Page 227 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 227

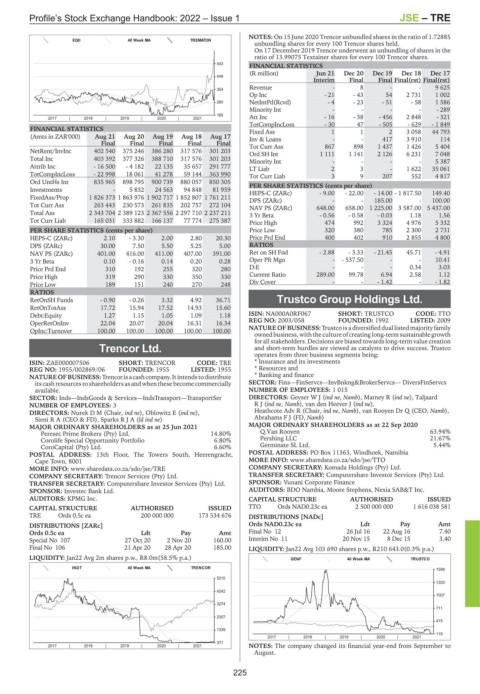

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – TRE

NOTES: On 15 June 2020 Trencor unbundled shares in the ratio of 1.72885

EQII 40 Week MA TREMATON

unbundling shares for every 100 Trencor shares held.

On 17 December 2019 Trencor underwent an unbundling of shares in the

ratio of 13.99075 Textainer shares for every 100 Trencor shares.

543

FINANCIAL STATISTICS

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17

449

Interim Final Final Final(rst) Final(rst)

Revenue - 8 - - 9 625

354

Op Inc - 21 - 43 54 2 731 1 002

260 NetIntPd(Rcvd) - 4 - 23 - 51 - 58 1 586

Minority Int - - - - - 289

165 Att Inc - 16 - 38 - 456 2 848 - 321

2017 | 2018 | 2019 | 2020 | 2021

TotCompIncLoss - 30 47 - 505 - 629 - 1 849

FINANCIAL STATISTICS Fixed Ass 1 1 2 3 058 44 793

(Amts in ZAR'000) Aug 21 Aug 20 Aug 19 Aug 18 Aug 17 Inv & Loans - - 417 3 910 114

Final Final Final Final Final Tot Curr Ass 867 898 1 437 1 426 5 404

NetRent/InvInc 402 540 375 246 386 280 317 576 301 203 Ord SH Int 1 111 1 141 2 126 6 231 7 048

Total Inc 403 392 377 326 388 710 317 576 301 203 Minority Int - - - - 5 387

Attrib Inc - 16 500 - 4 182 22 135 35 657 291 777 LT Liab 2 3 - 1 622 35 061

TotCompIncLoss - 22 998 18 061 41 278 59 144 363 990 Tot Curr Liab 3 9 207 552 4 817

Ord UntHs Int 835 965 898 795 900 739 880 057 850 305 PER SHARE STATISTICS (cents per share)

Investments - 5 832 24 563 94 848 81 959 HEPS-C (ZARc) - 9.00 - 22.00 - 14.00 - 1 817.50 149.40

FixedAss/Prop 1 826 373 1 863 976 1 902 717 1 852 807 1 761 211 DPS (ZARc) - - 185.00 - 100.00

Tot Curr Ass 263 443 230 573 261 835 202 757 272 104 NAV PS (ZARc) 648.00 658.00 1 225.00 3 587.00 5 437.00

Total Ass 2 343 704 2 389 123 2 367 556 2 297 710 2 237 211 3 Yr Beta - 0.56 - 0.58 - 0.03 1.18 1.56

Tot Curr Liab 165 031 333 882 166 137 77 774 275 387 Price High 474 992 3 324 4 976 5 332

PER SHARE STATISTICS (cents per share) Price Low 320 380 785 2 300 2 731

HEPS-C (ZARc) 2.10 - 3.30 2.00 2.80 20.30 Price Prd End 400 402 910 2 855 4 800

DPS (ZARc) 30.00 7.50 5.50 5.25 5.00 RATIOS

NAV PS (ZARc) 401.00 416.00 411.00 407.00 391.00 Ret on SH Fnd - 2.88 - 3.33 - 21.45 45.71 - 4.91

3 Yr Beta 0.10 - 0.16 0.14 0.20 0.28 Oper Pft Mgn - - 537.50 - - 10.41

Price Prd End 310 192 255 320 280 D:E - - - 0.34 3.03

Price High 319 290 330 350 330 Current Ratio 289.00 99.78 6.94 2.58 1.12

Price Low 189 151 240 270 248 Div Cover - - - 1.42 - - 1.82

RATIOS

RetOnSH Funds - 0.90 - 0.26 3.32 4.92 36.71 Trustco Group Holdings Ltd.

RetOnTotAss 17.72 15.94 17.52 14.93 15.60 TRU

Debt:Equity 1.27 1.15 1.05 1.09 1.18 ISIN: NA000A0RF067 SHORT: TRUSTCO CODE: TTO

OperRetOnInv 22.04 20.07 20.04 16.31 16.34 REG NO: 2003/058 FOUNDED: 1992 LISTED: 2009

OpInc:Turnover 100.00 100.00 100.00 100.00 100.00 NATURE OF BUSINESS:Trustco is a diversified dual listed majority family

ownedbusiness, with the culture of creating long-term sustainable growth

for all stakeholders. Decisions are biased towards long-term value creation

Trencor Ltd. and short-term hurdles are viewed as catalysts to drive success. Trustco

operates from three business segments being:

TRE

ISIN: ZAE000007506 SHORT: TRENCOR CODE: TRE * Insurance and its investments

REG NO: 1955/002869/06 FOUNDED: 1955 LISTED: 1955 * Resources and

NATUREOF BUSINESS:Trencorisacashcompany.Itintendstodistribute * Banking and finance

its cash resources to shareholders asandwhen these become commercially SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs

available. NUMBER OF EMPLOYEES: 1 015

SECTOR: Inds—IndsGoods & Services—IndsTransport—TransportSer DIRECTORS: GeyserWJ(ind ne, Namb), Marney R (ind ne), Taljaard

NUMBER OF EMPLOYEES: 3 RJ(ind ne, Namb), van den Heever J (ind ne),

DIRECTORS: Nurek D M (Chair, ind ne), Oblowitz E (ind ne), Heathcote Adv R (Chair, ind ne, Namb), van Rooyen Dr Q (CEO, Namb),

Sieni R A (CEO & FD), SparksRJA(ld ind ne) Abrahams F J (FD, Namb)

MAJOR ORDINARY SHAREHOLDERS as at 25 Jun 2021 MAJOR ORDINARY SHAREHOLDERS as at 22 Sep 2020

Peresec Prime Brokers (Pty) Ltd. 14.80% Q.Van Rooyen 63.94%

Corolife Special Opportunity Portfolio 6.80% Pershing LLC 21.67%

CoroCapital (Pty) Ltd. 6.60% Germinate SL Ltd. 5.44%

POSTAL ADDRESS: 13th Floor, The Towers South, Heerengracht, POSTAL ADDRESS: PO Box 11363, Windhoek, Namibia

Cape Town, 8001 MORE INFO: www.sharedata.co.za/sdo/jse/TTO

MORE INFO: www.sharedata.co.za/sdo/jse/TRE COMPANY SECRETARY: Komada Holdings (Pty) Ltd.

COMPANY SECRETARY: Trencor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Vunani Corporate Finance

SPONSOR: Investec Bank Ltd. AUDITORS: BDO Nambia, Moore Stephens, Nexia SAB&T Inc.

AUDITORS: KPMG Inc. CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED TTO Ords NAD0.23c ea 2 500 000 000 1 616 038 581

TRE Ords 0.5c ea 200 000 000 173 534 676 DISTRIBUTIONS [NADc]

DISTRIBUTIONS [ZARc] Ords NAD0.23c ea Ldt Pay Amt

Ords 0.5c ea Ldt Pay Amt Final No 12 26 Jul 16 22 Aug 16 7.40

Special No 107 27 Oct 20 2 Nov 20 160.00 Interim No 11 20 Nov 15 8 Dec 15 3.40

Final No 106 21 Apr 20 28 Apr 20 185.00 LIQUIDITY: Jan22 Avg 103 690 shares p.w., R210 643.0(0.3% p.a.)

LIQUIDITY: Jan22 Avg 2m shares p.w., R8.0m(58.5% p.a.) GENF 40 Week MA TRUSTCO

INDT 40 Week MA TRENCOR

1599

5210

1303

4242

1007

3274

711

2307

415

1339

119

2017 | 2018 | 2019 | 2020 | 2021

371

2017 | 2018 | 2019 | 2020 | 2021 NOTES: The company changed its financial year-end from September to

August.

225