Page 142 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 142

JSE – IND Profile’s Stock Exchange Handbook: 2021 – Issue 3

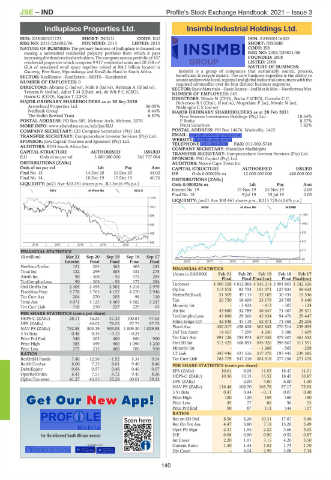

Indluplace Properties Ltd. Insimbi Industrial Holdings Ltd.

IND INS

ISIN: ZAE000201125 SHORT: INDLU CODE: ILU ISIN: ZAE000116828

REG NO: 2013/226082/06 FOUNDED: 2013 LISTED: 2015 SHORT: INSIMBI

NATURE OF BUSINESS: The primary business of Indluplace is focused on CODE: ISB

owning a substantial residential property portfolio from which it pays REG NO: 2002/029821/06

increasingdividendstoitsshareholders.Thecompanyownsaportfolioof167 FOUNDED: 2008

residential properties which comprise 9 917 residential units and 20 538 m 2 LISTED: 2008

GLA of associated retail space together valued at R4.2 billion located in NATURE OF BUSINESS:

Gauteng, Free State, Mpumalanga and KwaZulu-Natal in South Africa. Insimbi is a group of companies that sustainably source, process,

SECTOR: RealEstate—RealEstate—REITS—Residential beneficiate & recycle metals. The core business expertise is the ability to

sourceandprovidelocal,regionalandglobalindustrialconsumerswiththe

NUMBER OF EMPLOYEES: 0 required commodity over its four distinct business segments.

DIRECTORS: Abrams C (ind ne), Noik S (ind ne), Rehman A (ld ind ne), SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—NonferrousMet

Tetyana N (ind ne), Adler T M (Chair, ne), de Wit P C (CEO), NUMBER OF EMPLOYEES: 645

Harris G (COO), Kaplan T (CFO) DIRECTORS: Winde N (CFO), Botha F (CEO), Coombs C C,

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020 Dickerson R I (Chair, ld ind ne), Mogotlane P (ne), Mwale N (ne),

Arrowhead Properties Ltd. 56.05% NtshingilaCS(ind ne)

Nedbank Group 8.44% MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021

The Buffet Bewind Trust 6.57% New Seasons Investments Holdings (Pty) Ltd. 18.64%

POSTAL ADDRESS: PO Box 685, Melrose Arch, Melrose, 2076 F Botha 8.37%

MORE INFO: www.sharedata.co.za/sdo/jse/ILU Pruta Securities 7.82%

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd. POSTAL ADDRESS: PO Box 14676, Wadeville, 1422

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. EMAIL: cosec@insimbi-group.co.za.

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd. WEBSITE: insimbi-group.co.za FAX: 011-902-5749

TELEPHONE: 011-902-6930

AUDITORS: BDO South Africa Inc. COMPANY SECRETARY: Matseliso Madhlophe

CAPITAL STRUCTURE AUTHORISED ISSUED TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

ILU Ords of no par val 3 000 000 000 341 797 084

SPONSOR: PSG Capital (Pty) Ltd.

DISTRIBUTIONS [ZARc] AUDITORS: Moore Cape Town Inc

Ords of no par val Ldt Pay Amt CAPITAL STRUCTURE AUTHORISED ISSUED

Final No 15 14 Dec 20 21 Dec 20 44.02 ISB Ords 0.000025c ea 12 000 000 000 440 000 000

Final No 14 10 Dec 19 17 Dec 19 40.76 DISTRIBUTIONS [ZARc]

LIQUIDITY: Jul21 Ave 420 241 shares p.w., R1.3m(6.4% p.a.) Ords 0.000025c ea Ldt Pay Amt

Interim No 19 19 Nov 19 25 Nov 19 2.00

REIV 40 Week MA INDLU

Final No 18 9 Jul 19 15 Jul 19 2.00

1216

LIQUIDITY: Jun21 Ave 300 461 shares p.w., R213 729.6(3.6% p.a.)

1021 INDM 40 Week MA INSIMBI

826 1354

1093

630

435 832

240 572

2016 | 2017 | 2018 | 2019 | 2020 |

FINANCIAL STATISTICS 311

(R million) Mar 21 Sep 20 Sep 19 Sep 18 Sep 17

Interim Final Final Final Final 2016 | 2017 | 2018 | 2019 | 2020 | 50

NetRent/InvInc 121 283 362 404 243 FINANCIAL STATISTICS

Total Inc 122 299 385 431 275 (Amts in ZAR'000) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17

Attrib Inc 90 - 308 - 56 172 284 Final Final Final(rst) Final Final(rst)

TotCompIncLoss 90 - 308 - 56 172 284 Turnover 4 909 528 4 812 068 4 545 214 3 491 803 1 342 526

Ord UntHs Int 2 405 2 455 2 902 3 216 2 979

FixedAss/Prop 3 778 3 765 4 157 4 270 2 946 Op Inc 113 518 93 733 101 071 127 831 54 433

Tot Curr Ass 204 270 203 98 110 NetIntPd(Rcvd) 51 509 49 115 32 105 30 434 15 546

Total Ass 4 071 4 123 4 469 4 582 3 247 Tax 20 750 18 409 25 179 28 769 9 440

Tot Curr Liab 118 270 227 229 65 Minority Int - - 3 423 - 813 - 307 - 124

Att Inc 43 880 32 789 46 647 71 467 29 571

PER SHARE STATISTICS (cents per share) TotCompIncLoss 43 880 29 366 45 834 94 476 29 447

HEPS-C (ZARc) 28.11 16.25 37.32 100.81 97.65

DPS (ZARc) - 44.02 78.25 97.75 97.75 Hline Erngs-CO 42 848 41 118 52 871 71 368 29 206

NAV PS (ZARc) 782.88 803.19 903.04 1 009.30 1 029.98 Fixed Ass 436 017 458 628 362 842 270 514 239 095

3 Yr Beta 0.48 0.35 - 0.15 - 0.24 - Def Tax Asset 14 457 7 299 4 240 3 388 7 609

Price Prd End 340 303 460 860 960 Tot Curr Ass 991 126 785 973 617 038 479 307 461 352

Price High 385 459 900 1 090 1 200 Ord SH Int 512 425 468 893 445 926 398 867 311 551

Price Low 275 215 400 700 910 Minority Int - - - 1 268 - 565 - 258

RATIOS LT Liab 347 946 421 516 317 278 197 443 239 385

RetOnSH Funds 7.46 - 12.56 - 1.92 5.34 9.54 Tot Curr Liab 763 779 547 216 404 918 277 158 271 475

RetOnTotAss 6.00 7.25 8.61 9.40 8.46 PER SHARE STATISTICS (cents per share)

Debt:Equity 0.64 0.57 0.46 0.40 0.07 EPS (ZARc) 10.61 8.08 11.93 18.47 11.01

OperRetOnInv 6.43 7.51 8.72 9.45 8.26 HEPS-C (ZARc) 10.36 10.13 13.52 18.45 10.87

OpInc:Turnover 41.27 43.95 55.28 60.01 59.33

DPS (ZARc) - 2.00 4.00 6.00 1.50

NAV PS (ZARc) 116.46 108.70 103.78 97.17 75.93

3 Yr Beta 0.47 0.44 - 0.11 0.07 0.40

G Geett OOuurr NNeeww A Apppp!! Price High 120 120 159 160 150

49

Price Low

55

96

77

88

Price Prd End 90 87 113 144 107

RATIOS

Scan here Ret on SH Fnd 8.56 6.26 10.31 17.87 9.46

Ret On Tot Ass 4.47 3.80 7.18 13.26 5.49

Oper Pft Mgn 2.31 1.95 2.22 3.66 4.05

For the informed South African investor D:E 0.68 0.90 0.90 0.52 0.87

Int Cover 2.20 1.91 3.15 4.20 3.50

Available from Current Ratio 1.30 1.44 1.52 1.73 1.70

Powered by

Div Cover - 4.04 2.98 3.08 7.34

140