Page 176 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 176

CHAPTER 9

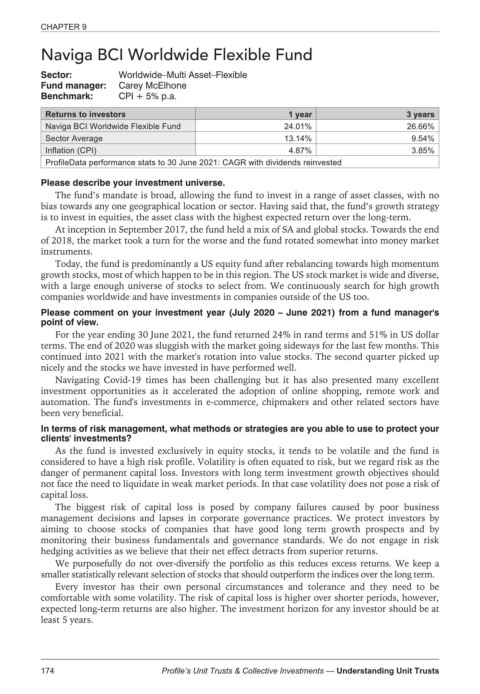

Naviga BCI Worldwide Flexible Fund

Sector: Worldwide–Multi Asset–Flexible

Fund manager: Carey McElhone

Benchmark: CPI + 5% p.a.

Returns to investors 1 year 3 years

Naviga BCI Worldwide Flexible Fund 24.01% 26.66%

Sector Average 13.14% 9.54%

Inflation (CPI) 4.87% 3.85%

ProfileData performance stats to 30 June 2021: CAGR with dividends reinvested

Please describe your investment universe.

The fund’s mandate is broad, allowing the fund to invest in a range of asset classes, with no

bias towards any one geographical location or sector. Having said that, the fund’s growth strategy

is to invest in equities, the asset class with the highest expected return over the long-term.

At inception in September 2017, the fund held a mix of SA and global stocks. Towards the end

of 2018, the market took a turn for the worse and the fund rotated somewhat into money market

instruments.

Today, the fund is predominantly a US equity fund after rebalancing towards high momentum

growth stocks, most of which happen to be in this region. The US stock market is wide and diverse,

with a large enough universe of stocks to select from. We continuously search for high growth

companies worldwide and have investments in companies outside of the US too.

Please comment on your investment year (July 2020 – June 2021) from a fund manager's

point of view.

For the year ending 30 June 2021, the fund returned 24% in rand terms and 51% in US dollar

terms. The end of 2020 was sluggish with the market going sideways for the last few months. This

continued into 2021 with the market's rotation into value stocks. The second quarter picked up

nicely and the stocks we have invested in have performed well.

Navigating Covid-19 times has been challenging but it has also presented many excellent

investment opportunities as it accelerated the adoption of online shopping, remote work and

automation. The fund's investments in e-commerce, chipmakers and other related sectors have

been very beneficial.

In terms of risk management, what methods or strategies are you able to use to protect your

clients' investments?

As the fund is invested exclusively in equity stocks, it tends to be volatile and the fund is

considered to have a high risk profile. Volatility is often equated to risk, but we regard risk as the

danger of permanent capital loss. Investors with long term investment growth objectives should

not face the need to liquidate in weak market periods. In that case volatility does not pose a risk of

capital loss.

The biggest risk of capital loss is posed by company failures caused by poor business

management decisions and lapses in corporate governance practices. We protect investors by

aiming to choose stocks of companies that have good long term growth prospects and by

monitoring their business fundamentals and governance standards. We do not engage in risk

hedging activities as we believe that their net effect detracts from superior returns.

We purposefully do not over-diversify the portfolio as this reduces excess returns. We keep a

smaller statistically relevant selection of stocks that should outperform the indices over the long term.

Every investor has their own personal circumstances and tolerance and they need to be

comfortable with some volatility. The risk of capital loss is higher over shorter periods, however,

expected long-term returns are also higher. The investment horizon for any investor should be at

least 5 years.

174 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts