Page 218 - SHB 2021 Issue 4

P. 218

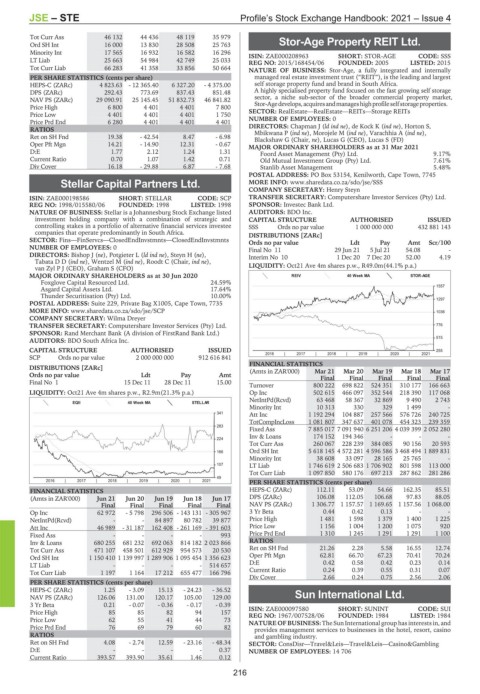

JSE – STE Profile’s Stock Exchange Handbook: 2021 – Issue 4

Tot Curr Ass 46 132 44 436 48 119 35 979

Ord SH Int 16 000 13 830 28 508 25 763 Stor-Age Property REIT Ltd.

Minority Int 17 565 16 932 16 582 16 296 ISIN: ZAE000208963 SHORT: STOR-AGE CODE: SSS

STO

LT Liab 25 663 54 984 42 749 25 033 REG NO: 2015/168454/06 FOUNDED: 2005 LISTED: 2015

Tot Curr Liab 66 283 41 358 33 856 50 664

NATURE OF BUSINESS: Stor-Age, a fully integrated and internally

PER SHARE STATISTICS (cents per share) managed real estate investment trust (“REIT”), is the leading and largest

HEPS-C (ZARc) 4 823.63 - 12 365.40 6 327.20 - 4 375.00 self storage property fund and brand in South Africa.

DPS (ZARc) 292.43 773.69 837.43 851.48 A highly specialised property fund focusedonthe fast growingselfstorage

NAV PS (ZARc) 29 090.91 25 145.45 51 832.73 46 841.82 sector, a niche sub-sector of the broader commercial property market,

Stor-Agedevelops,acquiresandmanageshighprofileselfstorageproperties.

Price High 6 800 4 401 4 401 7 800 SECTOR: RealEstate—RealEstate—REITs—Storage REITs

Price Low 4 401 4 401 4 401 1 750

Price Prd End 6 280 4 401 4 401 4 401 NUMBER OF EMPLOYEES: 0

RATIOS DIRECTORS: Chapman J (ld ind ne), de Kock K (ind ne), Horton S,

Ret on SH Fnd 19.38 - 42.54 8.47 - 6.98 Mbikwana P (ind ne), Morojele M (ind ne), Varachhia A (ind ne),

Blackshaw G (Chair, ne), Lucas G (CEO), Lucas S (FD)

Oper Pft Mgn 14.21 - 14.90 12.31 - 0.67 MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021

D:E 1.77 2.12 1.24 1.31 Foord Asset Management (Pty) Ltd. 9.17%

Current Ratio 0.70 1.07 1.42 0.71 Old Mutual Investment Group (Pty) Ltd. 7.61%

Div Cover 16.18 - 29.88 6.87 - 7.68 Stanlib Asset Management 5.48%

POSTAL ADDRESS: PO Box 53154, Kenilworth, Cape Town, 7745

Stellar Capital Partners Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/SSS

COMPANY SECRETARY: Henry Steyn

STE

ISIN: ZAE000198586 SHORT: STELLAR CODE: SCP TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

REG NO: 1998/015580/06 FOUNDED: 1998 LISTED: 1998 SPONSOR: Investec Bank Ltd.

NATURE OF BUSINESS: Stellar is a Johannesburg Stock Exchange listed AUDITORS: BDO Inc.

investment holding company with a combination of strategic and CAPITAL STRUCTURE AUTHORISED ISSUED

controlling stakes in a portfolio of alternative financial services investee SSS Ords no par value 1 000 000 000 432 881 143

companies that operate predominantly in South Africa. DISTRIBUTIONS [ZARc]

SECTOR: Fins—FinServcs—ClosedEndInvstmnts—ClosedEndInvstmnts Ords no par value Ldt Pay Amt Scr/100

NUMBER OF EMPLOYEES: 0 Final No 11 29 Jun 21 5 Jul 21 54.08 -

DIRECTORS: Bishop J (ne), Potgieter L (ld ind ne), Steyn H (ne), Interim No 10 1 Dec 20 7 Dec 20 52.00 4.19

TabataDD(ind ne), Wentzel M (ind ne), Roodt C (Chair, ind ne),

van Zyl P J (CEO), Graham S (CFO) LIQUIDITY: Oct21 Ave 4m shares p.w., R49.0m(44.1% p.a.)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 REIV 40 Week MA STOR-AGE

Foxglove Capital Resourced Ltd. 24.59%

Asgard Capital Assets Ltd. 17.64% 1557

Thunder Securitisation (Pty) Ltd. 10.00%

1297

POSTAL ADDRESS: Suite 229, Private Bag X1005, Cape Town, 7735

MORE INFO: www.sharedata.co.za/sdo/jse/SCP 1036

COMPANY SECRETARY: Wilma Dreyer

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 776

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

AUDITORS: BDO South Africa Inc. 515

CAPITAL STRUCTURE AUTHORISED ISSUED 255

2016 | 2017 | 2018 | 2019 | 2020 | 2021

SCP Ords no par value 2 000 000 000 912 616 841

FINANCIAL STATISTICS

DISTRIBUTIONS [ZARc] (Amts in ZAR'000) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17

Ords no par value Ldt Pay Amt Final Final Final Final Final

Final No 1 15 Dec 11 28 Dec 11 15.00

Turnover 800 222 698 822 524 351 310 177 166 663

LIQUIDITY: Oct21 Ave 4m shares p.w., R2.9m(21.3% p.a.) Op Inc 502 615 466 097 352 544 218 390 117 068

NetIntPd(Rcvd) 63 468 58 367 32 869 9 490 2 743

EQII 40 Week MA STELLAR

Minority Int 10 313 330 329 1 499 -

341 Att Inc 1 192 294 104 887 257 566 576 726 240 725

TotCompIncLoss 1 081 807 347 637 401 078 454 323 239 359

283

Fixed Ass 7 885 017 7 091 940 6 251 206 4 039 399 2 052 280

Inv & Loans 174 152 194 346 - - -

224

Tot Curr Ass 260 067 228 239 384 085 90 156 20 593

166 Ord SH Int 5 618 145 4 572 281 4 596 586 3 468 494 1 889 831

Minority Int 38 608 33 097 28 165 25 765 -

107 LT Liab 1 746 619 2 506 683 1 706 902 801 598 113 000

Tot Curr Liab 1 097 850 580 176 697 213 287 862 281 286

49

2016 | 2017 | 2018 | 2019 | 2020 | 2021 PER SHARE STATISTICS (cents per share)

FINANCIAL STATISTICS HEPS-C (ZARc) 112.11 53.09 54.66 162.35 85.51

(Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 DPS (ZARc) 106.08 112.05 106.68 97.83 88.05

Final Final Final Final Final NAV PS (ZARc) 1 306.77 1 157.57 1 169.65 1 157.56 1 068.00

Op Inc 62 972 - 5 798 296 506 - 143 131 - 305 967 3 Yr Beta 0.44 0.42 0.13 - -

NetIntPd(Rcvd) - - 84 897 80 782 39 877 Price High 1 481 1 598 1 379 1 400 1 225

Att Inc 46 989 - 31 187 162 408 - 261 169 - 391 603 Price Low 1 156 1 004 1 200 1 075 920

Fixed Ass - - - - 993 Price Prd End 1 310 1 245 1 291 1 291 1 100

Inv & Loans 680 255 681 232 692 063 814 182 2 023 866 RATIOS

Tot Curr Ass 471 107 458 501 612 929 954 573 20 530 Ret on SH Fnd 21.26 2.28 5.58 16.55 12.74

Ord SH Int 1 150 410 1 139 997 1 289 906 1 095 454 1 356 623 Oper Pft Mgn 62.81 66.70 67.23 70.41 70.24

LT Liab - - - - 514 657 D:E 0.42 0.58 0.42 0.23 0.14

Tot Curr Liab 1 197 1 164 17 212 655 477 166 796 Current Ratio 0.24 0.39 0.55 0.31 0.07

Div Cover 2.66 0.24 0.75 2.56 2.06

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 1.25 - 3.09 15.13 - 24.23 - 36.52

NAV PS (ZARc) 126.06 131.00 120.17 105.00 129.00 Sun International Ltd.

3 Yr Beta 0.21 - 0.07 - 0.36 - 0.17 - 0.39 SUN

CODE: SUI

Price High 85 85 82 94 157 ISIN: ZAE000097580 SHORT: SUNINT LISTED: 1984

FOUNDED: 1984

REG NO: 1967/007528/06

Price Low 62 55 41 44 73 NATURE OF BUSINESS:The Sun Internationalgroup has interests in, and

Price Prd End 76 69 79 60 82 provides management services to businesses in the hotel, resort, casino

RATIOS and gambling industry.

Ret on SH Fnd 4.08 - 2.74 12.59 - 23.16 - 48.34 SECTOR: ConsDisr—Travel&Leis—Travel&Leis—Casino&Gambling

D:E - - - - 0.37 NUMBER OF EMPLOYEES: 14 706

Current Ratio 393.57 393.90 35.61 1.46 0.12

216