Page 95 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 95

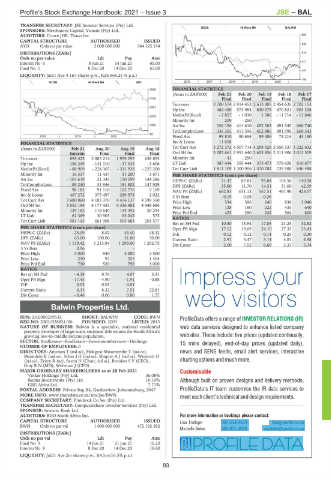

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – BAL

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

REDS 40 Week MA BALWIN

SPONSORS: Merchantec Capital, Vunani (Pty) Ltd.

AUDITORS: Crowe JHB, Thawt Inc 995

CAPITAL STRUCTURE AUTHORISED ISSUED

836

AYO Ords no par value 2 000 000 000 344 125 194

DISTRIBUTIONS [ZARc] 676

Ords no par value Ldt Pay Amt

Interim No 6 8 Jun 21 14 Jun 21 65.00 517

Final No 5 8 Dec 20 14 Dec 20 65.00

357

LIQUIDITY: Jul21 Ave 4 167 shares p.w., R26 666.2(-% p.a.)

198

SCOM 40 Week MA AYO 2016 | 2017 | 2018 | 2019 | 2020 |

5908 FINANCIAL STATISTICS

(Amts in ZAR'000) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17

4745 Final Final Final Final Final

Turnover 2 700 574 2 914 453 2 613 905 2 454 635 2 702 153

3581

Op Inc 462 450 573 984 630 075 670 821 903 338

NetIntPd(Rcvd) - 2 857 - 1 030 1 586 - 11 714 - 13 846

2418

Minority Int 209 - 250 - - -

1255 Att Inc 336 156 411 610 452 383 491 345 660 740

TotCompIncLoss 336 365 411 396 452 486 491 996 660 343

92

2018 | 2019 | 2020 | Fixed Ass 99 810 90 654 89 486 73 214 43 180

Inv & Loans 11 658 - - - -

FINANCIAL STATISTICS

(Amts in ZAR'000) Feb 21 Aug 20 Aug 19 Aug 18 Tot Curr Ass 5 272 372 4 507 714 4 298 926 3 556 337 3 222 632

Interim Final Final Final Ord SH Int 3 202 661 2 951 640 2 653 856 2 311 906 2 013 509

Turnover 895 422 2 885 214 1 959 292 638 893 Minority Int - 41 - 250 - - -

Op Inc - 156 249 - 141 310 - 37 345 - 5 606 LT Liab 387 434 355 444 375 473 579 628 610 677

NetIntPd(Rcvd) - 88 909 - 224 365 - 311 938 - 225 200 Tot Curr Liab 1 811 109 1 300 906 1 370 782 739 588 646 488

Minority Int 16 337 11 437 31 200 3 671 PER SHARE STATISTICS (cents per share)

Att Inc - 103 619 21 343 150 599 144 286 HEPS-C (ZARc) 71.47 87.83 95.84 104.56 140.58

TotCompIncLoss - 85 240 31 946 181 802 147 929 DPS (ZARc) 35.80 11.70 14.51 31.00 42.09

Fixed Ass 98 183 91 110 102 776 7 169 NAV PS (ZARc) 682.83 631.13 567.51 491.98 428.57

Inv & Loans 467 272 375 497 289 978 2 022 3 Yr Beta - 0.19 - 0.08 - 0.26 - -

Tot Curr Ass 3 680 060 4 183 370 4 476 137 4 598 350 Price High 534 396 640 830 1 040

Ord SH Int 3 852 194 4 177 452 4 336 482 4 448 686 Price Low 128 180 222 435 640

Minority Int 129 183 118 640 134 392 20 294 Price Prd End 425 350 242 564 800

LT Liab 61 369 30 903 63 042 575 RATIOS

Tot Curr Liab 581 143 661 908 595 683 201 577

Ret on SH Fnd 10.50 13.94 17.05 21.25 32.82

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 17.12 19.69 24.10 27.33 33.43

HEPS-C (ZARc) - 25.09 8.02 43.40 48.32 D:E 0.12 0.12 0.14 0.25 0.30

DPS (ZARc) 65.00 100.00 51.00 30.00 Current Ratio 2.91 3.47 3.14 4.81 4.98

NAV PS (ZARc) 1 119.42 1 213.94 1 299.00 1 292.75 Div Cover 2.00 7.52 6.60 3.37 3.34

3 Yr Beta 0.96 - - -

Price High 3 000 940 3 000 4 500

Price Low 250 92 555 1 404

Price Prd End 730 520 799 3 000

RATIOS

Ret on SH Fnd - 4.38 0.76 4.07 3.31

Oper Pft Mgn - 17.45 - 4.90 - 1.91 - 0.88

D:E 0.02 0.01 0.01 -

Current Ratio 6.33 6.32 7.51 22.81

Div Cover - 0.46 0.06 0.86 1.57

Balwin Properties Ltd.

BAL

ISIN: ZAE000209532 SHORT: BALWIN CODE: BWN

REG NO: 2003/028851/06 FOUNDED: 2003 LISTED: 2015

NATURE OF BUSINESS: Balwin is a specialist, national residential

property developer of large-scale, sectional title estates for South Africa’s

growing low-to-middle income population.

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

NUMBER OF EMPLOYEES: 0

DIRECTORS: Amosun T (ind ne), Mokgosi-Mwantembe T (ind ne),

Mzondeki K (ind ne), ScherJH(ind ne), ShapiroAJ(ind ne), Westcott D

(ind ne), Zekry R (ne), Saven H (Chair, ind ne), Brookes S V (CEO),

Gray R N (MD), Weltman J (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021

Volker Holdings (Pty) Ltd. 36.08%

Rodna Investments (Pty) Ltd. 10.10%

GRE Africa Ltd. 7.71%

POSTAL ADDRESS: Private Bag X4, Gardenview, Johannesburg, 2047

MORE INFO: www.sharedata.co.za/sdo/jse/BWN

COMPANY SECRETARY: Fluidrock Co Sec (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd.

AUDITORS: BDO South Africa Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

BWN Ords no par val 1 000 000 000 472 192 592

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt

Final No 9 14 Jun 21 21 Jun 21 16.20

Interim No 8 8 Dec 20 14 Dec 20 19.60

LIQUIDITY: Jul21 Ave 2m shares p.w., R4.5m(16.5% p.a.)

93