Page 92 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 92

JSE – ATT Profile’s Stock Exchange Handbook: 2021 – Issue 3

POSTAL ADDRESS: PostNet Suite 016, Private

Attacq Ltd. Bag X81, Halfway House, 1685

ATT EMAIL: brenda@attacq.co.za

WEBSITE: www.attacq.co.za

TELEPHONE: 010-549-1050

COMPANY SECRETARY: Anda Matwa

TRANSFER SECRETARY: Computershare

Investor Services (Pty) Ltd.

SPONSOR: Java Capital (Pty) Ltd.

Scan the QR code to AUDITORS: Ernst & Young

visit our website

BANKERS: Nedbank Ltd.

ISIN: ZAE000177218 SHORT: ATTACQ CODE: ATT CALENDAR Expected Status

REG NO: 1997/000543/06 FOUNDED: 2005 LISTED: 2013

Next Final Results 14 Sep 2021 Confirmed

NATURE OF BUSINESS: Annual General Meeting 18 Nov 2021 Confirmed

Attacq is a South Africa-based Real Estate Investment Trust Next Interim Results Mar 2022 Unconfirmed

(REIT), with a vision to be the best provider of community CAPITAL STRUCTURE AUTHORISED ISSUED

spaces. Its diversified South African portfolio provides sustain- ATT Ords no par value 2 000 000 000 751 551 292

DISTRIBUTIONS [ZARc]

able community spaces in each of its nodes, aimed at being the Ords no par value Ldt Pay Amt

destination of choice and setting Attacq apart from its peers. Interim No 4 17 Mar 20 23 Mar 20 45.00

The group reports on four drivers: the South African portfolio, Final No 3 1 Oct 19 7 Oct 19 41.00

Developments at Waterfall, Investment in MAS Real Estate Inc. Interim No 2 26 Mar 19 1 Apr 19 40.50

andtheRestofAfricaretailinvestments.Attacq’sintentistoexit Final No 1 2 Oct 18 8 Oct 18 74.00

the Rest of Africa retail investments in an orderly manner. LIQUIDITY: Jun21 Ave 7m shares p.w., R39.1m(50.6% p.a.)

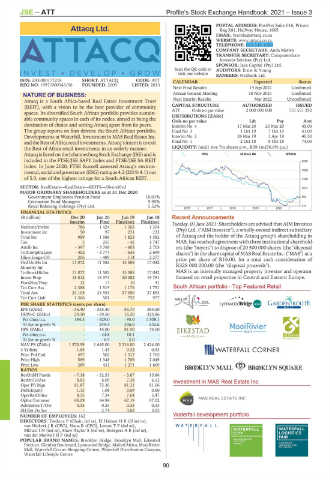

AttacqislistedontheJohannesburgStockExchange(JSE)andis REIV 40 Week MA ATTACQ

included in the FTSE/JSE SAPY Index and FTSE/JSE SA REIT 2220

Index. In June 2020, FTSE Russell assessed Attacq’s environ-

mental,socialandgovernance(ESG)ratingas4.2(2019:4.1)out 1838

of 5.0, one of the highest ratings for a South African REIT. 1456

SECTOR: RealEstate—RealEstate—REITS—Diversified 1074

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

Government Employees Pension Fund 10.01% 692

Coronation Fund Managers 9.90%

Royal Bafokeng Holdings (Pty) Ltd. 5.52% 310

2016 | 2017 | 2018 | 2019 | 2020 |

FINANCIAL STATISTICS

(R million) Dec 20 Jun 20 Jun 19 Jun 18 Recent Announcements

Interim Final Final(rst) Final(rst) Tuesday, 01 June 2021: Shareholders are advised that AIM Investco

NetRent/InvInc 786 1 424 1 503 1 304

Investment inc 50 97 231 233 (Pty) Ltd. ("AIM Investco"), a wholly-owned indirect subsidiary

Total Inc 989 1 586 1 823 1 582 of Attacq and the holder of the Attacq group's shareholding in

Tax 5 255 - 42 1 747 MAS, has reached agreement with three institutional sharehold-

Attrib Inc - 397 - 3 768 - 603 2 703 ers (the "buyers") to dispose of 20 500 000 shares (the "disposal

TotCompIncLoss - 402 - 3 777 - 636 2 699 shares") in the share capital of MAS Real Estate Inc. ("MAS") at a

Hline Erngs-CO 206 - 489 114 2 277 price per share of R16.00, for a total cash consideration of

Ord UntHs Int 11 072 11 582 15 588 17 042 R328 000 000.00 (the "disposal proceeds").

Minority Int - - - -

TotStockHldInt 11 072 11 582 15 588 17 042 MAS is an internally managed property investor and operator

Invest Prop 18 812 19 374 20 082 19 791 focused on retail properties in Central and Eastern Europe.

FixedAss/Prop 12 17 10 41

Tot Curr Ass 2 388 1 519 1 176 1 751

Total Ass 24 105 24 553 27 050 27 853

Tot Curr Liab 1 366 501 752 977

PER SHARE STATISTICS (cents per share)

EPS (ZARc) - 56.40 - 535.40 - 85.70 384.50

HEPS-C (ZARc) 29.30 - 69.50 16.20 323.86

Pct chng p.a. 184.3 - 529.0 - 95.0 1 308.1

Tr 5yr av grwth % - 249.4 336.0 632.6

DPS (ZARc) - 45.00 81.50 74.00

Pct chng p.a. - - 44.8 10.1 -

Tr 5yr av grwth % - - 6.9 2.0 -

NAV PS (ZARc) 1 570.59 1 645.00 2 216.00 2 424.00

3 Yr Beta 1.65 1.43 0.32 0.53

Price Prd End 497 502 1 312 1 705

Price High 569 1 348 1 709 2 049

Price Low 289 431 1 271 1 669

RATIOS

RetOnSH Funds - 7.18 - 32.53 - 3.87 15.86

RetOnTotAss 8.83 6.09 7.38 6.12

Oper Pft Mgn 81.87 72.36 81.21 81.06

Debt:Equity 1.13 1.08 0.69 0.60

OperRetOnInv 8.35 7.34 7.64 5.47

OpInc:Turnover 65.09 64.94 67.19 67.02

AdminFee:T/Ovr 0.35 0.35 0.33 0.33

SH Ret On Inv - 2.74 3.68 3.05

NUMBER OF EMPLOYEES: 162

DIRECTORS: Tredoux P (Chair, ind ne), El HaimerHR(ld ind ne),

van Niekerk J R (CEO), Nana R (CFO), LeeuwTP(ind ne),

MkhariIN(ind ne), Shaw-Taylor S (ind ne), SwiegersAE(ind ne),

van der MerweJHP(ind ne)

POPULAR BRAND NAMES: Brooklyn Bridge, Brooklyn Mall, Eikestad

Precinct, Glenfair Boulevard, Lynnwood Bridge, Mall of Africa, MooiRivier

Mall, Waterfall Corner Shopping Centre, Waterfall Distribution Campus,

Waterfall Lifestyle Centre

90