Page 89 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 89

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – ARR

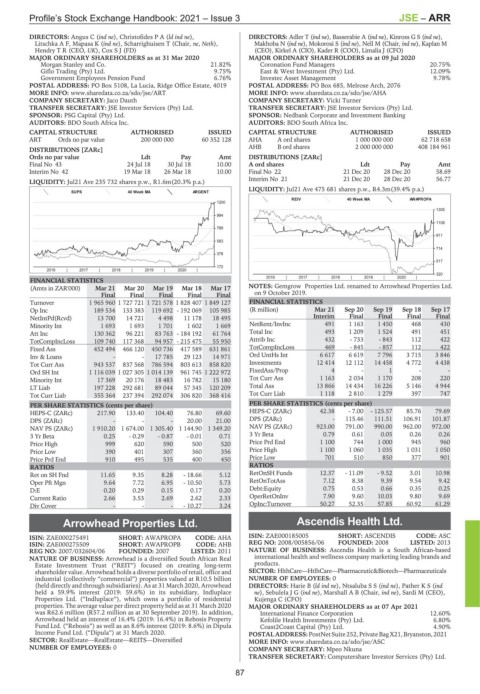

DIRECTORS: Angus C (ind ne), ChristofidesPA(ld ind ne), DIRECTORS: Adler T (ind ne), Basserabie A (ind ne), Kinross G S (ind ne),

Litschka A F, Mapasa K (ind ne), Scharrighuisen T (Chair, ne, Neth), Makhoba N (ind ne), Mokorosi S (ind ne), Nell M (Chair, ind ne), Kaplan M

Hendry T R (CEO, UK), Cox S J (FD) (CEO), Kirkel A (CIO), Kader R (COO), Limalia J (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 MAJOR ORDINARY SHAREHOLDERS as at 09 Jul 2020

Morgan Stanley and Co. 21.82% Coronation Fund Managers 20.75%

Giflo Trading (Pty) Ltd. 9.75% East & West Investment (Pty) Ltd. 12.09%

Government Employees Pension Fund 6.76% Investec Asset Management 9.78%

POSTAL ADDRESS: PO Box 5108, La Lucia, Ridge Office Estate, 4019 POSTAL ADDRESS: PO Box 685, Melrose Arch, 2076

MORE INFO: www.sharedata.co.za/sdo/jse/ART MORE INFO: www.sharedata.co.za/sdo/jse/AHA

COMPANY SECRETARY: Jaco Dauth COMPANY SECRETARY: Vicki Turner

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSOR: PSG Capital (Pty) Ltd. SPONSOR: Nedbank Corporate and Investment Banking

AUDITORS: BDO South Africa Inc. AUDITORS: BDO South Africa Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

ART Ords no par value 200 000 000 60 352 128 AHA A ord shares 1 000 000 000 62 718 658

AHB B ord shares 2 000 000 000 408 184 961

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt DISTRIBUTIONS [ZARc]

Final No 43 24 Jul 18 30 Jul 18 10.00 A ord shares Ldt Pay Amt

Interim No 42 19 Mar 18 26 Mar 18 10.00 Final No 22 21 Dec 20 28 Dec 20 58.69

Interim No 21 21 Dec 20 28 Dec 20 56.77

LIQUIDITY: Jul21 Ave 235 732 shares p.w., R1.6m(20.3% p.a.)

LIQUIDITY: Jul21 Ave 475 681 shares p.w., R4.3m(39.4% p.a.)

SUPS 40 Week MA ARGENT

REIV 40 Week MA AWAPROPA

1200

1305

994

1108

789

911

583

714

378

517

172

2016 | 2017 | 2018 | 2019 | 2020 |

320

2016 | 2017 | 2018 | 2019 | 2020 |

FINANCIAL STATISTICS

(Amts in ZAR'000) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17 NOTES: Gemgrow Properties Ltd. renamed to Arrowhead Properties Ltd.

Final Final Final Final Final on 9 October 2019.

Turnover 1 965 960 1 727 721 1 721 578 1 828 407 1 849 127 FINANCIAL STATISTICS

Op Inc 189 534 133 383 119 692 - 192 069 105 985 (R million) Mar 21 Sep 20 Sep 19 Sep 18 Sep 17

NetIntPd(Rcvd) 13 700 14 721 4 498 11 178 18 495 Interim Final Final Final Final

Minority Int 1 693 1 693 1 701 1 602 1 669 NetRent/InvInc 491 1 163 1 450 468 430

Att Inc 130 362 96 221 83 763 - 184 192 61 764 Total Inc 493 1 209 1 524 491 451

TotCompIncLoss 109 740 117 368 94 957 - 215 475 55 950 Attrib Inc 432 - 733 - 843 112 422

Fixed Ass 452 494 466 120 450 736 417 589 631 861 TotCompIncLoss 469 - 845 - 857 112 422

Inv & Loans - - 17 785 29 123 14 971 Ord UntHs Int 6 617 6 619 7 796 3 715 3 846

Tot Curr Ass 943 537 837 568 786 594 803 613 858 820 Investments 12 414 12 112 14 458 4 772 4 438

Ord SH Int 1 116 039 1 027 305 1 014 139 961 745 1 222 972 FixedAss/Prop 4 - 1 - -

Minority Int 17 369 20 176 18 483 16 782 15 180 Tot Curr Ass 1 163 2 034 1 170 208 220

LT Liab 197 228 292 681 89 044 57 345 120 209 Total Ass 13 866 14 434 16 226 5 146 4 944

Tot Curr Liab 355 364 237 394 292 074 306 820 368 416 Tot Curr Liab 1 118 2 810 1 279 397 747

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 217.90 133.40 104.40 76.80 69.60 HEPS-C (ZARc) 42.38 - 7.00 - 125.57 85.76 79.69

DPS (ZARc) - - - 20.00 21.00 DPS (ZARc) - 115.46 111.51 106.91 101.87

NAV PS (ZARc) 1 910.20 1 674.00 1 305.40 1 144.90 1 349.20 NAV PS (ZARc) 923.00 791.00 990.00 962.00 972.00

3 Yr Beta 0.25 - 0.29 - 0.87 - 0.01 0.71 3 Yr Beta 0.79 0.61 0.05 0.26 0.26

Price High 999 620 590 500 520 Price Prd End 1 100 744 1 000 945 960

Price Low 390 401 307 360 356 Price High 1 100 1 060 1 035 1 031 1 050

Price Prd End 910 495 535 400 450 Price Low 701 510 850 377 901

RATIOS RATIOS

Ret on SH Fnd 11.65 9.35 8.28 - 18.66 5.12 RetOnSH Funds 12.37 - 11.09 - 9.52 3.01 10.98

Oper Pft Mgn 9.64 7.72 6.95 - 10.50 5.73 RetOnTotAss 7.12 8.38 9.39 9.54 9.42

D:E 0.20 0.29 0.15 0.17 0.20 Debt:Equity 0.75 0.53 0.66 0.35 0.25

Current Ratio 2.66 3.53 2.69 2.62 2.33 OperRetOnInv 7.90 9.60 10.03 9.80 9.69

Div Cover - - - - 10.27 3.24 OpInc:Turnover 50.27 52.35 57.85 60.92 61.29

Arrowhead Properties Ltd. Ascendis Health Ltd.

ASC

ARR

ISIN: ZAE000275491 SHORT: AWAPROPA CODE: AHA ISIN: ZAE000185005 SHORT: ASCENDIS CODE: ASC

ISIN: ZAE000275509 SHORT: AWAPROPB CODE: AHB REG NO: 2008/005856/06 FOUNDED: 2008 LISTED: 2013

REG NO: 2007/032604/06 FOUNDED: 2007 LISTED: 2011 NATURE OF BUSINESS: Ascendis Health is a South African-based

NATURE OF BUSINESS: Arrowhead is a diversified South African Real international health and wellness company marketing leading brands and

Estate Investment Trust (“REIT”) focused on creating long-term products.

shareholder value. Arrowhead holds a diverse portfolio of retail, office and SECTOR: HlthCare—HtlhCare—Pharmaceutic&Biotech—Pharmaceuticals

industrial (collectively “commercial”) properties valued at R10.5 billion NUMBER OF EMPLOYEES: 0

(held directly and through subsidiaries). As at 31 March 2020, Arrowhead DIRECTORS: Harie B (ld ind ne), NtsalubaSS(ind ne), PatherKS(ind

held a 59.9% interest (2019: 59.6%) in its subsidiary, Indluplace ne), SebulelaJG(ind ne), Marshall A B (Chair, ind ne), Sardi M (CEO),

Properties Ltd. (“Indluplace”), which owns a portfolio of residential Kujenga C (CFO)

properties. The average value per direct property held as at 31 March 2020 MAJOR ORDINARY SHAREHOLDERS as at 07 Apr 2021

was R62.6 million (R57.2 million as at 30 September 2019). In addition, International Finance Corporation 12.60%

Arrowhead held an interest of 16.4% (2019: 16.4%) in Rebosis Property Kefolile Health Investments (Pty) Ltd. 6.80%

Fund Ltd. (“Rebosis”) as well as an 8.6% interest (2019: 8.6%) in Dipula Coast2Coast Capital (Pty) Ltd. 4.90%

Income Fund Ltd. (“Dipula”) at 31 March 2020. POSTAL ADDRESS:PostNetSuite252, PrivateBagX21,Bryanston,2021

SECTOR: RealEstate—RealEstate—REITS—Diversified MORE INFO: www.sharedata.co.za/sdo/jse/ASC

NUMBER OF EMPLOYEES: 0 COMPANY SECRETARY: Mpeo Nkuna

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

87