Page 178 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 178

CHAPTER 9

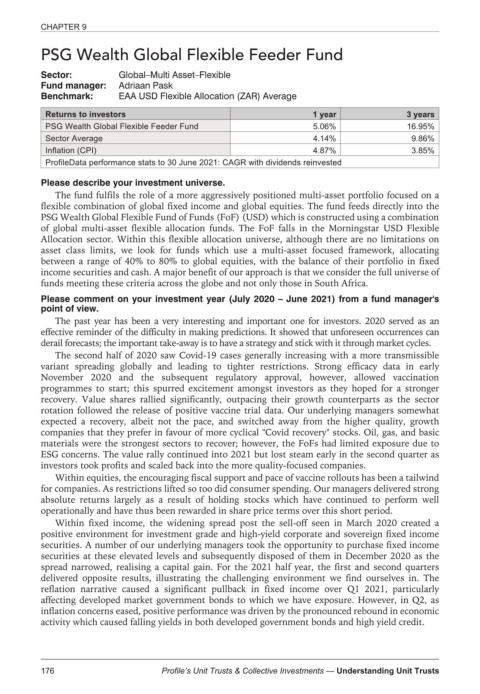

PSG Wealth Global Flexible Feeder Fund

Sector: Global–Multi Asset–Flexible

Fund manager: Adriaan Pask

Benchmark: EAA USD Flexible Allocation (ZAR) Average

Returns to investors 1 year 3 years

PSG Wealth Global Flexible Feeder Fund 5.06% 16.95%

Sector Average 4.14% 9.86%

Inflation (CPI) 4.87% 3.85%

ProfileData performance stats to 30 June 2021: CAGR with dividends reinvested

Please describe your investment universe.

The fund fulfils the role of a more aggressively positioned multi-asset portfolio focused on a

flexible combination of global fixed income and global equities. The fund feeds directly into the

PSG Wealth Global Flexible Fund of Funds (FoF) (USD) which is constructed using a combination

of global multi-asset flexible allocation funds. The FoF falls in the Morningstar USD Flexible

Allocation sector. Within this flexible allocation universe, although there are no limitations on

asset class limits, we look for funds which use a multi-asset focused framework, allocating

between a range of 40% to 80% to global equities, with the balance of their portfolio in fixed

income securities and cash. A major benefit of our approach is that we consider the full universe of

funds meeting these criteria across the globe and not only those in South Africa.

Please comment on your investment year (July 2020 – June 2021) from a fund manager's

point of view.

The past year has been a very interesting and important one for investors. 2020 served as an

effective reminder of the difficulty in making predictions. It showed that unforeseen occurrences can

derail forecasts; the important take-away is to have astrategyand stickwithitthrough market cycles.

The second half of 2020 saw Covid-19 cases generally increasing with a more transmissible

variant spreading globally and leading to tighter restrictions. Strong efficacy data in early

November 2020 and the subsequent regulatory approval, however, allowed vaccination

programmes to start; this spurred excitement amongst investors as they hoped for a stronger

recovery. Value shares rallied significantly, outpacing their growth counterparts as the sector

rotation followed the release of positive vaccine trial data. Our underlying managers somewhat

expected a recovery, albeit not the pace, and switched away from the higher quality, growth

companies that they prefer in favour of more cyclical "Covid recovery" stocks. Oil, gas, and basic

materials were the strongest sectors to recover; however, the FoFs had limited exposure due to

ESG concerns. The value rally continued into 2021 but lost steam early in the second quarter as

investors took profits and scaled back into the more quality-focused companies.

Within equities, the encouraging fiscal support and pace of vaccine rollouts has been a tailwind

for companies. As restrictions lifted so too did consumer spending. Our managers delivered strong

absolute returns largely as a result of holding stocks which have continued to perform well

operationally and have thus been rewarded in share price terms over this short period.

Within fixed income, the widening spread post the sell-off seen in March 2020 created a

positive environment for investment grade and high-yield corporate and sovereign fixed income

securities. A number of our underlying managers took the opportunity to purchase fixed income

securities at these elevated levels and subsequently disposed of them in December 2020 as the

spread narrowed, realising a capital gain. For the 2021 half year, the first and second quarters

delivered opposite results, illustrating the challenging environment we find ourselves in. The

reflation narrative caused a significant pullback in fixed income over Q1 2021, particularly

affecting developed market government bonds to which we have exposure. However, in Q2, as

inflation concerns eased, positive performance was driven by the pronounced rebound in economic

activity which caused falling yields in both developed government bonds and high yield credit.

176 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts