Page 94 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 94

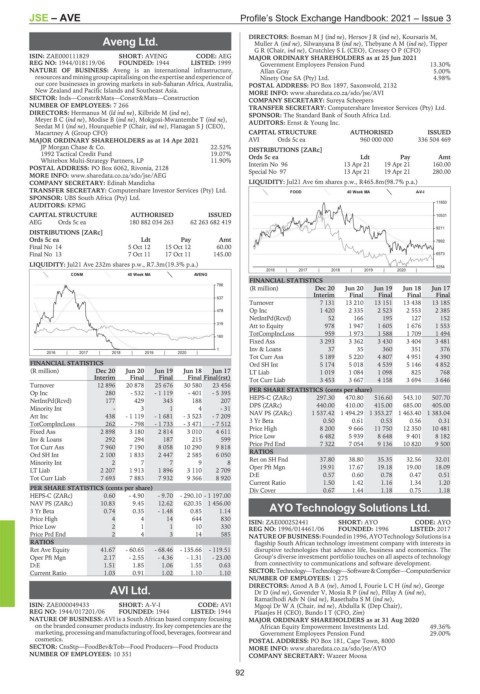

JSE – AVE Profile’s Stock Exchange Handbook: 2021 – Issue 3

DIRECTORS: BosmanMJ(ind ne), HersovJR(ind ne), Koursaris M,

Aveng Ltd. Muller A (ind ne), Silwanyana B (ind ne), ThebyaneAM(ind ne), Tipper

G R (Chair, ind ne), Crutchley S L (CEO), Cressey O P (CFO)

AVE

ISIN: ZAE000111829 SHORT: AVENG CODE: AEG MAJOR ORDINARY SHAREHOLDERS as at 25 Jun 2021

REG NO: 1944/018119/06 FOUNDED: 1944 LISTED: 1999 Government Employees Pension Fund 13.30%

NATURE OF BUSINESS: Aveng is an international infrastructure, Allan Gray 5.00%

resources and mining group capitalising on the expertise and experience of Ninety One SA (Pty) Ltd. 4.98%

our core businesses in growing markets in sub-Saharan Africa, Australia, POSTAL ADDRESS: PO Box 1897, Saxonwold, 2132

New Zealand and Pacific Islands and Southeast Asia. MORE INFO: www.sharedata.co.za/sdo/jse/AVI

SECTOR: Inds—Constr&Mats—Constr&Mats—Construction COMPANY SECRETARY: Sureya Scheepers

NUMBER OF EMPLOYEES: 7 266 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: Hermanus M (ld ind ne), Kilbride M (ind ne), SPONSOR: The Standard Bank of South Africa Ltd.

MeyerBC(ind ne), Modise B (ind ne), Mokgosi-Mwantembe T (ind ne), AUDITORS: Ernst & Young Inc.

SeedatMI(ind ne), Hourquebie P (Chair, ind ne), Flanagan S J (CEO),

Macartney A (Group CFO) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 14 Apr 2021 AVI Ords 5c ea 960 000 000 336 504 469

JP Morgan Chase & Co. 22.52% DISTRIBUTIONS [ZARc]

1992 Tactical Credit Fund 19.07% Ords 5c ea Ldt Pay Amt

Whitebox Multi-Strategy Partners, LP 11.90% Interim No 96 13 Apr 21 19 Apr 21 160.00

POSTAL ADDRESS: PO Box 6062, Rivonia, 2128

MORE INFO: www.sharedata.co.za/sdo/jse/AEG Special No 97 13 Apr 21 19 Apr 21 280.00

COMPANY SECRETARY: Edinah Mandizha LIQUIDITY: Jul21 Ave 6m shares p.w., R465.8m(98.7% p.a.)

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. FOOD 40 Week MA A-V-I

SPONSOR: UBS South Africa (Pty) Ltd.

AUDITORS: KPMG 11850

CAPITAL STRUCTURE AUTHORISED ISSUED 10531

AEG Ords 5c ea 180 882 034 263 62 263 682 419

9211

DISTRIBUTIONS [ZARc]

Ords 5c ea Ldt Pay Amt 7892

Final No 14 5 Oct 12 15 Oct 12 60.00

Final No 13 7 Oct 11 17 Oct 11 145.00 6573

LIQUIDITY: Jul21 Ave 232m shares p.w., R7.3m(19.3% p.a.) 5254

2016 | 2017 | 2018 | 2019 | 2020 |

CONM 40 Week MA AVENG

FINANCIAL STATISTICS

796

(R million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

Interim Final Final Final Final

637

Turnover 7 131 13 210 13 151 13 438 13 185

478 Op Inc 1 420 2 335 2 523 2 553 2 385

NetIntPd(Rcvd) 52 166 195 127 152

319 Att to Equity 978 1 947 1 605 1 676 1 553

TotCompIncLoss 959 1 973 1 588 1 709 1 494

160

Fixed Ass 3 293 3 362 3 430 3 404 3 481

1 Inv & Loans 37 35 360 351 376

2016 | 2017 | 2018 | 2019 | 2020 |

Tot Curr Ass 5 189 5 220 4 807 4 951 4 390

FINANCIAL STATISTICS Ord SH Int 5 174 5 018 4 539 5 146 4 852

(R million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17 LT Liab 1 019 1 084 1 098 825 768

Interim Final Final Final Final(rst) Tot Curr Liab 3 453 3 667 4 158 3 694 3 646

Turnover 12 896 20 878 25 676 30 580 23 456

Op Inc 280 - 532 - 1 119 - 401 - 5 395 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) 177 429 343 188 207 HEPS-C (ZARc) 297.30 470.80 516.60 543.10 507.70

415.00

685.00

405.00

440.00

410.00

Minority Int - 3 1 4 - 31 DPS (ZARc) 1 537.42 1 494.29 1 353.27 1 463.40 1 383.04

NAV PS (ZARc)

Att Inc 438 - 1 119 - 1 681 - 3 523 - 7 209

TotCompIncLoss 262 - 798 - 1 733 - 3 471 - 7 512 3 Yr Beta 0.50 0.61 0.53 0.56 0.31

Fixed Ass 2 898 3 180 2 814 3 010 4 611 Price High 8 200 9 666 11 750 12 350 10 481

Inv & Loans 292 294 187 215 599 Price Low 6 482 5 939 8 648 9 401 8 182

Tot Curr Ass 7 960 7 190 8 058 10 290 9 818 Price Prd End 7 322 7 054 9 136 10 820 9 500

RATIOS

Ord SH Int 2 100 1 833 2 447 2 585 6 050

Minority Int 2 7 7 9 8 Ret on SH Fnd 37.80 38.80 35.35 32.56 32.01

LT Liab 2 207 1 913 1 896 3 110 2 709 Oper Pft Mgn 19.91 17.67 19.18 19.00 18.09

Tot Curr Liab 7 693 7 883 7 932 9 366 8 920 D:E 0.57 0.60 0.78 0.47 0.51

Current Ratio 1.50 1.42 1.16 1.34 1.20

PER SHARE STATISTICS (cents per share) Div Cover 0.67 1.44 1.18 0.75 1.18

HEPS-C (ZARc) 0.60 - 4.90 - 9.70 - 290.10 - 1 197.00

NAV PS (ZARc) 10.83 9.45 12.62 620.35 1 456.00

3 Yr Beta 0.74 0.35 - 1.48 0.85 1.14 AYO Technology Solutions Ltd.

Price High 4 4 14 644 830 ISIN: ZAE000252441 SHORT: AYO CODE: AYO

AYO

Price Low 2 1 1 10 330 REG NO: 1996/014461/06 FOUNDED: 1996 LISTED: 2017

Price Prd End 2 4 3 14 585 NATUREOF BUSINESS:Foundedin1996, AYOTechnology Solutionsisa

RATIOS flagship South African technology investment company with interests in

Ret Ave Equity 41.67 - 60.65 - 68.46 - 135.66 - 119.51 disruptive technologies that advance life, business and economics. The

Oper Pft Mgn 2.17 - 2.55 - 4.36 - 1.31 - 23.00 Group’s diverse investment portfolio touches on all aspects of technology

D:E 1.51 1.85 1.06 1.55 0.63 from connectivity to communications and software development.

Current Ratio 1.03 0.91 1.02 1.10 1.10 SECTOR:Technology—Technology—Software&CompSer—ComputerService

NUMBER OF EMPLOYEES: 1 275

DIRECTORS: AmodABA(ne), Amod I, FourieLCH(ind ne), George

AVI Ltd. DrD(ind ne), Govender V, MosiaRP(ind ne), Pillay A (ind ne),

Ramatlhodi Adv N (ind ne), RasethabaSM(ind ne),

AVI

ISIN: ZAE000049433 SHORT: A-V-I CODE: AVI Mgoqi Dr W A (Chair, ind ne), Abdulla K (Dep Chair),

REG NO: 1944/017201/06 FOUNDED: 1944 LISTED: 1944 Plaatjes H (CEO), Bundo I T (CFO, Zim)

NATURE OF BUSINESS: AVI is a South African based company focusing MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2020

on the branded consumer products industry. Its key competencies are the African Equity Empowerment Investments Ltd. 49.36%

marketing, processingandmanufacturingoffood,beverages, footwearand Government Employees Pension Fund 29.00%

cosmetics. POSTAL ADDRESS: PO Box 181, Cape Town, 8000

SECTOR: CnsStp—FoodBev&Tob—Food Producers—Food Products MORE INFO: www.sharedata.co.za/sdo/jse/AYO

NUMBER OF EMPLOYEES: 10 351 COMPANY SECRETARY: Wazeer Moosa

92