Page 91 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 91

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – AST

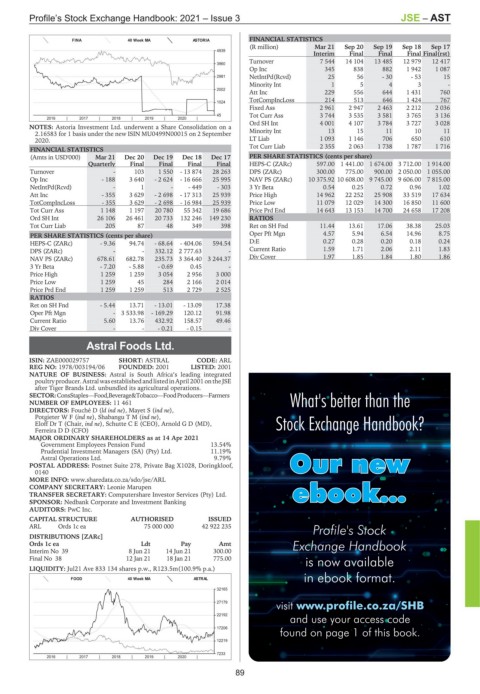

FINANCIAL STATISTICS

FINA 40 Week MA ASTORIA

(R million) Mar 21 Sep 20 Sep 19 Sep 18 Sep 17

4939

Interim Final Final Final Final(rst)

Turnover 7 544 14 104 13 485 12 979 12 417

3960

Op Inc 345 838 882 1 942 1 087

2981 NetIntPd(Rcvd) 25 56 - 30 - 53 15

Minority Int 1 5 4 3 -

2002

Att Inc 229 556 644 1 431 760

TotCompIncLoss 214 513 646 1 424 767

1024

Fixed Ass 2 961 2 947 2 463 2 212 2 036

45 Tot Curr Ass 3 744 3 535 3 581 3 765 3 136

2016 | 2017 | 2018 | 2019 | 2020 |

Ord SH Int 4 001 4 107 3 784 3 727 3 028

NOTES: Astoria Investment Ltd. underwent a Share Consolidation on a

2.16583 for 1 basis under the new ISIN MU0499N00015 on 2 September Minority Int 13 15 11 10 11

2020. LT Liab 1 093 1 146 706 650 610

Tot Curr Liab 2 355 2 063 1 738 1 787 1 716

FINANCIAL STATISTICS

(Amts in USD'000) Mar 21 Dec 20 Dec 19 Dec 18 Dec 17 PER SHARE STATISTICS (cents per share)

Quarterly Final Final Final Final HEPS-C (ZARc) 597.00 1 441.00 1 674.00 3 712.00 1 914.00

Turnover - 103 1 550 - 13 874 28 263 DPS (ZARc) 300.00 775.00 900.00 2 050.00 1 055.00

Op Inc - 188 3 640 - 2 624 - 16 666 25 995 NAV PS (ZARc) 10 375.92 10 608.00 9 745.00 9 606.00 7 815.00

NetIntPd(Rcvd) - 1 - - 449 - 303 3 Yr Beta 0.54 0.25 0.72 0.96 1.02

Att Inc - 355 3 629 - 2 698 - 17 313 25 939 Price High 14 962 22 252 25 908 33 519 17 634

TotCompIncLoss - 355 3 629 - 2 698 - 16 984 25 939 Price Low 11 079 12 029 14 300 16 850 11 600

Tot Curr Ass 1 148 1 197 20 780 55 342 19 686 Price Prd End 14 643 13 153 14 700 24 658 17 208

Ord SH Int 26 106 26 461 20 733 132 246 149 230 RATIOS

Tot Curr Liab 205 87 48 349 398 Ret on SH Fnd 11.44 13.61 17.06 38.38 25.03

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 4.57 5.94 6.54 14.96 8.75

HEPS-C (ZARc) - 9.36 94.74 - 68.64 - 404.06 594.54 D:E 0.27 0.28 0.20 0.18 0.24

DPS (ZARc) - - 332.12 2 777.63 - Current Ratio 1.59 1.71 2.06 2.11 1.83

NAV PS (ZARc) 678.61 682.78 235.73 3 364.40 3 244.37 Div Cover 1.97 1.85 1.84 1.80 1.86

3 Yr Beta - 7.20 - 5.88 - 0.69 0.45 -

Price High 1 259 1 259 3 054 2 956 3 000

Price Low 1 259 45 284 2 166 2 014

Price Prd End 1 259 1 259 513 2 729 2 525

RATIOS

Ret on SH Fnd - 5.44 13.71 - 13.01 - 13.09 17.38

Oper Pft Mgn - 3 533.98 - 169.29 120.12 91.98

Current Ratio 5.60 13.76 432.92 158.57 49.46

Div Cover - - - 0.21 - 0.15 -

Astral Foods Ltd.

AST

ISIN: ZAE000029757 SHORT: ASTRAL CODE: ARL

REG NO: 1978/003194/06 FOUNDED: 2001 LISTED: 2001

NATURE OF BUSINESS: Astral is South Africa’s leading integrated

poultryproducer. Astralwasestablished andlistedinApril2001 onthe JSE

after Tiger Brands Ltd. unbundled its agricultural operations.

SECTOR:ConsStaples—Food,Beverage&Tobacco—FoodProducers—Farmers

NUMBER OF EMPLOYEES: 11 461 What's better than the

DIRECTORS: Fouché D (ld ind ne), Mayet S (ind ne),

PotgieterWF(ind ne), ShabanguTM(ind ne),

Eloff Dr T (Chair, ind ne), Schutte C E (CEO), Arnold G D (MD), Stock Exchange Handbook?

Ferreira D D (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 14 Apr 2021

Government Employees Pension Fund 13.54%

Prudential Investment Managers (SA) (Pty) Ltd. 11.19%

Astral Operations Ltd. 9.79%

POSTAL ADDRESS: Postnet Suite 278, Private Bag X1028, Doringkloof, O Ouurr nneeww

0140

MORE INFO: www.sharedata.co.za/sdo/jse/ARL

COMPANY SECRETARY: Leonie Marupen

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. e ebbooookk……

SPONSOR: Nedbank Corporate and Investment Banking

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

ARL Ords 1c ea 75 000 000 42 922 235 Profile's Stock

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt Exchange Handbook

Interim No 39 8 Jun 21 14 Jun 21 300.00

Final No 38 12 Jan 21 18 Jan 21 775.00 is now available

LIQUIDITY: Jul21 Ave 833 134 shares p.w., R123.5m(100.9% p.a.)

in ebook format.

FOOD 40 Week MA ASTRAL

32165

visit www.profile.co.za/SHB

27179

22192

and use your access code

17206

found on page 1 of this book.

12219

7233

2016 | 2017 | 2018 | 2019 | 2020 |

89