Page 182 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 182

CHAPTER 9

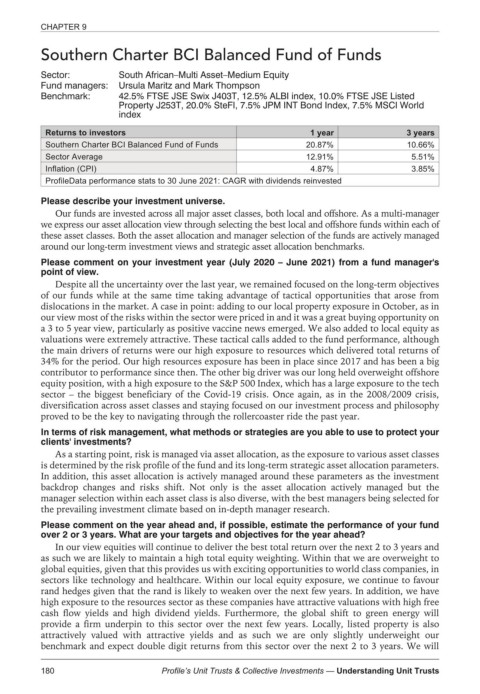

Southern Charter BCI Balanced Fund of Funds

Sector: South African–Multi Asset–Medium Equity

Fund managers: Ursula Maritz and Mark Thompson

Benchmark: 42.5% FTSE JSE Swix J403T, 12.5% ALBI index, 10.0% FTSE JSE Listed

Property J253T, 20.0% SteFI, 7.5% JPM INT Bond Index, 7.5% MSCI World

index

Returns to investors 1 year 3 years

Southern Charter BCI Balanced Fund of Funds 20.87% 10.66%

Sector Average 12.91% 5.51%

Inflation (CPI) 4.87% 3.85%

ProfileData performance stats to 30 June 2021: CAGR with dividends reinvested

Please describe your investment universe.

Our funds are invested across all major asset classes, both local and offshore. As a multi-manager

we express our asset allocation view through selecting the best local and offshore funds within each of

these asset classes. Both the asset allocation and manager selection of the funds are actively managed

around our long-term investment views and strategic asset allocation benchmarks.

Please comment on your investment year (July 2020 – June 2021) from a fund manager's

point of view.

Despite all the uncertainty over the last year, we remained focused on the long-term objectives

of our funds while at the same time taking advantage of tactical opportunities that arose from

dislocations in the market. A case in point: adding to our local property exposure in October, as in

our view most of the risks within the sector were priced in and it was a great buying opportunity on

a 3 to 5 year view, particularly as positive vaccine news emerged. We also added to local equity as

valuations were extremely attractive. These tactical calls added to the fund performance, although

the main drivers of returns were our high exposure to resources which delivered total returns of

34% for the period. Our high resources exposure has been in place since 2017 and has been a big

contributor to performance since then. The other big driver was our long held overweight offshore

equity position, with a high exposure to the S&P 500 Index, which has a large exposure to the tech

sector – the biggest beneficiary of the Covid-19 crisis. Once again, as in the 2008/2009 crisis,

diversification across asset classes and staying focused on our investment process and philosophy

proved to be the key to navigating through the rollercoaster ride the past year.

In terms of risk management, what methods or strategies are you able to use to protect your

clients' investments?

As a starting point, risk is managed via asset allocation, as the exposure to various asset classes

is determined by the risk profile of the fund and its long-term strategic asset allocation parameters.

In addition, this asset allocation is actively managed around these parameters as the investment

backdrop changes and risks shift. Not only is the asset allocation actively managed but the

manager selection within each asset class is also diverse, with the best managers being selected for

the prevailing investment climate based on in-depth manager research.

Please comment on the year ahead and, if possible, estimate the performance of your fund

over 2 or 3 years. What are your targets and objectives for the year ahead?

In our view equities will continue to deliver the best total return over the next 2 to 3 years and

as such we are likely to maintain a high total equity weighting. Within that we are overweight to

global equities, given that this provides us with exciting opportunities to world class companies, in

sectors like technology and healthcare. Within our local equity exposure, we continue to favour

rand hedges given that the rand is likely to weaken over the next few years. In addition, we have

high exposure to the resources sector as these companies have attractive valuations with high free

cash flow yields and high dividend yields. Furthermore, the global shift to green energy will

provide a firm underpin to this sector over the next few years. Locally, listed property is also

attractively valued with attractive yields and as such we are only slightly underweight our

benchmark and expect double digit returns from this sector over the next 2 to 3 years. We will

180 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts