Page 125 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 125

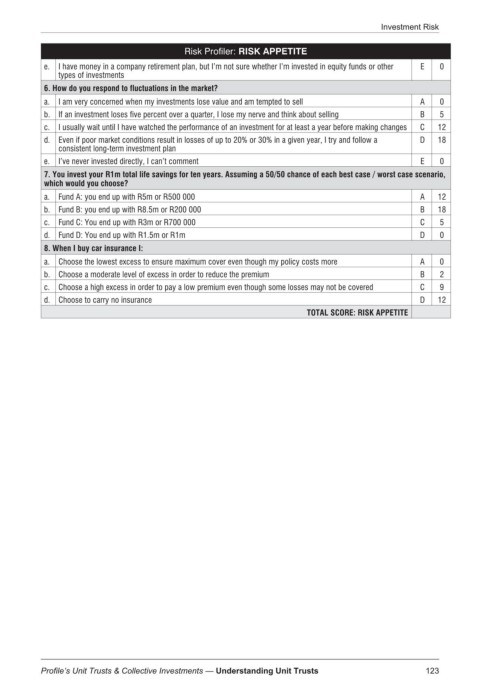

Investment Risk

Risk Profiler: RISK APPETITE

e. I have money in a company retirement plan, but I’m not sure whether I’m invested in equity funds or other E 0

types of investments

6. How do you respond to fluctuations in the market?

a. I am very concerned when my investments lose value and am tempted to sell A 0

b. If an investment loses five percent over a quarter, I lose my nerve and think about selling B 5

c. I usually wait until I have watched the performance of an investment for at least a year before making changes C 12

d. Even if poor market conditions result in losses of up to 20% or 30% in a given year, I try and follow a D 18

consistent long-term investment plan

e. I’ve never invested directly, I can’t comment E 0

7. You invest your R1m total life savings for ten years. Assuming a 50/50 chance of each best case / worst case scenario,

which would you choose?

a. Fund A: you end up with R5m or R500 000 A 12

b. Fund B: you end up with R8.5m or R200 000 B 18

c. Fund C: You end up with R3m or R700 000 C 5

d. Fund D: You end up with R1.5m or R1m D 0

8. When I buy car insurance I:

a. Choose the lowest excess to ensure maximum cover even though my policy costs more A 0

b. Choose a moderate level of excess in order to reduce the premium B 2

c. Choose a high excess in order to pay a low premium even though some losses may not be covered C 9

d. Choose to carry no insurance D 12

TOTAL SCORE: RISK APPETITE

123

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts