Page 121 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 121

Investment Risk

All figures to 31 August 2021

Risk Profile Worksheet scores can be related to volatility figures in fund fact sheets

Using the Risk Number

The risk numbers calculated from the worksheets try to position you on the risk spectrum (see

Chart 6.9). It does this by quantifying both subjective (risk appetite) and objective (risk capacity)

factors which have a bearing on your ability to tolerate risk, both due to your disposition (risk

prone or risk averse), and due to more objective factors, like your age and personal circumstances.

A high adjusted score (15 and above) means that you are in a position to take on a higher level

of risk. This certainly doesn’t mean that you should take on lots of risk. Rather, it means that if you

take on a riskier investment and suffer the consequences of risk (ie, lose money), you are in a

relatively good position to deal with the situation.

A low adjusted score (below 10) means that you should be cautious about taking on risk. Again,

this doesn’t mean that you should never consider a higher risk investment; rather, it means that your

ability to recover from the blow of a risky investment that fails to perform is not very good.

If you score between 9 and 16 you have a lot of options open to you because of the volatility

overlap in the middle of the risk spectrum. If you are at the lower end of the mid-risk area, look for

funds that have below average volatility for their specific sectors.

Sector Volatilities

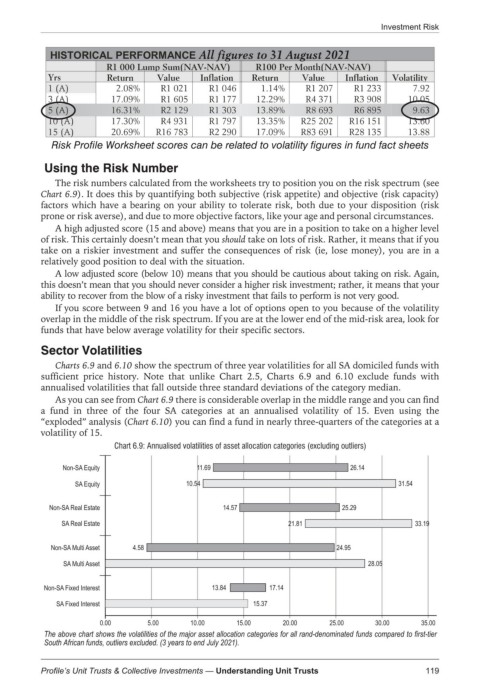

Charts 6.9 and 6.10 show the spectrum of three year volatilities for all SA domiciled funds with

sufficient price history. Note that unlike Chart 2.5, Charts 6.9 and 6.10 exclude funds with

annualised volatilities that fall outside three standard deviations of the category median.

As you can see from Chart 6.9 there is considerable overlap in the middle range and you can find

a fund in three of the four SA categories at an annualised volatility of 15. Even using the

“exploded” analysis (Chart 6.10) you can find a fund in nearly three-quarters of the categories at a

volatility of 15.

Chart 6.9: Annualised volatilities of asset allocation categories (excluding outliers)

Non-SA Equity 11.69 26.14

SA Equity 10.54 31.54

Non-SA Real Estate 14.57 25.29

SA Real Estate 21.81 33.19

Non-SA Multi Asset 4.58 24.95

SA Multi Asset 0.00 28.05

Non-SA Fixed Interest 13.84 17.14

SA Fixed Interest 0.00 15.37

0.00 5.00 10.00 15.00 20.00 25.00 30.00 35.00

The above chart shows the volatilities of the major asset allocation categories for all rand-denominated funds compared to first-tier

South African funds, outliers excluded. (3 years to end July 2021).

119

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts