Page 97 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 97

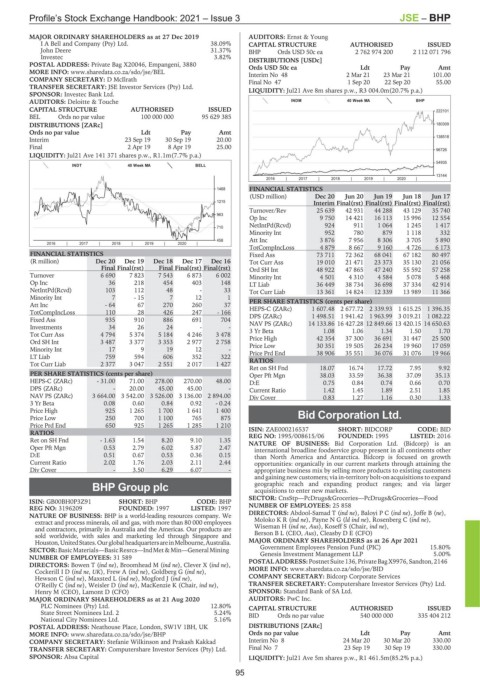

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – BHP

MAJOR ORDINARY SHAREHOLDERS as at 27 Dec 2019 AUDITORS: Ernst & Young

I A Bell and Company (Pty) Ltd. 38.09% CAPITAL STRUCTURE AUTHORISED ISSUED

John Deere 31.37% BHP Ords USD 50c ea 2 762 974 200 2 112 071 796

Investec 3.82% DISTRIBUTIONS [USDc]

POSTAL ADDRESS: Private Bag X20046, Empangeni, 3880 Ords USD 50c ea Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/BEL Interim No 48 2 Mar 21 23 Mar 21 101.00

COMPANY SECRETARY: D McIlrath Final No 47 1 Sep 20 22 Sep 20 55.00

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. LIQUIDITY: Jul21 Ave 8m shares p.w., R3 004.0m(20.7% p.a.)

SPONSOR: Investec Bank Ltd.

AUDITORS: Deloitte & Touche INDM 40 Week MA BHP

CAPITAL STRUCTURE AUTHORISED ISSUED 222101

BEL Ords no par value 100 000 000 95 629 385

DISTRIBUTIONS [ZARc] 180309

Ords no par value Ldt Pay Amt

Interim 23 Sep 19 30 Sep 19 20.00 138518

Final 2 Apr 19 8 Apr 19 25.00

96726

LIQUIDITY: Jul21 Ave 141 371 shares p.w., R1.1m(7.7% p.a.)

54935

INDT 40 Week MA BELL

13144

2016 | 2017 | 2018 | 2019 | 2020 |

1468 FINANCIAL STATISTICS

(USD million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

1215 Interim Final(rst) Final(rst) Final(rst) Final(rst)

Turnover/Rev 25 639 42 931 44 288 43 129 35 740

963

Op Inc 9 750 14 421 16 113 15 996 12 554

NetIntPd(Rcvd) 924 911 1 064 1 245 1 417

710

Minority Int 952 780 879 1 118 332

458 Att Inc 3 876 7 956 8 306 3 705 5 890

2016 | 2017 | 2018 | 2019 | 2020 |

TotCompIncLoss 4 879 8 667 9 160 4 726 6 173

FINANCIAL STATISTICS Fixed Ass 73 711 72 362 68 041 67 182 80 497

(R million) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16 Tot Curr Ass 19 010 21 471 23 373 35 130 21 056

Final Final(rst) Final Final(rst) Final(rst) Ord SH Int 48 922 47 865 47 240 55 592 57 258

Turnover 6 690 7 823 7 543 6 873 6 002 Minority Int 4 501 4 310 4 584 5 078 5 468

Op Inc 36 218 454 403 148 LT Liab 36 449 38 734 36 698 37 334 42 914

NetIntPd(Rcvd) 103 112 48 - 33 Tot Curr Liab 13 361 14 824 12 339 13 989 11 366

Minority Int 7 - 15 7 12 1

Att Inc - 64 67 270 260 37 PER SHARE STATISTICS (cents per share)

1 607.48 2 677.72 2 339.93 1 615.25 1 396.35

HEPS-C (ZARc)

TotCompIncLoss 110 28 426 247 - 166 DPS (ZARc) 1 498.51 1 941.42 1 963.99 3 019.21 1 082.22

Fixed Ass 935 910 886 691 704

Investments 34 26 24 - - NAV PS (ZARc) 14 133.86 16 427.28 12 849.66 13 420.15 14 650.63

1.08

1.70

1.50

1.34

1.06

Tot Curr Ass 4 794 5 374 5 184 4 246 3 478 3 Yr Beta 42 354 37 300 36 691 31 447 25 500

Price High

Ord SH Int 3 487 3 377 3 353 2 977 2 758 Price Low 30 351 19 505 26 234 19 960 17 059

Minority Int 17 9 19 12 -

LT Liab 759 594 606 352 322 Price Prd End 38 906 35 551 36 076 31 076 19 966

Tot Curr Liab 2 377 3 047 2 551 2 017 1 427 RATIOS

Ret on SH Fnd 18.07 16.74 17.72 7.95 9.92

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 38.03 33.59 36.38 37.09 35.13

HEPS-C (ZARc) - 31.00 71.00 278.00 270.00 48.00 D:E 0.75 0.84 0.74 0.66 0.70

DPS (ZARc) - 20.00 45.00 45.00 - Current Ratio 1.42 1.45 1.89 2.51 1.85

NAV PS (ZARc) 3 664.00 3 542.00 3 526.00 3 136.00 2 894.00 Div Cover 0.83 1.27 1.16 0.30 1.33

3 Yr Beta 0.08 0.60 0.84 0.92 - 0.24

Price High 925 1 265 1 700 1 641 1 400

Price Low 250 700 1 100 765 875 Bid Corporation Ltd.

Price Prd End 650 925 1 265 1 285 1 210 ISIN: ZAE000216537 SHORT: BIDCORP CODE: BID

BID

RATIOS REG NO: 1995/008615/06 FOUNDED: 1995 LISTED: 2016

Ret on SH Fnd - 1.63 1.54 8.20 9.10 1.35 NATURE OF BUSINESS: Bid Corporation Ltd. (Bidcorp) is an

Oper Pft Mgn 0.53 2.79 6.02 5.87 2.47 international broadline foodservice group present in all continents other

D:E 0.51 0.67 0.53 0.36 0.15 than North America and Antarctica. Bidcorp is focused on growth

Current Ratio 2.02 1.76 2.03 2.11 2.44 opportunities: organically in our current markets through attaining the

Div Cover - 3.50 6.29 6.07 - appropriate business mix by selling more products to existing customers

and gaining new customers; via in-territory bolt-on acquisitions to expand

BHP Group plc geographic reach and expanding product ranges; and via larger

acquisitions to enter new markets.

BHP SECTOR: CnsStp—PcDrugs&Groceries—PcDrugs&Groceries—Food

ISIN: GB00BH0P3Z91 SHORT: BHP CODE: BHP

REG NO: 3196209 FOUNDED: 1997 LISTED: 1997 NUMBER OF EMPLOYEES: 25 858

NATURE OF BUSINESS: BHP is a world-leading resources company. We DIRECTORS: Abdool-Samad T (ind ne), BaloyiPC(ind ne), Joffe B (ne),

extract and process minerals, oil and gas, with more than 80 000 employees MolokoKR(ind ne), PayneNG(ld ind ne), Rosenberg C (ind ne),

and contractors, primarily in Australia and the Americas. Our products are Wiseman H (ind ne, Aus), Koseff S (Chair, ind ne),

sold worldwide, with sales and marketing led through Singapore and Berson B L (CEO, Aus), Cleasby D E (CFO)

Houston,UnitedStates.OurglobalheadquartersareinMelbourne,Australia. MAJOR ORDINARY SHAREHOLDERS as at 26 Apr 2021

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining Government Employees Pension Fund (PIC) 15.80%

5.00%

Genesis Investment Management LLP

NUMBER OF EMPLOYEES: 31 589 POSTAL ADDRESS:PostnetSuite136, PrivateBagX9976, Sandton,2146

DIRECTORS: Bowen T (ind ne), Broomhead M (ind ne), Clever X (ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/BID

CockerillID(ind ne, UK), Frew A (ind ne), Goldberg G (ind ne),

Hewson C (ind ne), Maxsted L (ind ne), Mogford J (ind ne), COMPANY SECRETARY: Bidcorp Corporate Services

O’Reilly C (ind ne), Weisler D (ind ne), MacKenzie K (Chair, ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Henry M (CEO), Lamont D (CFO) SPONSOR: Standard Bank of SA Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 21 Aug 2020 AUDITORS: PwC Inc.

PLC Nominees (Pty) Ltd. 12.80% CAPITAL STRUCTURE AUTHORISED ISSUED

State Street Nominees Ltd. 2 5.24% BID Ords no par value 540 000 000 335 404 212

National City Nominees Ltd. 5.16%

POSTAL ADDRESS: Neathouse Place, London, SW1V 1BH, UK DISTRIBUTIONS [ZARc]

MORE INFO: www.sharedata.co.za/sdo/jse/BHP Ords no par value Ldt Pay Amt

COMPANY SECRETARY: Stefanie Wilkinson and Prakash Kakkad Interim No 8 24 Mar 20 30 Mar 20 330.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 7 23 Sep 19 30 Sep 19 330.00

SPONSOR: Absa Capital LIQUIDITY: Jul21 Ave 5m shares p.w., R1 461.5m(85.2% p.a.)

95