Page 173 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 173

Fund Manager Interviews

currently assigned to the property sector. For the sector to regain its former glory, we will need to

see evidence of a return to sustainable income growth (ie, no further negative rental reversions).

We do not expect this over the next 9 to 12 months but believe the year ahead will see a bottoming

of this trend, with growth thereafter.

Could you identify three shares that fall within your universe that you think will perform well

in the medium term?

MAS Real Estate. Eastern Europe is trading well, recovering fast, with growing per capita

incomes. We regard the management team highly and believe they can deliver superior NAV and

distributable income growth.

Stor-Age. This company offers diversification away from traditional sectors. Their experience

and unique IP allows them to capitalise on opportunities (both locally and abroad) and offer a

superior product and service.

Fairvest. Their focus on rural, township and commuter retail places them in good stead to

weather the tough local conditions. The management team has proven their ability and we believe

they will be successful in extracting value from the Arrowhead merger, should that go ahead.

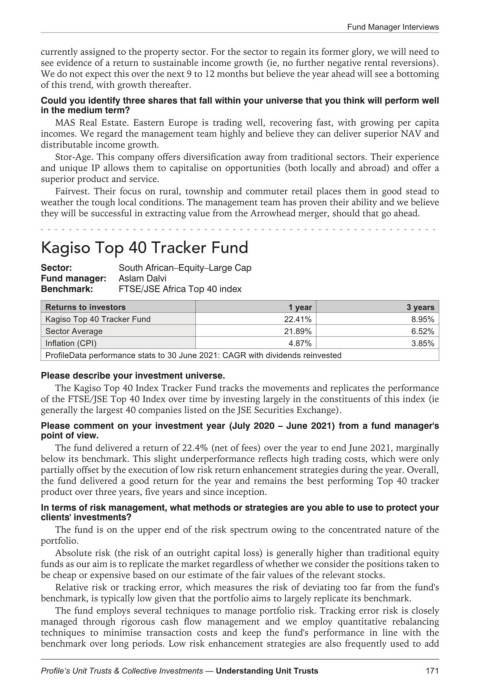

Kagiso Top 40 Tracker Fund

Sector: South African–Equity–Large Cap

Fund manager: Aslam Dalvi

Benchmark: FTSE/JSE Africa Top 40 index

Returns to investors 1 year 3 years

Kagiso Top 40 Tracker Fund 22.41% 8.95%

Sector Average 21.89% 6.52%

Inflation (CPI) 4.87% 3.85%

ProfileData performance stats to 30 June 2021: CAGR with dividends reinvested

Please describe your investment universe.

The Kagiso Top 40 Index Tracker Fund tracks the movements and replicates the performance

of the FTSE/JSE Top 40 Index over time by investing largely in the constituents of this index (ie

generally the largest 40 companies listed on the JSE Securities Exchange).

Please comment on your investment year (July 2020 – June 2021) from a fund manager's

point of view.

The fund delivered a return of 22.4% (net of fees) over the year to end June 2021, marginally

below its benchmark. This slight underperformance reflects high trading costs, which were only

partially offset by the execution of low risk return enhancement strategies during the year. Overall,

the fund delivered a good return for the year and remains the best performing Top 40 tracker

product over three years, five years and since inception.

In terms of risk management, what methods or strategies are you able to use to protect your

clients' investments?

The fund is on the upper end of the risk spectrum owing to the concentrated nature of the

portfolio.

Absolute risk (the risk of an outright capital loss) is generally higher than traditional equity

funds as our aim is to replicate the market regardless of whether we consider the positions taken to

be cheap or expensive based on our estimate of the fair values of the relevant stocks.

Relative risk or tracking error, which measures the risk of deviating too far from the fund's

benchmark, is typically low given that the portfolio aims to largely replicate its benchmark.

The fund employs several techniques to manage portfolio risk. Tracking error risk is closely

managed through rigorous cash flow management and we employ quantitative rebalancing

techniques to minimise transaction costs and keep the fund's performance in line with the

benchmark over long periods. Low risk enhancement strategies are also frequently used to add

171

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts