Page 164 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 164

CHAPTER 9

Please comment on your investment year (July 2020 – June 2021) from a fund manager's

point of view.

After the massive and unprecedented volatility introduced by the Covid-19 pandemic the

period of July 2020 – June 2021 resulted in stability returning to most markets. Emerging markets

and equity markets improved considerably in November after the American elections. The All

Bond Index enjoyed a 13.53% return over the twelve months. The Absa Bond Fund remained

cautiously positioned during this recovery but managed to beat the benchmark over the period.

The South African fundamentals have been gradually improving during 2021 with reduced weekly

bond issuance announced by National Treasury, as well some other positive developments.

In terms of risk management, what methods or strategies are you able to use to protect your

clients' investments?

The Absa Bond Fund can use duration management, interest rate bucket mismatches, cash as

well as derivatives within its strategies to protect clients’ investments.

Please comment on the year ahead and, if possible, estimate the performance of your fund

over 2 or 3 years. What are your targets and objectives for the year ahead?

The Absa Bond Fund aims to beat its benchmark at the lowest possible risk. South African

bonds should benefit from fundamental improvements over the next 2 to 3 years.

Please give your views regarding interest rate trends and the yield curve over the next 1 to 2

years. What interest rates can investors expect? Do you anticipate further repo rate cuts?

Global rates, as well as domestic rates, are expected to normalise higher in line with reflation in

the coming years. In South Africa this needs to be done in the interests of containing price inflation

while maintaining inclusive economic growth. As a result rates should move up gradually over the

next two years with the first hike possibly as soon as November 2021. Rates were cut aggressively

to assist the economy in 2020 and this strategy has been generally effective. However, it will need

to be reversed (albeit partially) as economic performance improves.

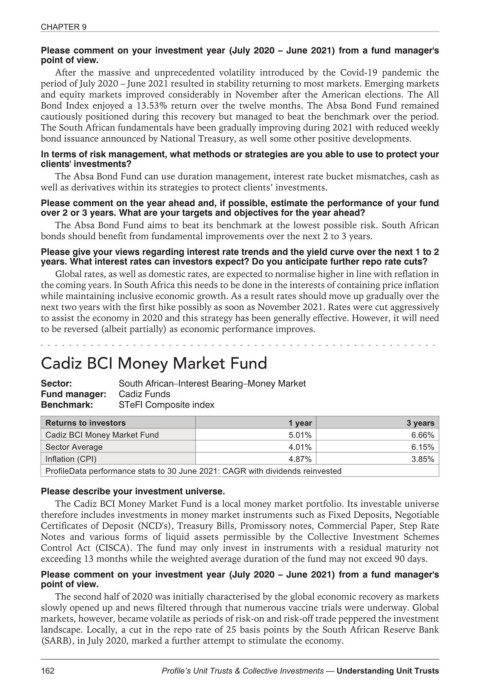

Cadiz BCI Money Market Fund

Sector: South African–Interest Bearing–Money Market

Fund manager: Cadiz Funds

Benchmark: STeFI Composite index

Returns to investors 1 year 3 years

Cadiz BCI Money Market Fund 5.01% 6.66%

Sector Average 4.01% 6.15%

Inflation (CPI) 4.87% 3.85%

ProfileData performance stats to 30 June 2021: CAGR with dividends reinvested

Please describe your investment universe.

The Cadiz BCI Money Market Fund is a local money market portfolio. Its investable universe

therefore includes investments in money market instruments such as Fixed Deposits, Negotiable

Certificates of Deposit (NCD's), Treasury Bills, Promissory notes, Commercial Paper, Step Rate

Notes and various forms of liquid assets permissible by the Collective Investment Schemes

Control Act (CISCA). The fund may only invest in instruments with a residual maturity not

exceeding 13 months while the weighted average duration of the fund may not exceed 90 days.

Please comment on your investment year (July 2020 – June 2021) from a fund manager's

point of view.

The second half of 2020 was initially characterised by the global economic recovery as markets

slowly opened up and news filtered through that numerous vaccine trials were underway. Global

markets, however, became volatile as periods of risk-on and risk-off trade peppered the investment

landscape. Locally, a cut in the repo rate of 25 basis points by the South African Reserve Bank

(SARB), in July 2020, marked a further attempt to stimulate the economy.

162 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts