Page 183 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 183

Fund Manager Interviews

maintain our core overweight bond position, as bonds are offering extremely attractive real yields

relative to cash and inflation and as fiscal risks are easing some capital returns from bonds can be

expected. Against this backdrop we expect the fund to deliver returns exceeding its performance

objective of CPI + 5%, barring any market shocks.

Are equity markets in general overpriced? Do you anticipate a significant correction or will

the bull run continue?

Offshore equities, particularly in the US are highly valued, although we don't foresee a big

correction as earnings are expected to remain firm and well supported by the growth outlook and

the Fed's cautious approach in managing any changes to monetary policy. Volatility may, however,

increase as tapering comes closer but is unlikely to trigger a correction as it will be well discounted

by the market by the time it starts. In terms of other markets, emerging markets are attractively

priced while South African equities look cheap historically and relative to most other markets.

Which asset classes do you expect will give the best total rates of return over the next few years?

Equities, both local and offshore together with local listed property should provide the best

total returns barring any major crisis.

What fund strategies or manager selections do you anticipate will perform best over the next

few years?

Within our funds we focus on having a blend of styles with managers being selected on having

robust investment processes, highly regarded teams and strong track records and not just focusing

on one style or strategy.

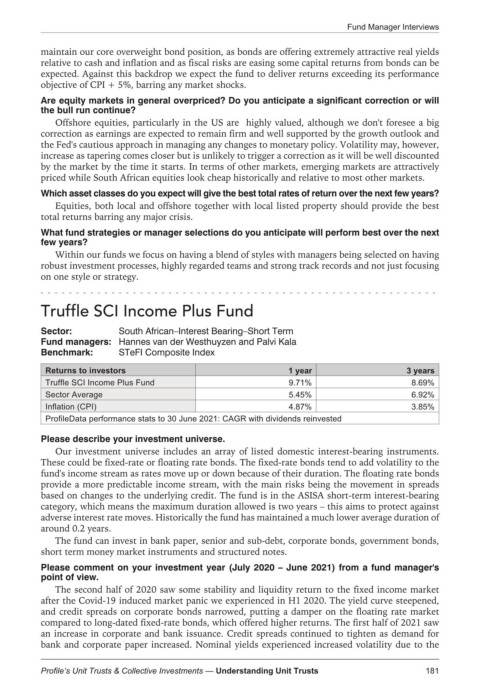

Truffle SCI Income Plus Fund

Sector: South African–Interest Bearing–Short Term

Fund managers: Hannes van der Westhuyzen and Palvi Kala

Benchmark: STeFI Composite Index

Returns to investors 1 year 3 years

Truffle SCI Income Plus Fund 9.71% 8.69%

Sector Average 5.45% 6.92%

Inflation (CPI) 4.87% 3.85%

ProfileData performance stats to 30 June 2021: CAGR with dividends reinvested

Please describe your investment universe.

Our investment universe includes an array of listed domestic interest-bearing instruments.

These could be fixed-rate or floating rate bonds. The fixed-rate bonds tend to add volatility to the

fund's income stream as rates move up or down because of their duration. The floating rate bonds

provide a more predictable income stream, with the main risks being the movement in spreads

based on changes to the underlying credit. The fund is in the ASISA short-term interest-bearing

category, which means the maximum duration allowed is two years – this aims to protect against

adverse interest rate moves. Historically the fund has maintained a much lower average duration of

around 0.2 years.

The fund can invest in bank paper, senior and sub-debt, corporate bonds, government bonds,

short term money market instruments and structured notes.

Please comment on your investment year (July 2020 – June 2021) from a fund manager's

point of view.

The second half of 2020 saw some stability and liquidity return to the fixed income market

after the Covid-19 induced market panic we experienced in H1 2020. The yield curve steepened,

and credit spreads on corporate bonds narrowed, putting a damper on the floating rate market

compared to long-dated fixed-rate bonds, which offered higher returns. The first half of 2021 saw

an increase in corporate and bank issuance. Credit spreads continued to tighten as demand for

bank and corporate paper increased. Nominal yields experienced increased volatility due to the

181

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts