Page 143 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 143

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – INV

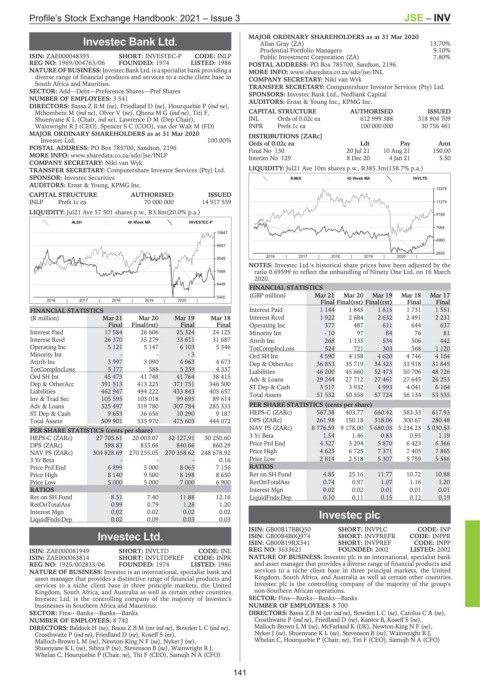

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

Investec Bank Ltd. Allan Gray (ZA) 13.70%

Prudential Portfolio Managers 9.10%

INV

ISIN: ZAE000048393 SHORT: INVESTEC-P CODE: INLP Public Investment Corporation (ZA) 7.80%

REG NO: 1969/004763/06 FOUNDED: 1974 LISTED: 1986 POSTAL ADDRESS: PO Box 785700, Sandton, 2196

NATURE OF BUSINESS:Investec Bank Ltd. is a specialist bank providing a MORE INFO: www.sharedata.co.za/sdo/jse/INL

diverse range of financial products and services to a niche client base in COMPANY SECRETARY: Niki van Wyk

South Africa and Mauritius. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SECTOR: Add—Debt—Preference Shares—Pref Shares SPONSORS: Investec Bank Ltd., Nedbank Capital

NUMBER OF EMPLOYEES: 3 541 AUDITORS: Ernst & Young Inc., KPMG Inc.

DIRECTORS: BassaZBM(ne), Friedland D (ne), Hourquebie P (ind ne),

Mthombeni M (ind ne), Olver V (ne), QhenaMG(ind ne), Titi F, CAPITAL STRUCTURE AUTHORISED ISSUED

Shuenyane K L (Chair, ind ne), Lawrence D M (Dep Chair), INL Ords of 0.02c ea 612 999 388 318 904 709

Wainwright R J (CEO), Spencer S C (COO), van der Walt M (FD) INPR Prefs 1c ea 100 000 000 30 756 461

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 DISTRIBUTIONS [ZARc]

Investec Ltd. 100.00% Ords of 0.02c ea Ldt Pay Amt

POSTAL ADDRESS: PO Box 785700, Sandton, 2196 Final No 130 20 Jul 21 10 Aug 21 150.00

MORE INFO: www.sharedata.co.za/sdo/jse/INLP Interim No 129 8 Dec 20 4 Jan 21 5.50

COMPANY SECRETARY: Niki van Wyk

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Jul21 Ave 10m shares p.w., R385.3m(158.7% p.a.)

SPONSOR: Investec Securities BANK 40 Week MA INVLTD

AUDITORS: Ernst & Young, KPMG Inc.

13378

CAPITAL STRUCTURE AUTHORISED ISSUED

INLP Prefs 1c ea 70 000 000 14 917 559 11274

LIQUIDITY: Jul21 Ave 57 501 shares p.w., R3.8m(20.0% p.a.) 9169

ALSH 40 Week MA INVESTEC-P

7064

10647

4960

9597

2855

2016 | 2017 | 2018 | 2019 | 2020 |

8548

NOTES: Investec Ltd.'s historical share prices have been adjusted by the

7499 ratio 0.69599 to reflect the unbundling of Ninety One Ltd. on 16 March

2020.

6449

FINANCIAL STATISTICS

(GBP million) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17

5400

2016 | 2017 | 2018 | 2019 | 2020 | Final Final(rst) Final(rst) Final Final

FINANCIAL STATISTICS Interest Paid 1 144 1 845 1 815 1 731 1 551

(R million) Mar 21 Mar 20 Mar 19 Mar 18 Interest Rcvd 1 922 2 684 2 632 2 491 2 231

Final Final(rst) Final Final Operating Inc 377 487 611 644 637

Interest Paid 17 584 26 606 25 324 24 125 Minority Int - 10 97 84 76 81

Interest Rcvd 26 370 35 279 33 611 31 687 Attrib Inc 268 1 135 534 506 442

Operating Inc 5 121 5 147 6 103 5 346 TotCompIncLoss 524 721 303 568 1 120

Minority Int - - - 3 - Ord SH Int 4 590 4 158 4 620 4 746 4 164

Attrib Inc 3 997 3 090 4 963 4 673 Dep & OtherAcc 36 853 35 719 34 323 33 918 31 845

TotCompIncLoss 5 177 588 5 259 4 337 Liabilities 46 200 45 660 52 473 50 706 48 726

Ord SH Int 45 473 41 748 41 764 38 415 Adv & Loans 29 244 27 712 27 461 27 645 26 253

Dep & OtherAcc 391 513 413 225 371 751 346 500 ST Dep & Cash 3 517 3 932 4 993 4 041 6 164

Liabilities 462 947 494 222 433 843 405 657

Inv & Trad Sec 105 595 103 018 99 695 89 614 Total Assets 51 532 50 558 57 724 56 134 53 535

Adv & Loans 325 497 319 780 307 784 285 333 PER SHARE STATISTICS (cents per share)

ST Dep & Cash 9 653 36 656 10 290 9 187 HEPS-C (ZARc) 567.38 403.77 660.42 583.33 617.93

Total Assets 509 901 535 970 475 603 444 072 DPS (ZARc) 261.98 150.18 318.06 300.67 280.48

NAV PS (ZARc) 8 776.59 9 178.00 5 680.03 5 234.23 5 030.53

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 27 705.61 20 003.07 32 127.91 30 250.60 3 Yr Beta 1.54 1.46 0.83 0.95 1.19

DPS (ZARc) 598.83 833.66 840.66 860.29 Price Prd End 4 327 3 294 5 870 6 423 6 366

NAV PS (ZARc) 304 828.69 270 255.05 270 358.62 248 678.92 Price High 4 625 6 725 7 371 7 405 7 865

3 Yr Beta - - - 0.16 Price Low 2 814 2 518 5 307 5 759 5 586

Price Prd End 6 899 5 000 8 065 7 156 RATIOS

Price High 8 140 9 500 8 198 8 650 Ret on SH Fund 4.85 25.16 11.77 10.72 10.88

Price Low 5 000 5 000 7 000 6 900 RetOnTotalAss 0.74 0.97 1.07 1.16 1.20

RATIOS Interest Mgn 0.02 0.02 0.01 0.01 0.01

Ret on SH Fund 8.51 7.40 11.88 12.16 LiquidFnds:Dep 0.10 0.11 0.15 0.12 0.19

RetOnTotalAss 0.99 0.79 1.28 1.20

Interest Mgn 0.02 0.02 0.02 0.02 Investec plc

LiquidFnds:Dep 0.02 0.09 0.03 0.03

INV

ISIN: GB00B17BBQ50 SHORT: INVPLC CODE: INP

Investec Ltd. ISIN: GB00B4B0Q974 SHORT: INVPREFR CODE: INPPR

ISIN: GB00B19RX541 SHORT: INVPREF CODE: INPP

INV

ISIN: ZAE000081949 SHORT: INVLTD CODE: INL REG NO: 3633621 FOUNDED: 2002 LISTED: 2002

ISIN: ZAE000063814 SHORT: INVLTDPREF CODE: INPR NATURE OF BUSINESS: Investec plc is an international, specialist bank

REG NO: 1925/002833/06 FOUNDED: 1974 LISTED: 1986 and asset manager that provides a diverse range of financial products and

NATURE OF BUSINESS: Investec is an international, specialist bank and services to a niche client base in three principal markets, the United

asset manager that provides a distinctive range of financial products and Kingdom, South Africa, and Australia as well as certain other countries.

services to a niche client base in three principle markets, the United Investec plc is the controlling company of the majority of the group's

Kingdom, South Africa, and Australia as well as certain other countries. non-Southern African operations.

Investec Ltd. is the controlling company of the majority of Investec's SECTOR: Fins—Banks—Banks—Banks

businesses in Southern Africa and Mauritius. NUMBER OF EMPLOYEES: 8 700

SECTOR: Fins—Banks—Banks—Banks DIRECTORS: Bassa Z B M (snr ind ne), Bowden L C (ne), Carolus C A (ne),

NUMBER OF EMPLOYEES: 8 742 Crosthwaite P (ind ne), Friedland D (ne), Kantor B, Koseff S (ne),

DIRECTORS: Baldock H (ne), Bassa Z B M (snr ind ne), Bowden L C (ind ne), Malloch-Brown L M (ne), McFarland K (UK), Newton-King N F (ne),

Crosthwaite P (ind ne), Friedland D (ne), Koseff S (ne), Nyker J (ne), Shuenyane K L (ne), Stevenson B (ne), Wainwright R J,

Malloch-Brown L M (ne), Newton-King N F (ne), Nyker J (ne), Whelan C, Hourquebie P (Chair, ne), Titi F (CEO), Samujh N A (CFO)

Shuenyane K L (ne), Sibiya P (ne), Stevenson B (ne), Wainwright R J,

Whelan C, Hourquebie P (Chair, ne), Titi F (CEO), Samujh N A (CFO)

141