Page 171 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 171

Fund Manager Interviews

Please comment on the year ahead and, if possible, estimate the performance of your fund

over 2 or 3 years. What are your targets and objectives for the year ahead?

From a fundamental perspective we are constructive on equity on a medium term (+/- 3 year)

horizon. Although valuation is not a good market timing tool, and hence more relevant to assess

expected returns with over longer periods of time of more than 5 years or even 7 years, current

valuations of domestic and global equity markets do suggest that investors can expect normal to

slightly higher than normal returns from equity markets over the next couple of years. However, as

we know, it won’t occur in a straight line, but will involve marked volatility.

Are equity markets in general overpriced? Do you anticipate a significant correction or will

the bull run continue?

Following the significant rebound from the Covid-19 induced sell-off during Q1 2020, there really

are no cheap asset classes available to investors anymore. So it is currently more about the relative

attractiveness of asset classes against each other rather than about absolute valuations. However, when

assessed in an absolute sense, via the equity risk premium, for example, most developed equity market

ERPs are not too far away from their own long-term averages, which would suggest that most equity

markets are not in bubble territory. A similar situation is evident in emerging markets.

When comparing equity risk premia of different countries versus those countries' own risk free

rates (using, for example, 10 year government bond yields as proxies), most countries' ERPs are

handsomely above their relevant risk free rates, suggesting that equities may still present a better

investment than bonds at this stage.

However, when committing new money to equity markets, after such a significant recovery,

investors should be careful and perhaps consider phasing money into equity markets instead of

investing lump sum cash amounts into equities as there are signs that equity markets are pricing in

a tremendous amount of good news currently, and that they could be vulnerable to some downside

risk if we were to get any marked disappointment from an economic growth, company profitability

or geo-political perspective.

Offshore investments are heavily influenced by the rand. Please give your view on the rand

over the next 1, 3 and 5 years.

Our fundamental fair value model for the rand versus the US dollar suggests that fair value is

currently above R15 to the US dollar.

Could you identify three shares that fall within your universe that you think will perform well

in the medium term?

In this specific fund, stock selection is not one of the main drivers of

performance/outperformance over time because both the domestic and global equity exposures in

the H4 Worldwide Equity Fund are achieved via index replication strategies or passive (ETF and

index fund) exposures.

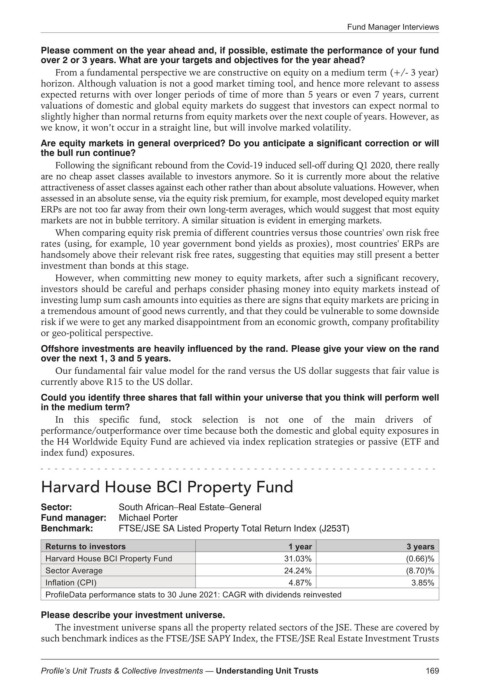

Harvard House BCI Property Fund

Sector: South African–Real Estate–General

Fund manager: Michael Porter

Benchmark: FTSE/JSE SA Listed Property Total Return Index (J253T)

Returns to investors 1 year 3 years

Harvard House BCI Property Fund 31.03% (0.66)%

Sector Average 24.24% (8.70)%

Inflation (CPI) 4.87% 3.85%

ProfileData performance stats to 30 June 2021: CAGR with dividends reinvested

Please describe your investment universe.

The investment universe spans all the property related sectors of the JSE. These are covered by

such benchmark indices as the FTSE/JSE SAPY Index, the FTSE/JSE Real Estate Investment Trusts

169

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts