Page 220 - SHB 2021 Issue 4

P. 220

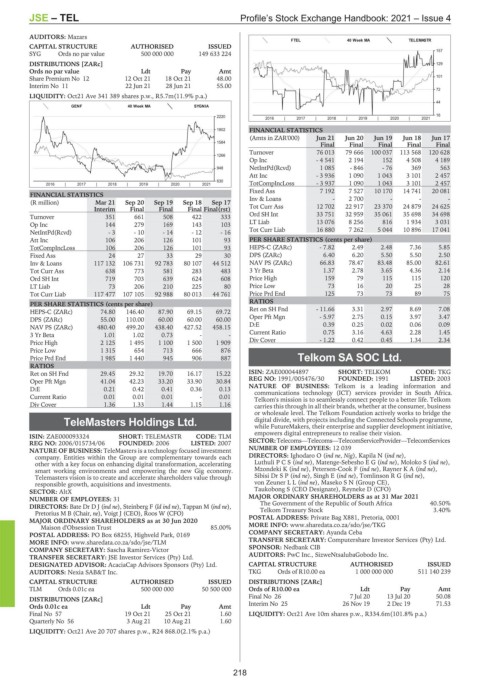

JSE – TEL Profile’s Stock Exchange Handbook: 2021 – Issue 4

AUDITORS: Mazars

FTEL 40 Week MA TELEMASTR

CAPITAL STRUCTURE AUTHORISED ISSUED

157

SYG Ords no par value 500 000 000 149 633 224

DISTRIBUTIONS [ZARc] 129

Ords no par value Ldt Pay Amt

Share Premium No 12 12 Oct 21 18 Oct 21 48.00 101

Interim No 11 22 Jun 21 28 Jun 21 55.00

72

LIQUIDITY: Oct21 Ave 341 389 shares p.w., R5.7m(11.9% p.a.)

44

GENF 40 Week MA SYGNIA

2220 16

2016 | 2017 | 2018 | 2019 | 2020 | 2021

1902 FINANCIAL STATISTICS

(Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

1584

Final Final Final Final Final

Turnover 76 013 79 666 100 037 113 568 120 628

1266

Op Inc - 4 541 2 194 152 4 508 4 189

948 NetIntPd(Rcvd) 1 085 - 846 - 76 369 563

Att Inc - 3 936 1 090 1 043 3 101 2 457

630 TotCompIncLoss - 3 937 1 090 1 043 3 101 2 457

2016 | 2017 | 2018 | 2019 | 2020 | 2021

Fixed Ass 7 192 7 527 10 170 14 741 20 081

FINANCIAL STATISTICS Inv & Loans - 2 700 - - -

(R million) Mar 21 Sep 20 Sep 19 Sep 18 Sep 17

Interim Final Final Final Final(rst) Tot Curr Ass 12 702 22 917 23 370 24 879 24 625

Turnover 351 661 508 422 333 Ord SH Int 33 751 32 959 35 061 35 698 34 698

LT Liab 13 076 8 256 816 1 934 3 031

Op Inc 144 279 169 143 103

NetIntPd(Rcvd) - 3 - 10 - 14 - 12 - 16 Tot Curr Liab 16 880 7 262 5 044 10 896 17 041

Att Inc 106 206 126 101 93 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 106 206 126 101 93 HEPS-C (ZARc) - 7.82 2.49 2.48 7.36 5.85

Fixed Ass 24 27 33 29 30 DPS (ZARc) 6.40 6.20 5.50 5.50 2.50

Inv & Loans 117 132 106 731 92 783 80 107 44 512 NAV PS (ZARc) 66.83 78.47 83.48 85.00 82.61

Tot Curr Ass 638 773 581 283 483 3 Yr Beta 1.37 2.78 3.65 4.36 2.14

Ord SH Int 719 703 639 624 608 Price High 159 79 115 115 120

LT Liab 73 206 210 225 80 Price Low 73 16 20 25 28

Tot Curr Liab 117 477 107 105 92 988 80 013 44 761 Price Prd End 125 73 73 89 75

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 74.80 146.40 87.90 69.15 69.72 Ret on SH Fnd - 11.66 3.31 2.97 8.69 7.08

DPS (ZARc) 55.00 110.00 60.00 60.00 60.00 Oper Pft Mgn - 5.97 2.75 0.15 3.97 3.47

NAV PS (ZARc) 480.40 499.20 438.40 427.52 458.15 D:E 0.39 0.25 0.02 0.06 0.09

3 Yr Beta 1.01 1.02 0.73 - - Current Ratio 0.75 3.16 4.63 2.28 1.45

Price High 2 125 1 495 1 100 1 500 1 909 Div Cover - 1.22 0.42 0.45 1.34 2.34

Price Low 1 315 654 713 666 876

Price Prd End 1 985 1 440 945 906 887 Telkom SA SOC Ltd.

RATIOS TEL

Ret on SH Fnd 29.45 29.32 19.70 16.17 15.22 ISIN: ZAE000044897 SHORT: TELKOM CODE: TKG

Oper Pft Mgn 41.04 42.23 33.20 33.90 30.84 REG NO: 1991/005476/30 FOUNDED: 1991 LISTED: 2003

D:E 0.21 0.42 0.41 0.36 0.13 NATURE OF BUSINESS: Telkom is a leading information and

communications technology (ICT) services provider in South Africa.

Current Ratio 0.01 0.01 0.01 - 0.01 Telkom's mission is to seamlessly connect people to a better life. Telkom

Div Cover 1.36 1.33 1.44 1.15 1.16 carries this through in all their brands, whether at the consumer, business

or wholesale level. The Telkom Foundation actively works to bridge the

TeleMasters Holdings Ltd. digital divide, with projects including the Connected Schools programme,

while FutureMakers, their enterprise and supplier development initiative,

TEL empowers digital entrepreneurs to realise their vision.

ISIN: ZAE000093324 SHORT: TELEMASTR CODE: TLM

REG NO: 2006/015734/06 FOUNDED: 2006 LISTED: 2007 SECTOR:Telecoms—Telecoms—TelecomServiceProvider—TelecomServices

NATURE OF BUSINESS: TeleMasters is a technology focused investment NUMBER OF EMPLOYEES: 12 039

company. Entities within the Group are complementary towards each DIRECTORS: Ighodaro O (ind ne, Nig), Kapila N (ind ne),

other with a key focus on enhancing digital transformation, accelerating LuthuliPCS(ind ne), Matenge-SebeshoEG(ind ne), Moloko S (ind ne),

smart working environments and empowering the new Gig economy. Mzondeki K (ind ne), Petersen-Cook F (ind ne), RaynerKA(ind ne),

Telemasters vision is to create and accelerate shareholders value through Sibisi DrSP(ind ne), Singh E (ind ne), TomlinsonRG(ind ne),

responsible growth, acquisitions and investments. von ZeunerLL(ind ne), Maseko S N (Group CE),

SECTOR: AltX Taukobong S (CEO Designate), Reyneke D (CFO)

NUMBER OF EMPLOYEES: 31 MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021

DIRECTORS: Bate Dr D J (ind ne), Steinberg F (ld ind ne), Tappan M (ind ne), The Government of the Republic of South Africa 40.50%

Pretorius M B (Chair, ne), Voigt J (CEO), Roos W (CFO) Telkom Treasury Stock 3.40%

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 POSTAL ADDRESS: Private Bag X881, Pretoria, 0001

Maison d'Obsession Trust 85.00% MORE INFO: www.sharedata.co.za/sdo/jse/TKG

POSTAL ADDRESS: PO Box 68255, Highveld Park, 0169 COMPANY SECRETARY: Ayanda Ceba

MORE INFO: www.sharedata.co.za/sdo/jse/TLM TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

COMPANY SECRETARY: Sascha Ramirez-Victor SPONSOR: Nedbank CIB

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. AUDITORS: PwC Inc., SizweNtsalubaGobodo Inc.

DESIGNATED ADVISOR: AcaciaCap Advisors Sponsors (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: Nexia SAB&T Inc. TKG Ords of R10.00 ea 1 000 000 000 511 140 239

CAPITAL STRUCTURE AUTHORISED ISSUED DISTRIBUTIONS [ZARc]

TLM Ords 0.01c ea 500 000 000 50 500 000 Ords of R10.00 ea Ldt Pay Amt

Final No 26 7 Jul 20 13 Jul 20 50.08

DISTRIBUTIONS [ZARc]

Ords 0.01c ea Ldt Pay Amt Interim No 25 26 Nov 19 2 Dec 19 71.53

Final No 57 19 Oct 21 25 Oct 21 1.60 LIQUIDITY: Oct21 Ave 10m shares p.w., R334.6m(101.8% p.a.)

Quarterly No 56 3 Aug 21 10 Aug 21 1.60

LIQUIDITY: Oct21 Ave 20 707 shares p.w., R24 868.0(2.1% p.a.)

218