

DPS (ZARc) 37.47 - 71.37 89.31 102.80 DPS (ZARc) 55.41 53.18 10.83 52.75 81.50

NAV PS (ZARc) 625.88 584.27 564.78 655.15 777.67 NAV PS (ZARc) 2 268.40 2 214.66 1 846.49 1 761.56 1 403.91

3 Yr Beta 0.92 0.95 0.57 0.08 0.53 3 Yr Beta 1.01 0.74 - 0.17 - 0.44 - 0.88

Price Prd End 325 140 390 605 790 Price High 3 270 2 150 2 200 2 400 2 974

860

Price High 380 405 650 830 925 Price Low 1 350 1 481 1 600 1 550 1 160

Price Prd End

1 750

1 940

2 120

2 900

Price Low 74 82 340 548 663

RATIOS RATIOS 35.89 17.13 2.90 17.09 24.89

Ret on SH Fnd

RetOnSH Funds 7.57 - 1.43 - 25.28 - 2.69 4.53 Oper Pft Mgn 33.30 21.59 7.06 17.85 28.15

RetOnTotAss 6.83 10.29 10.08 9.44 9.71 D:E 0.32 0.39 0.38 0.40 0.29

Debt:Equity 0.64 0.83 0.25 0.16 0.50 Current Ratio 2.46 1.80 1.64 2.04 1.81

OperRetOnInv 11.43 9.76 11.00 9.19 9.11 Div Cover 5.91 4.94 5.30 4.72 3.62

OpInc:Turnover 64.95 59.29 65.19 70.81 73.60

Thungela Resources Ltd.

Tharisa plc THU

ISIN: ZAE000296554 SHORT: THUNGELA CODE: TGA

THA

ISIN: CY0103562118 SHORT: THARISA CODE: THA REG NO: 2021/303811/06 FOUNDED: 2020 LISTED: 2021

REG NO: HE223412 FOUNDED: 2006 LISTED: 2014 NATURE OF BUSINESS: The Group is one of the largest pure-play

NATURE OF BUSINESS: Tharisa is an integrated resource group producers andexporters of thermal coal in South Africa based onaggregate

incorporating mining, processing, exploration and the beneficiation, thermal coal reserves and marketable thermal coal production. The Group

marketing, sales and logistics of PGMs and chrome concentrates. Its owns interests in, and produces its thermal coal predominantly from seven

principal asset is the Tharisa Mine located in the South-Western Limb of mining operations, namely Goedehoop, Greenside, Isibonelo, Khwezela,

the Bushveld complex, South Africa. The mechanised mine has a 14-year AAIC (operating the Zibulo colliery), Mafube Coal Mining (operating the

open pit life of mine (LOM) and the ability to extend operations Mafube colliery) and Butsanani Energy (operating the Rietvlei colliery)

underground by at least an additional 40 years. Tharisa also owns the which consist of both underground and open cast mines located in the

Salene Chrome project, a development stage, low cost, open pit asset, Mpumalanga province of South Africa.

located in the Great Dyke in Zimbabwe. Tharisa is listed on the SECTOR: Energy—Energy—OilGas&Coal—Coal

Johannesburg Stock Exchange (JSE: THA) and the Main Market of the NUMBER OF EMPLOYEES: 7 525

London Stock Exchange (LSE: THS). DIRECTORS: French S (ne), KodisangBM(ind ne), Mzondeki K (ind ne),

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining SetiloaneTML(ind ne), Ntsaluba S S (Chair, ne), Ndlovu J (CEO, Zim),

NUMBER OF EMPLOYEES: 1 736 Smith D (CFO)

DIRECTORS: Bell C (ld ind ne), ChuVWY(ne), Davey R (ind ne, UK), MAJOR ORDINARY SHAREHOLDERS as at 19 Oct 2021

Djakouris A (ind ne), HongZL(ne), KamalOM(ind ne), Salter Dr J Public Investment Corporation 8.55%

D(ld ind ne, UK), Pouroulis L C (Chair), Pouroulis P (CEO), Jones BlackRock Inc. 3.81%

M G (CFO) Tarl Investments Holdings Ltd. 3.37%

MAJOR ORDINARY SHAREHOLDERS as at 16 Mar 2021 POSTAL ADDRESS: PO Box 1521, Saxonwold, 2132

Medway Developments Ltd. 39.87% MORE INFO: www.sharedata.co.za/sdo/jse/TGA

Rance Holdings Ltd. 14.74% COMPANY SECRETARY: Francois Klem

FIL Ltd. 4.99%

POSTAL ADDRESS: PO Box 62425, Paphos, Cyprus, 8064 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR:RandMerchantBank(AdivisionofFirstRandBankLtd.(SA))

MORE INFO: www.sharedata.co.za/sdo/jse/THA AUDITORS: PwC Inc.

COMPANY SECRETARY: Lysandros Lysandrides, Sanet Findlay

ISSUED

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED 136 311 808

TGA

10 000 000 000

Ords no par value

SPONSOR: Investec Bank Ltd.

AUDITORS: Ernst & Young Cyprus Ltd. LIQUIDITY: Oct21 Ave 7m shares p.w., R365.8m(281.5% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED OILP 80 Day MA THUNGELA

THA Ords USD0.001 10 000 000 000 275 000 000 10066

DISTRIBUTIONS [USDc]

8561

Ords USD0.001 Ldt Pay Amt

Interim No 8 14 Jun 21 30 Jun 21 4.00 7056

Final No 7 23 Feb 21 10 Mar 21 3.50

5550

LIQUIDITY: Oct21 Ave 396 444 shares p.w., R9.0m(7.5% p.a.)

INDM 40 Week MA THARISA 4045

7839

2540

Jun 21 | Jul | Aug | Sep | Oct

6351

FINANCIAL STATISTICS

(Amts in ZAR'000) Dec 21

4863

Interim

3376 Turnover 10 046 000

Op Inc 990 000

1888 NetIntPd(Rcvd) 143 000

Minority Int 118 000

400 Att Inc 233 000

2016 | 2017 | 2018 | 2019 | 2020 | 2021

TotCompIncLoss 289 000

FINANCIAL STATISTICS

Fixed Ass 10 745 000

(Amts in USD'000) Mar 21 Sep 20 Sep 19 Sep 18 Sep 17 Inv & Loans 390 000

Interim Final Final Final Final Tot Curr Ass 8 997 000

Turnover 313 626 405 995 342 885 406 268 349 443 Ord SH Int 10 527 000

Op Inc 104 452 87 645 24 213 72 538 98 369 Minority Int 1 507 000

NetIntPd(Rcvd) 2 195 5 982 7 375 8 910 6 567 LT Liab 7 506 000

Minority Int 18 224 11 655 - 2 240 2 539 10 072 Tot Curr Liab 4 572 000

Att Inc 57 439 43 296 10 616 48 433 57 601 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 109 849 30 833 - 5 609 40 309 67 286 HEPS-C (ZARc) 305.00

Fixed Ass 343 316 278 960 263 980 264 311 232 559 NAV PS (ZARc) 7 722.74

Inv & Loans 10 284 10 303 8 781 4 438 4 505 Price High 6 280

Tot Curr Ass 273 728 207 980 172 747 179 479 141 099 Price Low 3 550

Ord SH Int 422 923 351 409 322 771 324 872 296 903 Price Prd End 6 275

Minority Int - 1 280 - 30 580 - 33 982 - 26 538 - 25 057 RATIOS

LT Liab 109 403 69 918 58 988 69 807 35 121 Ret on SH Fnd 5.83

Tot Curr Liab 111 167 115 854 105 574 87 783 77 753 Oper Pft Mgn 9.85

D:E 0.63

Current Ratio 1.97

220