Page 180 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 180

CHAPTER 9

a negative headwind for certain fixed income securities and more beneficial for companies which

are able to pass inflation-related cost increases on to the end consumer.

Offshore investments are heavily influenced by the rand. Please give your view on the rand

over the next 1, 3 and 5 years.

Within the fund research team, we do not focus on creating our own internal forecasts for asset

classes, currencies, etc. It does not fit into our process and philosophy and we do not believe we

have a unique ability to forecast macro events. We remain informed and up to date on aspects

related to this, but it is not part of our business to generate forecasts/expectations, etc.

Our focus is predominantly on manager selection and therefore we allocate our time

accordingly. Given the large number of factors influencing currency fluctuations, we do not believe

any investor can accurately forecast currency movements consistently over any reasonable period.

However, there are some tools available (like inflation differentials and current account

balances) that can provide limited insights on the valuation level of a given currency. The US dollar

seems to have generally been quite overvalued for some time on a purchasing power parity basis,

and more recently we have seen this starting to reverse. In general, most emerging market

currencies seem to be poised to improve as the US dollar loses some of its strength, with the South

African rand specifically seeming very oversold.

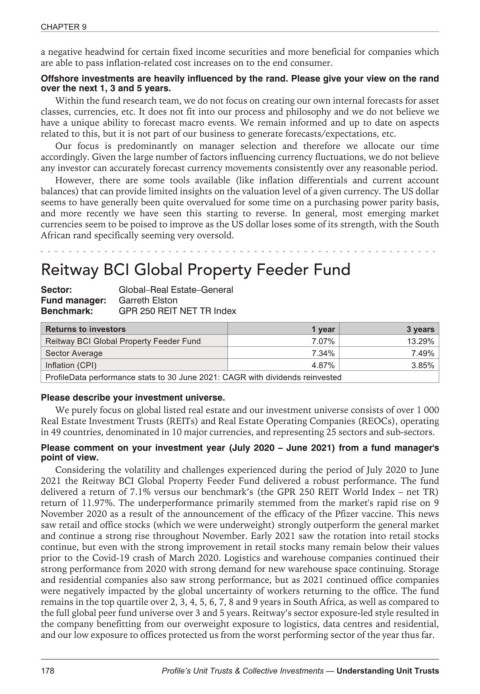

Reitway BCI Global Property Feeder Fund

Sector: Global–Real Estate–General

Fund manager: Garreth Elston

Benchmark: GPR 250 REIT NET TR Index

Returns to investors 1 year 3 years

Reitway BCI Global Property Feeder Fund 7.07% 13.29%

Sector Average 7.34% 7.49%

Inflation (CPI) 4.87% 3.85%

ProfileData performance stats to 30 June 2021: CAGR with dividends reinvested

Please describe your investment universe.

We purely focus on global listed real estate and our investment universe consists of over 1 000

Real Estate Investment Trusts (REITs) and Real Estate Operating Companies (REOCs), operating

in 49 countries, denominated in 10 major currencies, and representing 25 sectors and sub-sectors.

Please comment on your investment year (July 2020 – June 2021) from a fund manager's

point of view.

Considering the volatility and challenges experienced during the period of July 2020 to June

2021 the Reitway BCI Global Property Feeder Fund delivered a robust performance. The fund

delivered a return of 7.1% versus our benchmark’s (the GPR 250 REIT World Index – net TR)

return of 11.97%. The underperformance primarily stemmed from the market's rapid rise on 9

November 2020 as a result of the announcement of the efficacy of the Pfizer vaccine. This news

saw retail and office stocks (which we were underweight) strongly outperform the general market

and continue a strong rise throughout November. Early 2021 saw the rotation into retail stocks

continue, but even with the strong improvement in retail stocks many remain below their values

prior to the Covid-19 crash of March 2020. Logistics and warehouse companies continued their

strong performance from 2020 with strong demand for new warehouse space continuing. Storage

and residential companies also saw strong performance, but as 2021 continued office companies

were negatively impacted by the global uncertainty of workers returning to the office. The fund

remains in the top quartile over 2, 3, 4, 5, 6, 7, 8 and 9 years in South Africa, as well as compared to

the full global peer fund universe over 3 and 5 years. Reitway’s sector exposure-led style resulted in

the company benefitting from our overweight exposure to logistics, data centres and residential,

and our low exposure to offices protected us from the worst performing sector of the year thus far.

178 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts