Page 219 - SHB 2021 Issue 4

P. 219

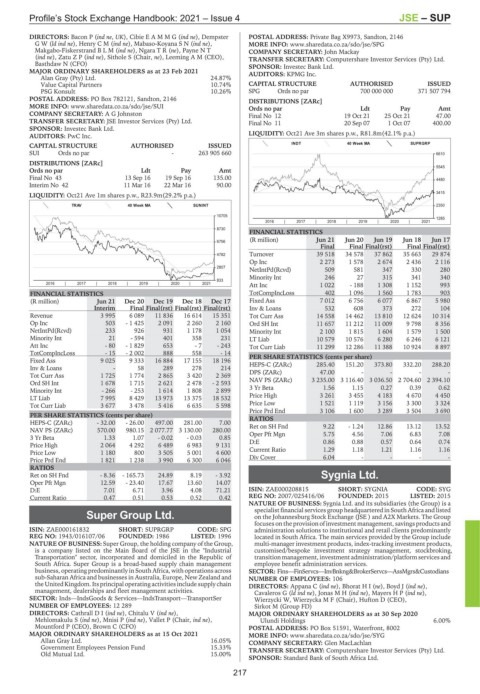

Profile’s Stock Exchange Handbook: 2021 – Issue 4 JSE – SUP

DIRECTORS: Bacon P (ind ne, UK), CibieEAMMG(ind ne), Dempster POSTAL ADDRESS: Private Bag X9973, Sandton, 2146

GW(ld ind ne), HenryCM(ind ne), Mabaso-KoyanaSN(ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/SPG

Makgabo-FiskerstrandBLM(ind ne), NgaraTR(ne), Payne N T COMPANY SECRETARY: John Mackay

(ind ne), ZatuZP(ind ne), Sithole S (Chair, ne), Leeming A M (CEO), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Basthdaw N (CFO) SPONSOR: Investec Bank Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 23 Feb 2021 AUDITORS: KPMG Inc.

Alan Gray (Pty) Ltd. 24.87%

Value Capital Partners 10.74% CAPITAL STRUCTURE AUTHORISED ISSUED

PSG Konsult 10.26% SPG Ords no par 700 000 000 371 507 794

POSTAL ADDRESS: PO Box 782121, Sandton, 2146 DISTRIBUTIONS [ZARc]

MORE INFO: www.sharedata.co.za/sdo/jse/SUI Ords no par Ldt Pay Amt

COMPANY SECRETARY: A G Johnston Final No 12 19 Oct 21 25 Oct 21 47.00

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. Final No 11 20 Sep 07 1 Oct 07 400.00

SPONSOR: Investec Bank Ltd.

AUDITORS: PwC Inc. LIQUIDITY: Oct21 Ave 3m shares p.w., R81.8m(42.1% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED INDT 40 Week MA SUPRGRP

SUI Ords no par - 263 905 660 6610

DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt 5545

Final No 43 13 Sep 16 19 Sep 16 135.00 4480

Interim No 42 11 Mar 16 22 Mar 16 90.00

3415

LIQUIDITY: Oct21 Ave 1m shares p.w., R23.9m(29.2% p.a.)

TRAV 40 Week MA SUNINT 2350

10705 1285

2016 | 2017 | 2018 | 2019 | 2020 | 2021

8730

FINANCIAL STATISTICS

(R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

6756

Final Final Final(rst) Final Final(rst)

4782 Turnover 39 518 34 578 37 862 35 663 29 874

Op Inc 2 273 1 578 2 674 2 436 2 116

2807

NetIntPd(Rcvd) 509 581 347 330 280

Minority Int 246 27 315 341 340

833

2016 | 2017 | 2018 | 2019 | 2020 | 2021 Att Inc 1 022 - 188 1 308 1 152 993

FINANCIAL STATISTICS TotCompIncLoss 402 1 096 1 560 1 783 903

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17 Fixed Ass 7 012 6 756 6 077 6 867 5 980

Interim Final Final(rst) Final(rst) Final(rst) Inv & Loans 532 608 373 272 104

Revenue 3 995 6 089 11 836 16 614 15 351 Tot Curr Ass 14 558 14 462 13 810 12 624 10 314

Op Inc 503 - 1 425 2 091 2 260 2 160 Ord SH Int 11 657 11 212 11 009 9 798 8 356

NetIntPd(Rcvd) 233 926 931 1 178 1 054 Minority Int 2 100 1 815 1 604 1 579 1 500

Minority Int 21 - 594 401 358 231 LT Liab 10 579 10 576 6 280 6 246 6 121

Att Inc - 80 - 1 829 653 - 7 - 243 Tot Curr Liab 11 299 12 286 11 388 10 924 8 897

TotCompIncLoss - 15 - 2 002 888 558 - 14 PER SHARE STATISTICS (cents per share)

Fixed Ass 9 025 9 333 16 884 17 155 18 196

Inv & Loans - 58 289 278 214 HEPS-C (ZARc) 285.40 151.20 - 373.80 - 332.20 - 288.20 -

47.00

DPS (ZARc)

Tot Curr Ass 1 725 1 774 2 865 3 420 2 369

Ord SH Int 1 678 1 715 2 621 2 478 - 2 593 NAV PS (ZARc) 3 235.00 3 116.40 3 036.50 2 704.60 2 394.10

Minority Int - 266 - 253 1 614 1 808 2 899 3 Yr Beta 1.56 1.15 0.27 0.39 0.62

LT Liab 7 995 8 429 13 973 13 375 18 532 Price High 3 261 3 455 4 183 4 670 4 450

Tot Curr Liab 3 677 3 478 5 416 6 635 5 598 Price Low 1 521 1 119 3 156 3 300 3 324

Price Prd End 3 106 1 600 3 289 3 504 3 690

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) - 32.00 - 26.00 497.00 281.00 7.00

NAV PS (ZARc) 570.00 980.15 2 077.77 3 130.00 280.00 Ret on SH Fnd 9.22 - 1.24 12.86 13.12 13.52

6.83

7.06

Oper Pft Mgn

7.08

4.56

5.75

3 Yr Beta 1.33 1.07 - 0.02 - 0.03 0.85

Price High 2 064 4 292 6 489 6 983 9 131 D:E 0.86 0.88 0.57 0.64 0.74

Price Low 1 180 800 3 505 5 001 4 600 Current Ratio 1.29 1.18 1.21 1.16 1.16

Price Prd End 1 821 1 238 3 990 6 300 6 046 Div Cover 6.04 - - - -

RATIOS

Ret on SH Fnd - 8.36 - 165.73 24.89 8.19 - 3.92 Sygnia Ltd.

Oper Pft Mgn 12.59 - 23.40 17.67 13.60 14.07 SYG

D:E 7.01 6.71 3.96 4.08 71.21 ISIN: ZAE000208815 SHORT: SYGNIA CODE: SYG

Current Ratio 0.47 0.51 0.53 0.52 0.42 REG NO: 2007/025416/06 FOUNDED: 2015 LISTED: 2015

NATURE OF BUSINESS: Sygnia Ltd. and its subsidiaries (the Group) is a

specialist financial services group headquartered in South Africa and listed

Super Group Ltd. on the Johannesburg Stock Exchange (JSE ) and A2X Markets. The Group

focuses on the provision of investment management, savings products and

SUP

ISIN: ZAE000161832 SHORT: SUPRGRP CODE: SPG administration solutions to institutional and retail clients predominantly

REG NO: 1943/016107/06 FOUNDED: 1986 LISTED: 1996 located in South Africa. The main services provided by the Group include

NATURE OF BUSINESS: Super Group, the holding company of the Group, multi-manager investment products, index-tracking investment products,

is a company listed on the Main Board of the JSE in the "Industrial customised/bespoke investment strategy management, stockbroking,

Transportation" sector, incorporated and domiciled in the Republic of transition management, investment administration/platformservices and

South Africa. Super Group is a broad-based supply chain management employee benefit administration services.

business, operating predominantly in South Africa, with operations across SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians

sub-Saharan Africa and businesses in Australia, Europe, New Zealand and NUMBER OF EMPLOYEES: 106

the United Kingdom. Its principal operating activities include supply chain DIRECTORS: Appana C (ind ne), BhoratHI(ne), Boyd J (ind ne),

management, dealerships and fleet management activities. Cavaleros G (ld ind ne), JonasMH(ind ne), MayersHP(ind ne),

SECTOR: Inds—IndsGoods & Services—IndsTransport—TransportSer Wierzycki W, Wierzycka M F (Chair), Hufton D (CEO),

NUMBER OF EMPLOYEES: 12 289 Sirkot M (Group FD)

DIRECTORS: CathrallDI(ind ne), Chitalu V (ind ne), MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020

Mehlomakulu S (ind ne), Mnisi P (ind ne), Vallet P (Chair, ind ne), Ulundi Holdings 6.00%

Mountford P (CEO), Brown C (CFO) POSTAL ADDRESS: PO Box 51591, Waterfront, 8002

MAJOR ORDINARY SHAREHOLDERS as at 15 Oct 2021 MORE INFO: www.sharedata.co.za/sdo/jse/SYG

Allan Gray Ltd. 16.05% COMPANY SECRETARY: Glen MacLachlan

Government Employees Pension Fund 15.33% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Old Mutual Ltd. 15.00%

SPONSOR: Standard Bank of South Africa Ltd.

217