Page 163 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 163

Fund Manager Interviews

Chapter 9

Fund Manager Interviews

Fund Manager Interviews

NQF

Relevant to

The fund manager interviews presented in this chapter provide a fascinating insight into 119997: 3

the different approaches to investment management required by different types of 242594: 2, 3

collective investment schemes, and the differing views for the future. The interviews 243130: 2, 3

243148: 2

are comments from fund managers about the way in which they manage their funds, 243153: 4

how they make investment decisions, what they anticipate for the year ahead and, in

some cases, specific shares which they fancy.

For this issue, a selection of top performing funds was made in order to present both the major

collective investment scheme managers and a cross-section of categories (general equity, specialist

equity, bond funds, hedge funds, etc). The managers of all the funds selected were invited to

contribute. Not all those invited were able or willing to make a contribution, so the interviews

included here do not necessarily cover all the sectors which we would like to cover.

In addition to the comments provided by each fund manager, we also show the one and three

year lump sum returns (NAV to NAV, dividends reinvested) for each featured fund, the average

performance of the sector, and inflation for the period. The performance figures are annual

compound returns (CAGR).

Bear in mind that the performance figures for each fund are not simply a function of each

manager’s approach or skill. With the exception of hedge funds and some multi asset funds, the

mandates of unit trusts require the fund manager to remain invested in particular sectors or asset

classes regardless of the state of the markets. This means that a fund manager’s choices in a bear

market might be limited to switching part of the portfolio from growth shares to defensive stocks.

In short, the performance figures often reflect sector performance as well as manager performance.

The interviews reveal both the different approaches of different managers, and the significant

effect of sector choice. The manager of a specialist theme fund, for example, works on the

assumption that investors in the fund want to be fully invested in that sector. He will see his job as

outperforming the fund’s benchmark (and his peers); not making asset allocation choices.

In other words, the manager of a theme fund is not striving for an absolute return. This makes

the choice of sector (and fund) very important from the investor’s point of view.

Absa Bond Fund

Sector: South African–Interest Bearing–Variable Term

Fund manager: James Turp

Benchmark: BEASSA All Bond index

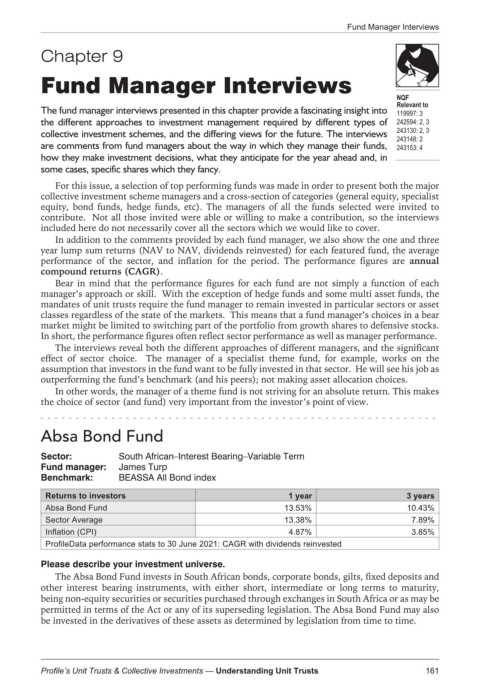

Returns to investors 1 year 3 years

Absa Bond Fund 13.53% 10.43%

Sector Average 13.38% 7.89%

Inflation (CPI) 4.87% 3.85%

ProfileData performance stats to 30 June 2021: CAGR with dividends reinvested

Please describe your investment universe.

The Absa Bond Fund invests in South African bonds, corporate bonds, gilts, fixed deposits and

other interest bearing instruments, with either short, intermediate or long terms to maturity,

being non-equity securities or securities purchased through exchanges in South Africa or as may be

permitted in terms of the Act or any of its superseding legislation. The Absa Bond Fund may also

be invested in the derivatives of these assets as determined by legislation from time to time.

161

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts