Page 90 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 90

JSE – ASP Profile’s Stock Exchange Handbook: 2021 – Issue 3

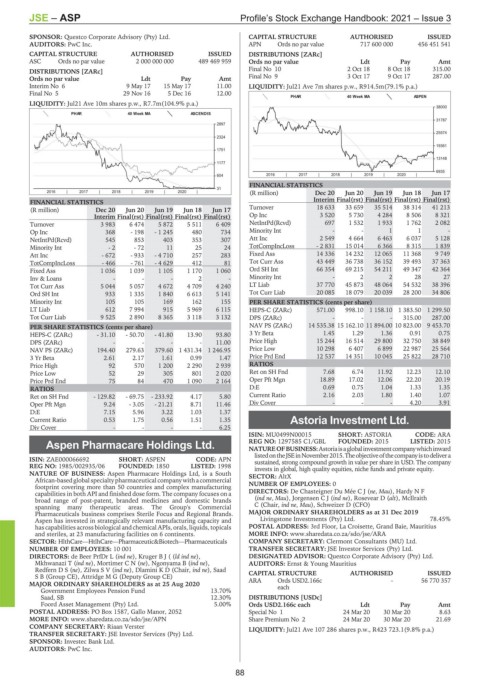

SPONSOR: Questco Corporate Advisory (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: PwC Inc. APN Ords no par value 717 600 000 456 451 541

CAPITAL STRUCTURE AUTHORISED ISSUED DISTRIBUTIONS [ZARc]

ASC Ords no par value 2 000 000 000 489 469 959 Ords no par value Ldt Pay Amt

DISTRIBUTIONS [ZARc] Final No 10 2 Oct 18 8 Oct 18 315.00

Ords no par value Ldt Pay Amt Final No 9 3 Oct 17 9 Oct 17 287.00

Interim No 6 9 May 17 15 May 17 11.00 LIQUIDITY: Jul21 Ave 7m shares p.w., R914.5m(79.1% p.a.)

Final No 5 29 Nov 16 5 Dec 16 12.00

PHAR 40 Week MA ASPEN

LIQUIDITY: Jul21 Ave 10m shares p.w., R7.7m(104.9% p.a.)

38000

PHAR 40 Week MA ASCENDIS

31787

2897

25574

2324

19361

1751

13148

1177

6935

604 2016 | 2017 | 2018 | 2019 | 2020 |

FINANCIAL STATISTICS

31

2016 | 2017 | 2018 | 2019 | 2020 | (R million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

FINANCIAL STATISTICS Interim Final(rst) Final(rst) Final(rst) Final(rst)

(R million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17 Turnover 18 633 33 659 35 514 38 314 41 213

Interim Final(rst) Final(rst) Final(rst) Final(rst) Op Inc 3 520 5 730 4 284 8 506 8 321

Turnover 3 983 6 474 5 872 5 511 6 409 NetIntPd(Rcvd) 697 1 532 1 933 1 762 2 082

Op Inc 368 - 198 - 1 245 480 734 Minority Int - - 1 1 -

NetIntPd(Rcvd) 545 853 403 353 307 Att Inc 2 549 4 664 6 463 6 037 5 128

Minority Int - 2 - 72 11 25 24 TotCompIncLoss - 2 831 15 014 6 366 8 315 1 839

Att Inc - 672 - 933 - 4 710 257 283 Fixed Ass 14 336 14 232 12 065 11 368 9 749

TotCompIncLoss - 466 - 761 - 4 629 412 81 Tot Curr Ass 43 449 36 738 36 152 39 493 37 363

Fixed Ass 1 036 1 039 1 105 1 170 1 060 Ord SH Int 66 354 69 215 54 211 49 347 42 364

Inv & Loans - - - 2 - Minority Int - 2 2 28 27

Tot Curr Ass 5 044 5 057 4 672 4 709 4 240 LT Liab 37 770 45 873 48 064 54 532 38 396

Ord SH Int 933 1 335 1 840 6 613 5 141 Tot Curr Liab 20 085 18 079 20 039 28 200 34 806

Minority Int 105 105 169 162 155 PER SHARE STATISTICS (cents per share)

LT Liab 612 7 994 915 5 969 6 115 HEPS-C (ZARc) 571.00 998.10 1 158.10 1 383.50 1 299.50

Tot Curr Liab 9 525 2 890 8 365 3 118 3 132 DPS (ZARc) - - - 315.00 287.00

PER SHARE STATISTICS (cents per share) NAV PS (ZARc) 14 535.38 15 162.10 11 894.00 10 823.00 9 453.70

HEPS-C (ZARc) - 31.10 - 50.70 - 41.80 13.90 93.80 3 Yr Beta 1.45 1.29 1.36 0.91 0.75

DPS (ZARc) - - - - 11.00 Price High 15 244 16 514 29 800 32 750 38 849

NAV PS (ZARc) 194.40 279.63 379.60 1 431.34 1 246.95 Price Low 10 298 6 407 6 899 22 987 25 564

3 Yr Beta 2.61 2.17 1.61 0.99 1.47 Price Prd End 12 537 14 351 10 045 25 822 28 710

Price High 92 570 1 200 2 290 2 939 RATIOS

Price Low 52 29 305 801 2 020 Ret on SH Fnd 7.68 6.74 11.92 12.23 12.10

Price Prd End 75 84 470 1 090 2 164 Oper Pft Mgn 18.89 17.02 12.06 22.20 20.19

RATIOS D:E 0.69 0.75 1.04 1.33 1.35

Ret on SH Fnd - 129.82 - 69.75 - 233.92 4.17 5.80 Current Ratio 2.16 2.03 1.80 1.40 1.07

Oper Pft Mgn 9.24 - 3.05 - 21.21 8.71 11.46 Div Cover - - - 4.20 3.91

D:E 7.15 5.96 3.22 1.03 1.37

Current Ratio 0.53 1.75 0.56 1.51 1.35 Astoria Investment Ltd.

Div Cover - - - - 6.25

AST

ISIN: MU0499N00015 SHORT: ASTORIA CODE: ARA

Aspen Pharmacare Holdings Ltd. REG NO: 1297585 C1/GBL FOUNDED: 2015 LISTED: 2015

NATUREOFBUSINESS:Astoriaisaglobalinvestmentcompanywhichinward

ASP listedontheJSEinNovember2015.Theobjectiveofthecompanyistodelivera

ISIN: ZAE000066692 SHORT: ASPEN CODE: APN sustained, strong compound growth in value per share in USD. The company

REG NO: 1985/002935/06 FOUNDED: 1850 LISTED: 1998 invests in global, high quality equities, niche funds and private equity.

NATURE OF BUSINESS: Aspen Pharmacare Holdings Ltd, is a South SECTOR: AltX

African-basedglobalspecialty pharmaceutical companywithacommercial

footprint covering more than 50 countries and complex manufacturing NUMBER OF EMPLOYEES: 0

capabilities in both API and finished dose form. The company focuses on a DIRECTORS: De Chasteigner Du MéeCJ(ne, Mau), Hardy N F

broad range of post-patent, branded medicines and domestic brands (ind ne, Mau), JorgensenCJ(ind ne), Rosevear D (alt), McIlraith

spanning many therapeutic areas. The Group's Commercial C (Chair, ind ne, Mau), Schweizer D (CFO)

Pharmaceuticals business comprises Sterile Focus and Regional Brands. MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

Aspen has invested in strategically relevant manufacturing capacity and Livingstone Investments (Pty) Ltd. 78.45%

has capabilities across biological and chemical APIs, orals, liquids, topicals POSTAL ADDRESS: 3rd Floor, La Croisette, Grand Baie, Mauritius

and steriles, at 23 manufacturing facilities on 6 continents. MORE INFO: www.sharedata.co.za/sdo/jse/ARA

SECTOR: HlthCare—HtlhCare—Pharmaceutic&Biotech—Pharmaceuticals COMPANY SECRETARY: Clermont Consultants (MU) Ltd.

NUMBER OF EMPLOYEES: 10 001 TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

DIRECTORS: de Beer PrfDr L (ind ne), KrugerBJ((ld ind ne), DESIGNATED ADVISOR: Questco Corporate Advisory (Pty) Ltd.

Mkhwanazi T (ind ne), MortimerCN(ne), Ngonyama B (ind ne), AUDITORS: Ernst & Young Mauritius

RedfernDS(ne), ZilwaSV(ind ne), Dlamini K D (Chair, ind ne), Saad

S B (Group CE), Attridge M G (Deputy Group CE) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 25 Aug 2020 ARA Ords USD2.166c - 56 770 357

each

Government Employees Pension Fund 13.70%

Saad, SB 12.30% DISTRIBUTIONS [USDc]

Foord Asset Management (Pty) Ltd. 5.00% Ords USD2.166c each Ldt Pay Amt

POSTAL ADDRESS: PO Box 1587, Gallo Manor, 2052 Special No 1 24 Mar 20 30 Mar 20 8.63

MORE INFO: www.sharedata.co.za/sdo/jse/APN Share Premium No 2 24 Mar 20 30 Mar 20 21.69

COMPANY SECRETARY: Riaan Verster LIQUIDITY: Jul21 Ave 107 286 shares p.w., R423 723.1(9.8% p.a.)

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd.

AUDITORS: PwC Inc.

88