Page 124 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 124

CHAPTER 6

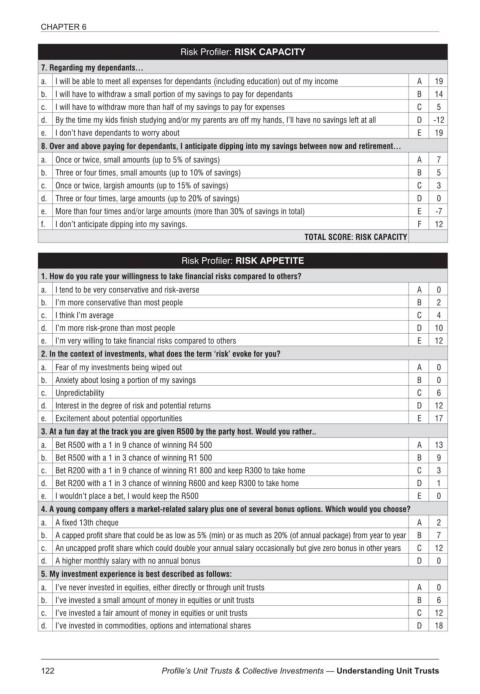

Risk Profiler: RISK CAPACITY

7. Regarding my dependants…

a. I will be able to meet all expenses for dependants (including education) out of my income A 19

b. I will have to withdraw a small portion of my savings to pay for dependants B 14

c. I will have to withdraw more than half of my savings to pay for expenses C 5

d. By the time my kids finish studying and/or my parents are off my hands, I’ll have no savings left at all D -12

e. I don’t have dependants to worry about E 19

8. Over and above paying for dependants, I anticipate dipping into my savings between now and retirement…

a. Once or twice, small amounts (up to 5% of savings) A 7

b. Three or four times, small amounts (up to 10% of savings) B 5

c. Once or twice, largish amounts (up to 15% of savings) C 3

d. Three or four times, large amounts (up to 20% of savings) D 0

e. More than four times and/or large amounts (more than 30% of savings in total) E -7

f. I don’t anticipate dipping into my savings. F 12

TOTAL SCORE: RISK CAPACITY

Risk Profiler: RISK APPETITE

1. How do you rate your willingness to take financial risks compared to others?

a. I tend to be very conservative and risk-averse A 0

b. I’m more conservative than most people B 2

c. I think I’m average C 4

d. I’m more risk-prone than most people D 10

e. I’m very willing to take financial risks compared to others E 12

2. In the context of investments, what does the term ‘risk’ evoke for you?

a. Fear of my investments being wiped out A 0

b. Anxiety about losing a portion of my savings B 0

c. Unpredictability C 6

d. Interest in the degree of risk and potential returns D 12

e. Excitement about potential opportunities E 17

3. At a fun day at the track you are given R500 by the party host. Would you rather..

a. Bet R500 with a 1 in 9 chance of winning R4 500 A 13

b. Bet R500 with a 1 in 3 chance of winning R1 500 B 9

c. Bet R200 with a 1 in 9 chance of winning R1 800 and keep R300 to take home C 3

d. Bet R200 with a 1 in 3 chance of winning R600 and keep R300 to take home D 1

e. I wouldn’t place a bet, I would keep the R500 E 0

4. A young company offers a market-related salary plus one of several bonus options. Which would you choose?

a. A fixed 13th cheque A 2

b. A capped profit share that could be as low as 5% (min) or as much as 20% (of annual package) from year to year B 7

c. An uncapped profit share which could double your annual salary occasionally but give zero bonus in other years C 12

d. A higher monthly salary with no annual bonus D 0

5. My investment experience is best described as follows:

a. I’ve never invested in equities, either directly or through unit trusts A 0

b. I’ve invested a small amount of money in equities or unit trusts B 6

c. I’ve invested a fair amount of money in equities or unit trusts C 12

d. I’ve invested in commodities, options and international shares D 18

122 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts