Page 30 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 30

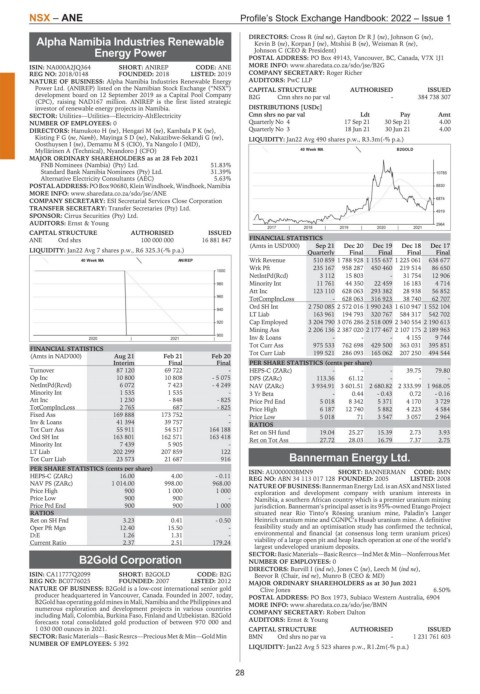

NSX – ANE Profile’s Stock Exchange Handbook: 2022 – Issue 1

DIRECTORS: Cross R (ind ne), Gayton DrRJ(ne), Johnson G (ne),

Alpha Namibia Industries Renewable Kevin B (ne), Korpan J (ne), Mtshisi B (ne), Weisman R (ne),

Energy Power Johnson C (CEO & President)

POSTAL ADDRESS: PO Box 49143, Vancouver, BC, Canada, V7X 1J1

ANE

ISIN: NA000A2JQ364 SHORT: ANIREP CODE: ANE MORE INFO: www.sharedata.co.za/sdo/jse/B2G

REG NO: 2018/0148 FOUNDED: 2018 LISTED: 2019 COMPANY SECRETARY: Roger Richer

NATURE OF BUSINESS: Alpha Namibia Industries Renewable Energy AUDITORS: PwC LLP

Power Ltd. (ANIREP) listed on the Namibian Stock Exchange (“NSX”) CAPITAL STRUCTURE AUTHORISED ISSUED

development board on 12 September 2019 as a Capital Pool Company B2G Cmn shrs no par val - 384 738 307

(CPC), raising NAD167 million. ANIREP is the first listed strategic

investor of renewable energy projects in Namibia. DISTRIBUTIONS [USDc]

SECTOR: Utilities—Utilities—Electricity-AltElectricity Cmn shrs no par val Ldt Pay Amt

NUMBER OF EMPLOYEES: 0 Quarterly No 4 17 Sep 21 30 Sep 21 4.00

DIRECTORS: Hamukoto H (ne), Hengari M (ne), KambalaPK(ne), Quarterly No 3 18 Jun 21 30 Jun 21 4.00

KistingFG(ne, Namb), MayingaSD(ne), Nakazibwe-Sekandi G (ne), LIQUIDITY: Jan22 Avg 490 shares p.w., R3.3m(-% p.a.)

Oosthuysen I (ne), Demamu M S (CIO), Ya Nangolo I (MD),

Myllärinen A (Technical), Nyandoro J (CFO) 40 Week MA B2GOLD

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021

FNB Nominees (Nambia) (Pty) Ltd. 51.83%

Standard Bank Namibia Nominees (Pty) Ltd. 31.39% 10785

Alternative Electricity Consultants (AEC) 5.63%

POSTAL ADDRESS:POBox90680, KleinWindhoek, Windhoek, Namibia 8830

MORE INFO: www.sharedata.co.za/sdo/jse/ANE

COMPANY SECRETARY: ESI Secretarial Services Close Corporation 6874

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

4919

SPONSOR: Cirrus Securities (Pty) Ltd.

AUDITORS: Ernst & Young 2964

2017 | 2018 | 2019 | 2020 | 2021

CAPITAL STRUCTURE AUTHORISED ISSUED

ANE Ord shrs 100 000 000 16 881 847 FINANCIAL STATISTICS

(Amts in USD'000) Sep 21 Dec 20 Dec 19 Dec 18 Dec 17

LIQUIDITY: Jan22 Avg 7 shares p.w., R6 325.3(-% p.a.) Quarterly Final Final Final Final

Wrk Revenue 510 859 1 788 928 1 155 637 1 225 061 638 677

40 Week MA ANIREP

Wrk Pft 235 167 958 287 450 460 219 514 86 650

1000

NetIntPd(Rcd) 3 112 15 803 - 31 754 12 906

Minority Int 11 761 44 350 22 459 16 183 4 714

980

Att Inc 123 110 628 063 293 382 28 938 56 852

960

TotCompIncLoss - 628 063 316 923 38 740 62 707

Ord SH Int 2 750 085 2 572 016 1 990 243 1 610 947 1 552 104

940

LT Liab 163 961 194 793 320 767 584 317 542 702

920 Cap Employed 3 204 790 3 076 286 2 518 009 2 340 554 2 190 613

Mining Ass 2 206 136 2 387 020 2 177 467 2 107 175 2 189 963

900 Inv & Loans - - - 4 155 9 744

2020 | 2021 |

Tot Curr Ass 975 533 762 698 429 500 363 031 395 851

FINANCIAL STATISTICS Tot Curr Liab 199 521 286 093 165 062 207 250 494 544

(Amts in NAD'000) Aug 21 Feb 21 Feb 20

Interim Final Final PER SHARE STATISTICS (cents per share)

Turnover 87 120 69 722 - HEPS-C (ZARc) - - - 39.75 79.80

Op Inc 10 800 10 808 - 5 075 DPS (ZARc) 113.36 61.12 - - -

NetIntPd(Rcvd) 6 072 7 423 - 4 249 NAV (ZARc) 3 934.91 3 601.51 2 680.82 2 333.99 1 968.05

Minority Int 1 535 1 535 - 3 Yr Beta - 0.44 - 0.43 0.72 - 0.16

Att Inc 1 230 - 848 - 825 Price Prd End 5 018 8 342 5 371 4 170 3 729

TotCompIncLoss 2 765 687 - 825 Price High 6 187 12 740 5 882 4 223 4 584

Fixed Ass 169 888 173 752 - Price Low 5 018 71 3 547 3 057 2 964

Inv & Loans 41 394 39 757 - RATIOS

Tot Curr Ass 55 911 54 517 164 188 Ret on SH fund 19.04 25.27 15.39 2.73 3.93

Ord SH Int 163 801 162 571 163 418 Ret on Tot Ass 27.72 28.03 16.79 7.37 2.75

Minority Int 7 439 5 905 -

LT Liab 202 299 207 859 122

Tot Curr Liab 23 573 21 687 916 Bannerman Energy Ltd.

PER SHARE STATISTICS (cents per share) ISIN: AU000000BMN9 SHORT: BANNERMAN CODE: BMN

BMN

HEPS-C (ZARc) 16.00 4.00 - 0.11 REG NO: ABN 34 113 017 128 FOUNDED: 2005 LISTED: 2008

NAV PS (ZARc) 1 014.00 998.00 968.00 NATURE OF BUSINESS:BannermanEnergy Ltd. is anASXandNSX listed

Price High 900 1 000 1 000 exploration and development company with uranium interests in

Price Low 900 900 - Namibia, a southern African country which is a premier uranium mining

Price Prd End 900 900 1 000 jurisdiction. Bannerman’s principal asset is its 95%-owned Etango Project

RATIOS situated near Rio Tinto’s Rössing uranium mine, Paladin’s Langer

Ret on SH Fnd 3.23 0.41 - 0.50 Heinrich uranium mine and CGNPC’s Husab uranium mine. A definitive

Oper Pft Mgn 12.40 15.50 - feasibility study and an optimisation study has confirmed the technical,

D:E 1.26 1.31 - environmental and financial (at consensus long term uranium prices)

Current Ratio 2.37 2.51 179.24 viability of a large open pit and heap leach operation at one of the world’s

largest undeveloped uranium deposits.

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—NonferrousMet

B2Gold Corporation NUMBER OF EMPLOYEES: 0

DIRECTORS: Burvill I (ind ne), Jones C (ne), Leech M (ind ne),

B2G

ISIN: CA11777Q2099 SHORT: B2GOLD CODE: B2G Beevor R (Chair, ind ne), Munro B (CEO & MD)

REG NO: BC0776025 FOUNDED: 2007 LISTED: 2012 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021

NATURE OF BUSINESS: B2Gold is a low-cost international senior gold Clive Jones 6.50%

producer headquartered in Vancouver, Canada. Founded in 2007, today, POSTAL ADDRESS: PO Box 1973, Subiaco Western Australia, 6904

B2Gold has operating gold mines in Mali, Namibia and the Philippines and MORE INFO: www.sharedata.co.za/sdo/jse/BMN

numerous exploration and development projects in various countries

including Mali, Colombia, Burkina Faso, Finland and Uzbekistan. B2Gold COMPANY SECRETARY: Robert Dalton

forecasts total consolidated gold production of between 970 000 and AUDITORS: Ernst & Young

1 030 000 ounces in 2021. CAPITAL STRUCTURE AUTHORISED ISSUED

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—GoldMin BMN Ord shrs no par va - 1 231 761 603

NUMBER OF EMPLOYEES: 5 392

LIQUIDITY: Jan22 Avg 5 523 shares p.w., R1.2m(-% p.a.)

28