Page 123 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 123

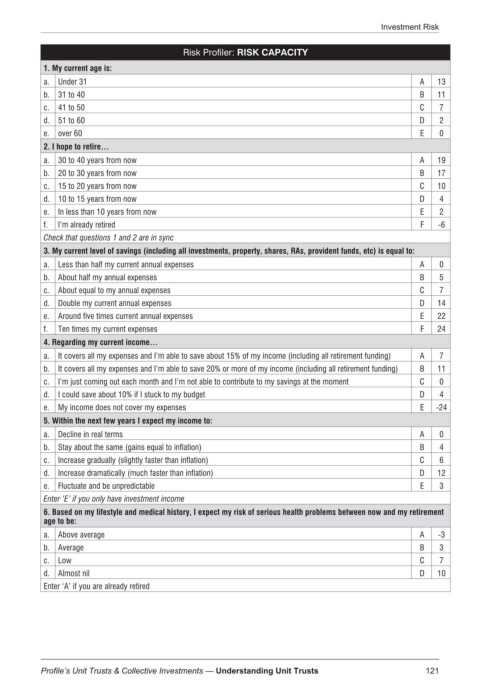

Investment Risk

Risk Profiler: RISK CAPACITY

1. My current age is:

a. Under 31 A 13

b. 31 to 40 B 11

c. 41 to 50 C 7

d. 51 to 60 D 2

e. over 60 E 0

2. I hope to retire…

a. 30 to 40 years from now A 19

b. 20 to 30 years from now B 17

c. 15 to 20 years from now C 10

d. 10 to 15 years from now D 4

e. In less than 10 years from now E 2

f. I’m already retired F -6

Check that questions 1 and 2 are in sync

3. My current level of savings (including all investments, property, shares, RAs, provident funds, etc) is equal to:

a. Less than half my current annual expenses A 0

b. About half my annual expenses B 5

c. About equal to my annual expenses C 7

d. Double my current annual expenses D 14

e. Around five times current annual expenses E 22

f. Ten times my current expenses F 24

4. Regarding my current income…

a. It covers all my expenses and I’m able to save about 15% of my income (including all retirement funding) A 7

b. It covers all my expenses and I’m able to save 20% or more of my income (including all retirement funding) B 11

c. I’m just coming out each month and I’m not able to contribute to my savings at the moment C 0

d. I could save about 10% if I stuck to my budget D 4

e. My income does not cover my expenses E -24

5. Within the next few years I expect my income to:

a. Decline in real terms A 0

b. Stay about the same (gains equal to inflation) B 4

c. Increase gradually (slightly faster than inflation) C 6

d. Increase dramatically (much faster than inflation) D 12

e. Fluctuate and be unpredictable E 3

Enter ‘E’ if you only have investment income

6. Based on my lifestyle and medical history, I expect my risk of serious health problems between now and my retirement

age to be:

a. Above average A -3

b. Average B 3

c. Low C 7

d. Almost nil D 10

Enter ‘A’ if you are already retired

121

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts