Page 170 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 170

CHAPTER 9

a flurry of regulatory pressure and derated along with Chinese tech stocks. We have viewed this as

a buying opportunity and find Tencent undervalued at these levels. They have proven to navigate

these successfully in the past, with the Gaming clamp-down in 2018. We think they will do this

again and continue to grow more than 10% p.a. over the medium term. They have an unrivalled

ecosystem with various under-monetized opportunities. Their investment portfolio is worth

approximately $200bn, almost 35% of their current market cap.

Impala and Anglo America Plc. The key risk to global growth continues to be the pandemic. The

rapid spread of the more transmittable Delta variant has created uncertainty around a full global

reopening. However, evidence suggests that vaccinations are an effective tool against this new

variant, breaking the link between infections and hospitalisations. We remain constructive that we

are in a strong commodity up-cycle underpinned by continued global growth, supportive

infrastructure plans and greenification targets that will require considerable amounts of industrial

metals (favouring copper, nickel and PGMs). From a bottom-up perspective, the equities are not

fully pricing in the commodity spot prices and we continue to see upside potential.

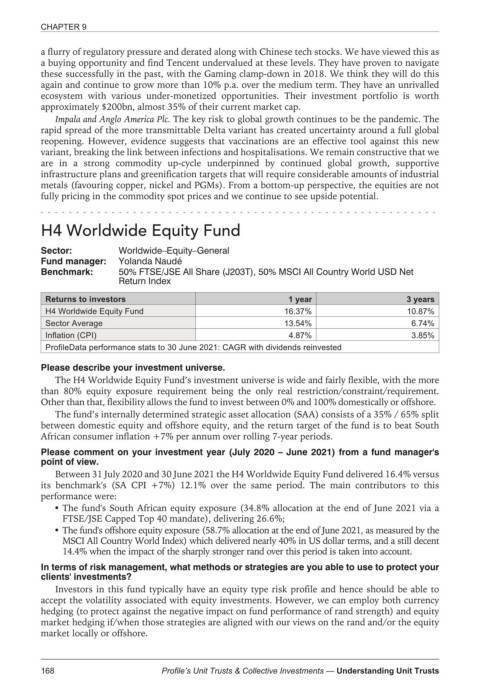

H4 Worldwide Equity Fund

Sector: Worldwide–Equity–General

Fund manager: Yolanda Naudé

Benchmark: 50% FTSE/JSE All Share (J203T), 50% MSCI All Country World USD Net

Return Index

Returns to investors 1 year 3 years

H4 Worldwide Equity Fund 16.37% 10.87%

Sector Average 13.54% 6.74%

Inflation (CPI) 4.87% 3.85%

ProfileData performance stats to 30 June 2021: CAGR with dividends reinvested

Please describe your investment universe.

The H4 Worldwide Equity Fund’s investment universe is wide and fairly flexible, with the more

than 80% equity exposure requirement being the only real restriction/constraint/requirement.

Other than that, flexibility allows the fund to invest between 0% and 100% domestically or offshore.

The fund’s internally determined strategic asset allocation (SAA) consists of a 35% / 65% split

between domestic equity and offshore equity, and the return target of the fund is to beat South

African consumer inflation +7% per annum over rolling 7-year periods.

Please comment on your investment year (July 2020 – June 2021) from a fund manager's

point of view.

Between 31 July 2020 and 30 June 2021 the H4 Worldwide Equity Fund delivered 16.4% versus

its benchmark's (SA CPI +7%) 12.1% over the same period. The main contributors to this

performance were:

The fund's South African equity exposure (34.8% allocation at the end of June 2021 via a

FTSE/JSE Capped Top 40 mandate), delivering 26.6%;

The fund's offshore equity exposure (58.7% allocation at the end of June 2021, as measured by the

MSCI All Country World Index) which delivered nearly 40% in US dollar terms, and a still decent

14.4% when the impact of the sharply stronger rand over this period is taken into account.

In terms of risk management, what methods or strategies are you able to use to protect your

clients' investments?

Investors in this fund typically have an equity type risk profile and hence should be able to

accept the volatility associated with equity investments. However, we can employ both currency

hedging (to protect against the negative impact on fund performance of rand strength) and equity

market hedging if/when those strategies are aligned with our views on the rand and/or the equity

market locally or offshore.

168 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts