Page 166 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 166

CHAPTER 9

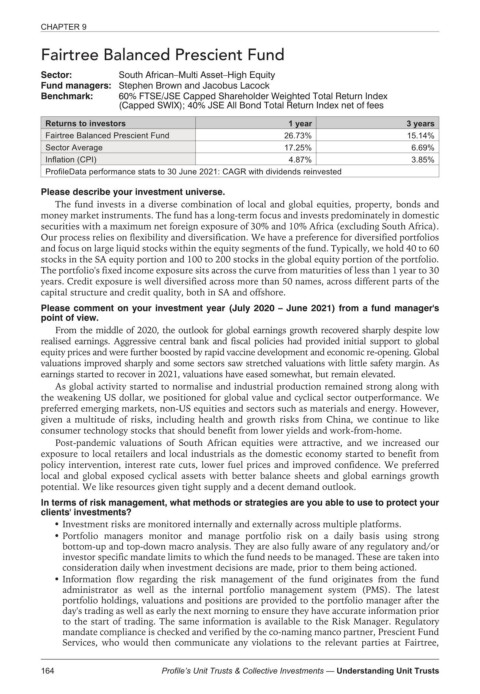

Fairtree Balanced Prescient Fund

Sector: South African–Multi Asset–High Equity

Fund managers: Stephen Brown and Jacobus Lacock

Benchmark: 60% FTSE/JSE Capped Shareholder Weighted Total Return Index

(Capped SWIX); 40% JSE All Bond Total Return Index net of fees

Returns to investors 1 year 3 years

Fairtree Balanced Prescient Fund 26.73% 15.14%

Sector Average 17.25% 6.69%

Inflation (CPI) 4.87% 3.85%

ProfileData performance stats to 30 June 2021: CAGR with dividends reinvested

Please describe your investment universe.

The fund invests in a diverse combination of local and global equities, property, bonds and

money market instruments. The fund has a long-term focus and invests predominately in domestic

securities with a maximum net foreign exposure of 30% and 10% Africa (excluding South Africa).

Our process relies on flexibility and diversification. We have a preference for diversified portfolios

and focus on large liquid stocks within the equity segments of the fund. Typically, we hold 40 to 60

stocks in the SA equity portion and 100 to 200 stocks in the global equity portion of the portfolio.

The portfolio's fixed income exposure sits across the curve from maturities of less than 1 year to 30

years. Credit exposure is well diversified across more than 50 names, across different parts of the

capital structure and credit quality, both in SA and offshore.

Please comment on your investment year (July 2020 – June 2021) from a fund manager's

point of view.

From the middle of 2020, the outlook for global earnings growth recovered sharply despite low

realised earnings. Aggressive central bank and fiscal policies hadprovidedinitial support to global

equity prices and were further boosted by rapid vaccine development and economic re-opening. Global

valuations improved sharply and some sectors saw stretched valuations with little safety margin. As

earnings started to recover in 2021, valuations have eased somewhat, but remain elevated.

As global activity started to normalise and industrial production remained strong along with

the weakening US dollar, we positioned for global value and cyclical sector outperformance. We

preferred emerging markets, non-US equities and sectors such as materials and energy. However,

given a multitude of risks, including health and growth risks from China, we continue to like

consumer technology stocks that should benefit from lower yields and work-from-home.

Post-pandemic valuations of South African equities were attractive, and we increased our

exposure to local retailers and local industrials as the domestic economy started to benefit from

policy intervention, interest rate cuts, lower fuel prices and improved confidence. We preferred

local and global exposed cyclical assets with better balance sheets and global earnings growth

potential. We like resources given tight supply and a decent demand outlook.

In terms of risk management, what methods or strategies are you able to use to protect your

clients' investments?

Investment risks are monitored internally and externally across multiple platforms.

Portfolio managers monitor and manage portfolio risk on a daily basis using strong

bottom-up and top-down macro analysis. They are also fully aware of any regulatory and/or

investor specific mandate limits to which the fund needs to be managed. These are taken into

consideration daily when investment decisions are made, prior to them being actioned.

Information flow regarding the risk management of the fund originates from the fund

administrator as well as the internal portfolio management system (PMS). The latest

portfolio holdings, valuations and positions are provided to the portfolio manager after the

day's trading as well as early the next morning to ensure they have accurate information prior

to the start of trading. The same information is available to the Risk Manager. Regulatory

mandate compliance is checked and verified by the co-naming manco partner, Prescient Fund

Services, who would then communicate any violations to the relevant parties at Fairtree,

164 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts