Page 174 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 174

CHAPTER 9

incremental returns with a view to somewhat offsetting the management fee. Strict cash

management allows the fund to track the FTSE/JSE Top 40 Index with minimal tracking error and

to ensure maximum practical exposure to the index at all times.

Please comment on the year ahead and, if possible, estimate the performance of your fund

over 2 or 3 years. What are your targets and objectives for the year ahead?

The fund aims to replicate the performance of the FTSE/JSE Top 40 Index. We therefore expect

the fund to deliver a performance in line with its benchmark in the coming year. The share price

performance for Anglo American, BHP Billiton, Richemont and Naspers/Prosus will be a key

driver of the FTSE/JSE’s Top 40 performance, given their large weight in the index.

Are equity markets in general overpriced? Do you anticipate a significant correction or will

the bull run continue?

Globally, extremely high developed market fiscal and monetary stimulus, which is being

sustained (and in the case of the USA, increased) into the recovery phase, are providing a powerful

support for financial markets and have led to dramatic increases in general asset prices. As a result,

many global markets are looking expensive and we would expect increased volatility when fiscal

stimulus inevitably wanes, if inflation emerges, and when interest rates rise from their extremely

low levels.

Despite the much-improved global recovery backdrop and mining cycle, together with the

buoyant agricultural sector, RSA still considerably lags from a growth perspective. JSE-listed

companies that are exposed primarily to the non-commodity parts of our local economy are likely

to remain challenged and face poor growth prospects. There are, however, areas of significant value

within the SA market and good stock selection will be key to deliver outperformance.

Within the SA context, we expect companies with stronger balance sheets, better business

models and flexible, more adaptable management teams to outperform in the recovery period. We

believe the outperformance will be even more pronounced in the face of a weaker economy in the

years ahead.

As a passive fund, what advantages, in your view, does the underlying index you track offer

investors?

This fund is suitable for investors who are seeking to own the JSE/FTSE Top 40's entire stock

selection at a very low cost, and who seek long-term capital growth with no short-term income

requirements.

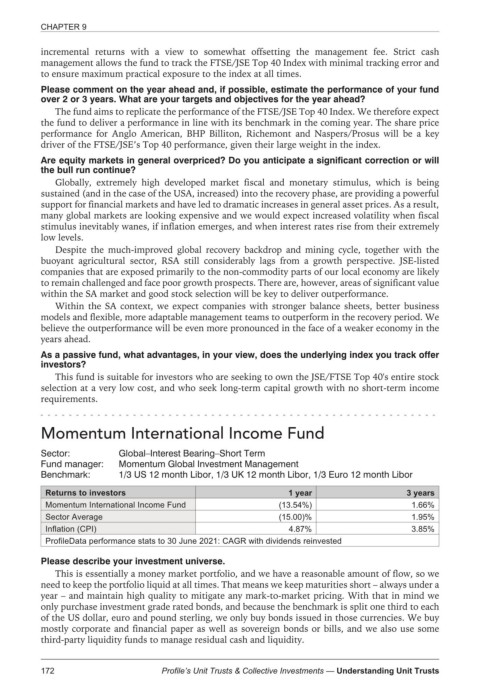

Momentum International Income Fund

Sector: Global–Interest Bearing–Short Term

Fund manager: Momentum Global Investment Management

Benchmark: 1/3 US 12 month Libor, 1/3 UK 12 month Libor, 1/3 Euro 12 month Libor

Returns to investors 1 year 3 years

Momentum International Income Fund (13.54%) 1.66%

Sector Average (15.00)% 1.95%

Inflation (CPI) 4.87% 3.85%

ProfileData performance stats to 30 June 2021: CAGR with dividends reinvested

Please describe your investment universe.

This is essentially a money market portfolio, and we have a reasonable amount of flow, so we

need to keep the portfolio liquid at all times. That means we keep maturities short – always under a

year – and maintain high quality to mitigate any mark-to-market pricing. With that in mind we

only purchase investment grade rated bonds, and because the benchmark is split one third to each

of the US dollar, euro and pound sterling, we only buy bonds issued in those currencies. We buy

mostly corporate and financial paper as well as sovereign bonds or bills, and we also use some

third-party liquidity funds to manage residual cash and liquidity.

172 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts