Page 224 - SHB 2021 Issue 4

P. 224

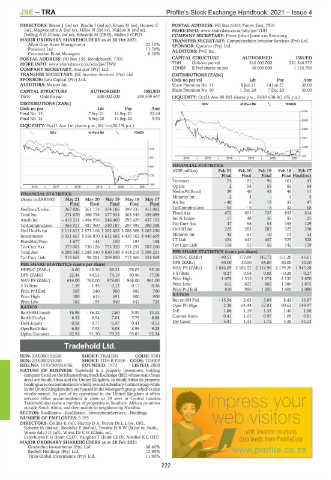

JSE – TRA Profile’s Stock Exchange Handbook: 2021 – Issue 4

DIRECTORS: Bester J (ind ne), Brodie I (ind ne), Evans M (ne), Hansen C POSTAL ADDRESS: PO Box 6100, Parow East, 7501

(ne), Magwentshu A (ind ne), Milne N (ind ne), Naidoo R (ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/TDH

Dalling A D (Chair, ind ne), Edwards M (CEO), Mabin J (CFO) COMPANY SECRETARY: Pieter Johan Janse van Rensburg

MAJOR ORDINARY SHAREHOLDERS as at 20 Oct 2021 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Allan Gray Asset Management 22.10% SPONSOR: Questco (Pty) Ltd.

Prescient Ltd. 11.79% AUDITORS: PwC Inc.

Coronation Fund Managers 9.18%

POSTAL ADDRESS: PO Box 155, Rondebosch, 7701 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/TWR TDH Ords no par val 310 000 000 261 346 570

COMPANY SECRETARY: Statucor (Pty) Ltd. TDHBP B Pref shares no par 40 000 000 1 134 790

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. DISTRIBUTIONS [ZARc]

SPONSOR: Java Capital (Pty) Ltd. Ords no par val Ldt Pay Amt

AUDITORS: Mazars Inc. Share Premium No 11 8 Jun 21 14 Jun 21 30.00

CAPITAL STRUCTURE AUTHORISED ISSUED Share Premium No 10 1 Dec 20 7 Dec 20 30.00

TWR Ords no par 500 000 000 339 549 647 LIQUIDITY: Oct21 Ave 80 892 shares p.w., R680 638.8(1.6% p.a.)

DISTRIBUTIONS [ZARc] REIV 40 Week MA TRADEH

Ords no par Ldt Pay Amt

Final No 15 7 Sep 21 13 Sep 21 22.44 3450

Final No 14 8 Sep 20 14 Sep 20 9.53

2909

LIQUIDITY: Oct21 Ave 1m shares p.w., R4.1m(20.1% p.a.)

2368

REIV 40 Week MA TOWER

1827

1286

812

745

651 2016 | 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS

491

(GBP million) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17

330 Final Final Final Final Final(rst)

Turnover 74 95 96 101 43

169 Op Inc 2 58 55 82 64

2016 | 2017 | 2018 | 2019 | 2020 | 2021

NetIntPd(Rcvd) 39 40 43 46 11

FINANCIAL STATISTICS Minority Int - 2 4 - 4 5

(Amts in ZAR'000) May 21 May 20 May 19 May 18 May 17

Final Final Final Final Final Att Inc - 40 6 13 31 47

NetRent/InvInc 267 826 361 173 374 186 399 035 413 082 TotCompIncLoss - 53 - 5 - 5 32 68

Total Inc 271 670 366 758 377 534 403 349 458 089 Fixed Ass 672 691 737 853 814

Attrib Inc - 418 211 - 494 956 246 400 293 429 437 103 Inv & Loans 17 48 36 43 25

TotCompIncLoss - 458 917 - 487 960 310 187 297 495 390 398 Tot Curr Ass 47 58 53 155 129

Ord UntHs Int 2 111 613 2 571 106 3 302 425 3 288 508 3 263 220 Ord SH Int 225 283 287 325 298

Investments 3 921 667 4 558 070 4 632 602 4 439 102 4 449 699 Minority Int 45 51 10 14 13

FixedAss/Prop 1 677 144 150 193 198 LT Liab 424 441 447 525 528

Tot Curr Ass 375 001 730 126 753 920 737 297 707 260 Tot Curr Liab 114 55 55 142 159

Total Ass 4 298 345 5 288 340 5 610 149 5 414 218 5 398 251 PER SHARE STATISTICS (cents per share)

Tot Curr Liab 515 663 98 283 269 830 713 465 354 569 HEPS-C (ZARc) - 40.51 177.08 142.72 161.28 43.61

PER SHARE STATISTICS (cents per share) DPS (ZARc) 60.00 30.00 55.00 50.00 10.00

HEPS-C (ZARc) 6.60 45.30 58.21 78.03 95.10 NAV PS (ZARc) 1 846.09 2 186.52 2 114.98 2 139.20 1 945.28

DPS (ZARc) 22.44 44.53 74.19 80.96 77.08 3 Yr Beta 0.27 0.54 0.02 - 0.28 - 0.27

NAV PS (ZARc) 614.00 762.00 979.00 968.00 961.00 Price High 1 075 1 315 1 674 2 135 3 870

3 Yr Beta 1.59 1.45 0.12 0.17 0.36 Price Low 612 825 802 1 380 1 875

Price Prd End 365 240 600 682 760 Price Prd End 810 950 1 250 1 600 2 080

Price High 380 615 691 800 900 RATIOS

Price Low 182 155 540 642 725 Ret on SH Fnd - 15.54 2.62 3.88 8.42 16.97

RATIOS Oper Pft Mgn 2.38 61.44 57.01 80.62 149.97

RetOnSH Funds - 16.96 - 16.12 7.60 8.93 13.52 D:E 1.66 1.19 1.33 1.40 1.98

RetOnTotAss 6.32 6.94 7.01 7.79 8.88 Current Ratio 0.41 1.05 0.97 1.09 0.81

Debt:Equity 0.58 0.77 0.47 0.41 0.53 Div Cover - 5.47 1.43 1.72 4.38 45.13

OperRetOnInv 6.83 7.92 8.08 8.99 9.28

OpInc:Turnover 82.93 91.30 79.32 95.83 92.34

Tradehold Ltd.

TRA

ISIN: ZAE000152658 SHORT: TRADEH CODE: TDH

ISIN: ZAE000253050 SHORT: TDH B PREF CODE: TDHBP

REG NO: 1970/009054/06 FOUNDED: 1970 LISTED: 2000

NATURE OF BUSINESS: Tradehold is a property investment holding

company listed on the Johannesburg Stock Exchange (JSE) whose main focus

areas are South Africa and the United Kingdom. In South Africa its property

holdingsareconcentratedinitswholly-ownedsubsidiaryCollinsGroupwhile

inthe UnitedKingdom they are housedinthe Moorgarth group, which isalso

wholly-owned. As part of its operations in the United Kingdom it offers

serviced office accommodation at close to 30 sites in Central London.

Tradeholdalsoownsanumberofproperties in Southern African countries Impress your

outside South Africa, and then mainly in neighbouring Namibia.

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

NUMBER OF EMPLOYEES: 5 195 web visitors

DIRECTORS: Collins K (ne), Harrop D A, Porter DrLL(ne, UK),

Roberts M (ind ne), Roelofse P (ind ne), TroskieHRW(ld ind ne, Neth),

Wiese AdvJD(alt), Wiese Dr C H (Chair, ne), with investor relations

Esterhuyse F H (Joint CEO), Vaughan T (Joint CEO), Nordier K L (FD)

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021 data feeds from ProfileData

Granadino Investments (Pty) Ltd. 38.40%

Redbill Holdings (Pty) Ltd. 12.90% www.profile.co.za

Titan Global Investments (Pty) Ltd. 11.90%

222