Page 226 - SHB 2021 Issue 4

P. 226

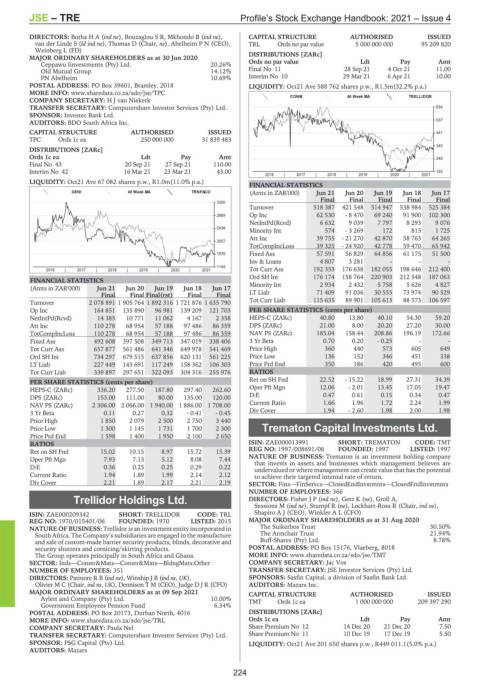

JSE – TRE Profile’s Stock Exchange Handbook: 2021 – Issue 4

DIRECTORS: BothaHA(ind ne), Bouzaglou S R, Mkhondo B (ind ne), CAPITAL STRUCTURE AUTHORISED ISSUED

van der Linde S (ld ind ne), Thomas D (Chair, ne), Abelheim P N (CEO), TRL Ords no par value 5 000 000 000 95 209 820

Weinberg L (FD)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 DISTRIBUTIONS [ZARc]

Ceppawu Iinvestments (Pty) Ltd. 20.26% Ords no par value Ldt Pay Amt

Old Mutual Group 14.12% Final No 11 28 Sep 21 4 Oct 21 11.00

PN Abelheim 10.69% Interim No 10 29 Mar 21 6 Apr 21 10.00

POSTAL ADDRESS: PO Box 39601, Bramley, 2018 LIQUIDITY: Oct21 Ave 588 762 shares p.w., R1.5m(32.2% p.a.)

MORE INFO: www.sharedata.co.za/sdo/jse/TPC

COMPANY SECRETARY: H J van Niekerk CONM 40 Week MA TRELLIDOR

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 634

SPONSOR: Investec Bank Ltd.

AUDITORS: BDO South Africa Inc. 537

CAPITAL STRUCTURE AUTHORISED ISSUED 441

TPC Ords 1c ea 250 000 000 31 839 483

345

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt 249

Final No 43 20 Sep 21 27 Sep 21 110.00

Interim No 42 16 Mar 21 23 Mar 21 43.00 153

2016 | 2017 | 2018 | 2019 | 2020 | 2021

LIQUIDITY: Oct21 Ave 67 082 shares p.w., R1.0m(11.0% p.a.)

FINANCIAL STATISTICS

GENI 40 Week MA TRNPACO (Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

Final Final Final Final Final

3300

Turnover 518 387 421 548 514 947 538 984 525 384

2869 Op Inc 62 530 - 8 470 69 240 91 900 102 300

NetIntPd(Rcvd) 6 632 9 039 7 797 8 293 9 076

2438

Minority Int 574 - 3 269 172 815 1 725

Att Inc 39 755 - 21 270 42 870 58 763 64 265

2007

TotCompIncLoss 39 325 - 24 920 42 778 59 470 65 942

1576 Fixed Ass 57 591 56 829 64 856 61 175 51 500

Inv & Loans 4 807 3 281 - - -

1145 Tot Curr Ass 192 353 176 638 182 055 198 646 212 400

2016 | 2017 | 2018 | 2019 | 2020 | 2021

Ord SH Int 176 174 158 764 220 903 212 548 187 063

FINANCIAL STATISTICS Minority Int 2 934 2 432 5 758 5 626 4 827

(Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

Final Final Final(rst) Final Final LT Liab 71 409 91 036 30 555 73 974 90 529

Turnover 2 078 891 1 905 764 1 892 316 1 721 876 1 635 790 Tot Curr Liab 115 635 89 901 105 613 88 573 106 597

Op Inc 164 851 135 890 96 981 139 209 121 703 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) 14 385 10 771 11 062 4 167 2 358 HEPS-C (ZARc) 40.80 13.80 40.10 54.30 59.20

Att Inc 110 278 68 954 57 188 97 486 86 359 DPS (ZARc) 21.00 8.00 20.20 27.20 30.00

TotCompIncLoss 110 278 68 954 57 188 97 486 86 359 NAV PS (ZARc) 185.04 158.44 208.86 196.19 172.66

Fixed Ass 492 608 397 508 349 713 347 019 338 406 3 Yr Beta 0.70 0.20 - 0.25 - -

Tot Curr Ass 657 877 561 486 641 346 649 978 541 469 Price High 360 440 573 605 649

Ord SH Int 734 297 679 515 637 856 620 131 561 225 Price Low 136 152 346 451 338

LT Liab 227 449 143 691 117 249 158 362 106 303 Price Prd End 350 186 420 495 600

Tot Curr Liab 339 897 297 651 322 093 304 316 255 976 RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH Fnd 22.52 - 15.22 18.99 27.31 34.39

HEPS-C (ZARc) 336.20 277.50 187.80 297.40 262.60 Oper Pft Mgn 12.06 - 2.01 13.45 17.05 19.47

DPS (ZARc) 153.00 111.00 80.00 135.00 120.00 D:E 0.47 0.61 0.15 0.34 0.47

NAV PS (ZARc) 2 306.00 2 066.00 1 940.00 1 886.00 1 708.00 Current Ratio 1.66 1.96 1.72 2.24 1.99

3 Yr Beta 0.11 0.27 0.32 - 0.41 - 0.45 Div Cover 1.94 - 2.60 1.98 2.00 1.98

Price High 1 850 2 079 2 500 2 750 3 440

Price Low 1 300 1 145 1 731 1 700 2 300 Trematon Capital Investments Ltd.

Price Prd End 1 598 1 400 1 950 2 100 2 650 TRE

RATIOS ISIN: ZAE000013991 SHORT: TREMATON CODE: TMT

Ret on SH Fnd 15.02 10.15 8.97 15.72 15.39 REG NO: 1997/008691/06 FOUNDED: 1997 LISTED: 1997

Oper Pft Mgn 7.93 7.13 5.12 8.08 7.44 NATURE OF BUSINESS: Trematon is an investment holding company

that invests in assets and businesses which management believes are

D:E 0.36 0.25 0.25 0.29 0.22 undervalued or where management can create value that has the potential

Current Ratio 1.94 1.89 1.99 2.14 2.12 to achieve their targeted internal rate of return.

Div Cover 2.21 1.89 2.17 2.21 2.19 SECTOR: Fins—FinServcs—ClosedEndInvstmnts—ClosedEndInvstmnts

NUMBER OF EMPLOYEES: 366

Trellidor Holdings Ltd. DIRECTORS: FisherJP(ind ne), Getz K (ne), Groll A,

Sessions M (ind ne), Stumpf R (ne), Lockhart-Ross R (Chair, ind ne),

TRE

ISIN: ZAE000209342 SHORT: TRELLIDOR CODE: TRL Shapiro A J (CEO), Winkler A L (CFO)

REG NO: 1970/015401/06 FOUNDED: 1970 LISTED: 2015 MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2020

NATURE OF BUSINESS: Trellidor is an investment entity incorporated in The Suikerbos Trust 30.50%

South Africa. The Company’s subsidiaries are engaged in the manufacture The Armchair Trust 21.94%

and sale of custom-made barrier security products, blinds, decorative and Buff-Shares (Pty) Ltd. 8.78%

security shutters and cornicing/skirting products. POSTAL ADDRESS: PO Box 15176, Vlaeberg, 8018

The Group operates principally in South Africa and Ghana. MORE INFO: www.sharedata.co.za/sdo/jse/TMT

SECTOR: Inds—Constr&Mats—Constr&Mats—BldngMats:Other COMPANY SECRETARY: Jac Vos

NUMBER OF EMPLOYEES: 351 TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

DIRECTORS: Patmore R B (ind ne), Winship J B (ind ne, UK), SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd.

Olivier M C (Chair, ind ne, UK), Dennison T M (CEO), Judge D J R (CFO) AUDITORS: Mazars Inc.

MAJOR ORDINARY SHAREHOLDERS as at 09 Sep 2021 CAPITAL STRUCTURE AUTHORISED ISSUED

Aylett and Company (Pty) Ltd. 10.00% TMT Ords 1c ea 1 000 000 000 209 397 290

Government Employees Pension Fund 6.34%

POSTAL ADDRESS: PO Box 20173, Durban North, 4016 DISTRIBUTIONS [ZARc]

MORE INFO: www.sharedata.co.za/sdo/jse/TRL Ords 1c ea Ldt Pay Amt

COMPANY SECRETARY: Paula Nel Share Premium No 12 14 Dec 20 21 Dec 20 7.50

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Share Premium No 11 10 Dec 19 17 Dec 19 5.50

SPONSOR: PSG Capital (Pty) Ltd. LIQUIDITY: Oct21 Ave 201 650 shares p.w., R449 011.1(5.0% p.a.)

AUDITORS: Mazars

224