Page 168 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 168

CHAPTER 9

despite their strong position and they do not earn much from advertising. Both of these are

potential future monetization opportunities.

Tencent has derated significantly on the back of the Chinese regulatory roll-out. They have

proven to navigate these successfully in the past, with the Gaming clamp-down in 2018. We think

they will do this again and continue to grow more than 10% p.a. over the medium term. They have

an unrivalled ecosystem with various under-monetized opportunities. Their investment portfolio

is worth approximately $200bn, almost 35% of their current market cap. As a whole, the portfolio

is close to breakeven, so Tencent is much cheaper than the forward P/E of 24x would suggest.

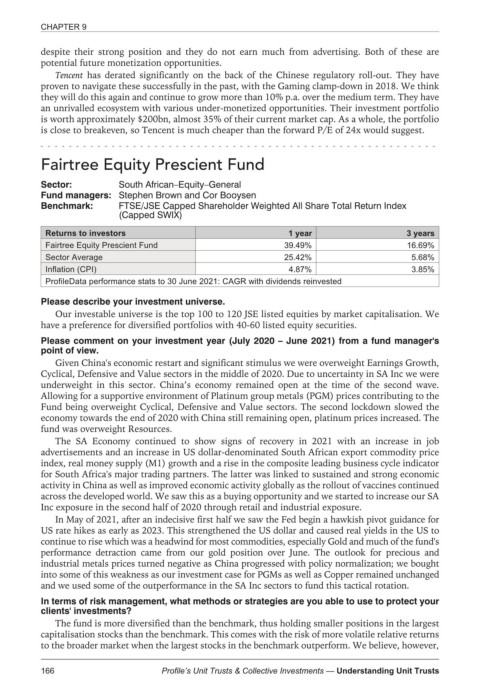

Fairtree Equity Prescient Fund

Sector: South African–Equity–General

Fund managers: Stephen Brown and Cor Booysen

Benchmark: FTSE/JSE Capped Shareholder Weighted All Share Total Return Index

(Capped SWIX)

Returns to investors 1 year 3 years

Fairtree Equity Prescient Fund 39.49% 16.69%

Sector Average 25.42% 5.68%

Inflation (CPI) 4.87% 3.85%

ProfileData performance stats to 30 June 2021: CAGR with dividends reinvested

Please describe your investment universe.

Our investable universe is the top 100 to 120 JSE listed equities by market capitalisation. We

have a preference for diversified portfolios with 40-60 listed equity securities.

Please comment on your investment year (July 2020 – June 2021) from a fund manager's

point of view.

Given China's economic restart and significant stimulus we were overweight Earnings Growth,

Cyclical, Defensive and Value sectors in the middle of 2020. Due to uncertainty in SA Inc we were

underweight in this sector. China’s economy remained open at the time of the second wave.

Allowing for a supportive environment of Platinum group metals (PGM) prices contributing to the

Fund being overweight Cyclical, Defensive and Value sectors. The second lockdown slowed the

economy towards the end of 2020 with China still remaining open, platinum prices increased. The

fund was overweight Resources.

The SA Economy continued to show signs of recovery in 2021 with an increase in job

advertisements and an increase in US dollar-denominated South African export commodity price

index, real money supply (M1) growth and a rise in the composite leading business cycle indicator

for South Africa's major trading partners. The latter was linked to sustained and strong economic

activity in China as well as improved economic activity globally as the rollout of vaccines continued

across the developed world. We saw this as a buying opportunity and we started to increase our SA

Inc exposure in the second half of 2020 through retail and industrial exposure.

In May of 2021, after an indecisive first half we saw the Fed begin a hawkish pivot guidance for

US rate hikes as early as 2023. This strengthened the US dollar and caused real yields in the US to

continue to rise which was a headwind for most commodities, especially Gold and much of the fund's

performance detraction came from our gold position over June. The outlook for precious and

industrial metals prices turned negative as China progressed with policy normalization; we bought

into some of this weakness as our investment case for PGMs as well as Copper remained unchanged

and we used some of the outperformance in the SA Inc sectors to fund this tactical rotation.

In terms of risk management, what methods or strategies are you able to use to protect your

clients' investments?

The fund is more diversified than the benchmark, thus holding smaller positions in the largest

capitalisation stocks than the benchmark. This comes with the risk of more volatile relative returns

to the broader market when the largest stocks in the benchmark outperform. We believe, however,

166 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts