Page 145 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 145

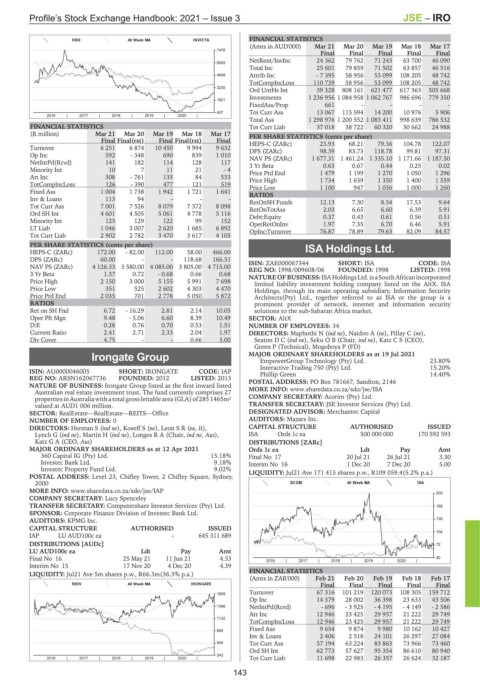

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – IRO

IIND 40 Week MA INVICTA FINANCIAL STATISTICS

(Amts in AUD'000) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17

7476

Final Final Final Final Final

NetRent/InvInc 24 362 79 762 71 243 63 700 46 090

6062

Total Inc 25 601 79 859 71 502 63 857 46 516

4648 Attrib Inc - 7 395 58 956 53 099 108 205 48 742

TotCompIncLoss 110 739 58 956 53 099 108 205 48 742

3235

Ord UntHs Int 39 328 808 161 621 477 617 363 505 668

Investments 1 236 956 1 084 958 1 062 767 986 696 779 350

1821

FixedAss/Prop 661 - - - -

407 Tot Curr Ass 13 067 115 594 14 200 10 976 5 906

2016 | 2017 | 2018 | 2019 | 2020 |

Total Ass 1 298 976 1 200 552 1 083 411 998 639 786 532

FINANCIAL STATISTICS Tot Curr Liab 37 018 38 722 60 320 30 662 24 988

(R million) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17 PER SHARE STATISTICS (cents per share)

Final Final(rst) Final Final(rst) Final HEPS-C (ZARc) 23.93 68.21 79.36 104.78 122.07

Turnover 6 251 6 874 10 450 9 994 9 632 DPS (ZARc) 98.39 83.73 118.78 99.81 97.31

Op Inc 592 - 348 690 839 1 010 NAV PS (ZARc) 1 677.31 1 461.24 1 335.10 1 171.66 1 187.50

NetIntPd(Rcvd) 141 182 114 128 117 3 Yr Beta 0.63 0.67 0.44 0.25 0.02

Minority Int 10 7 11 21 - 4 Price Prd End 1 479 1 199 1 270 1 050 1 296

Att Inc 308 - 761 135 84 533 Price High 1 734 1 639 1 350 1 400 1 559

TotCompIncLoss 126 - 390 477 121 519 Price Low 1 100 947 1 036 1 000 1 260

Fixed Ass 1 004 1 738 1 942 1 721 1 641 RATIOS

Inv & Loans 113 94 - - - RetOnSH Funds 12.13 7.30 8.54 17.53 9.64

Tot Curr Ass 7 001 7 526 8 079 7 372 8 098 RetOnTotAss 2.03 6.65 6.60 6.39 5.91

Ord SH Int 4 601 4 505 5 061 4 778 5 116 Debt:Equity 0.37 0.43 0.61 0.56 0.51

Minority Int 125 129 122 99 152 OperRetOnInv 1.97 7.35 6.70 6.46 5.91

LT Liab 1 046 3 007 2 620 1 685 6 892 OpInc:Turnover 76.87 78.89 79.63 82.09 84.57

Tot Curr Liab 2 902 2 782 3 470 3 617 4 105

PER SHARE STATISTICS (cents per share) ISA Holdings Ltd.

HEPS-C (ZARc) 172.00 - 82.00 112.00 58.00 466.00

DPS (ZARc) 60.00 - - 118.68 166.51 ISIN: ZAE000067344 SHORT: ISA CODE: ISA

ISA

NAV PS (ZARc) 4 126.33 3 580.00 4 085.00 3 805.00 4 715.00 REG NO: 1998/009608/06 FOUNDED: 1998 LISTED: 1998

3 Yr Beta 1.37 0.72 - 0.68 0.66 0.68 NATUREOF BUSINESS:ISAHoldingsLtd.isaSouthAfricanincorporated

Price High 2 150 3 000 5 155 5 991 7 698 limited liability investment holding company listed on the AltX. ISA

Price Low 351 525 2 602 4 303 4 470 Holdings, through its main operating subsidiary, Information Security

Price Prd End 2 035 701 2 778 5 050 5 872 Architects(Pty) Ltd., together referred to as ISA or the group is a

RATIOS prominent provider of network, internet and information security

Ret on SH Fnd 6.72 - 16.29 2.81 2.14 10.05 solutions to the sub-Saharan Africa market.

Oper Pft Mgn 9.48 - 5.06 6.60 8.39 10.49 SECTOR: AltX

D:E 0.28 0.76 0.70 0.53 1.51 NUMBER OF EMPLOYEES: 34

Current Ratio 2.41 2.71 2.33 2.04 1.97 DIRECTORS: Maphothi N (ind ne), Naidoo A (ne), Pillay C (ne),

Div Cover 4.75 - - 0.66 3.00 SeatonDC(ind ne), Seku O B (Chair, ind ne), Katz C S (CEO),

Green P (Technical), Mogoboya P (FD)

Irongate Group MAJOR ORDINARY SHAREHOLDERS as at 19 Jul 2021 23.80%

EmpowerGroup Technology (Pty) Ltd.

IRO Interactive Trading 750 (Pty) Ltd. 15.20%

ISIN: AU0000046005 SHORT: IRONGATE CODE: IAP Phillip Green 14.40%

REG NO: ARSN162067736 FOUNDED: 2012 LISTED: 2013

NATURE OF BUSINESS: Irongate Group listed as the first inward listed POSTAL ADDRESS: PO Box 781667, Sandton, 2146

Australian real estate investment trust. The fund currently comprises 27 MORE INFO: www.sharedata.co.za/sdo/jse/ISA

propertiesinAustraliawithatotalgrosslettablearea(GLA)of285 1465m² COMPANY SECRETARY: Acorim (Pty) Ltd.

valued at AUD1 006 million. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SECTOR: RealEstate—RealEstate—REITS—Office DESIGNATED ADVISOR: Merchantec Capital

NUMBER OF EMPLOYEES: 0 AUDITORS: Mazars Inc.

DIRECTORS: Herman S (ind ne), Koseff S (ne), LeonSR(ne, It), CAPITAL STRUCTURE AUTHORISED ISSUED

Lynch G (ind ne), Martin H (ind ne), Longes R A (Chair, ind ne, Aus), ISA Ords 1c ea 500 000 000 170 592 593

Katz G A (CEO, Aus) DISTRIBUTIONS [ZARc]

MAJOR ORDINARY SHAREHOLDERS as at 12 Apr 2021 Ords 1c ea Ldt Pay Amt

360 Capital IG (Pty) Ltd. 15.18% Final No 17 20 Jul 21 26 Jul 21 3.30

Investec Bank Ltd. 9.18% Interim No 16 1 Dec 20 7 Dec 20 5.00

Investec Property Fund Ltd. 9.02% LIQUIDITY: Jul21 Ave 171 415 shares p.w., R109 059.4(5.2% p.a.)

POSTAL ADDRESS: Level 23, Chifley Tower, 2 Chifley Square, Sydney,

2000 SCOM 40 Week MA ISA

MORE INFO: www.sharedata.co.za/sdo/jse/IAP

200

COMPANY SECRETARY: Lucy Spenceley

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 168

SPONSOR: Corporate Finance Division of Investec Bank Ltd.

AUDITORS: KPMG Inc. 136

CAPITAL STRUCTURE AUTHORISED ISSUED

104

IAP LU AUD100c ea - 645 311 689

DISTRIBUTIONS [AUDc] 72

LU AUD100c ea Ldt Pay Amt

Final No 16 25 May 21 11 Jun 21 4.53 2016 | 2017 | 2018 | 2019 | 2020 | 40

Interim No 15 17 Nov 20 4 Dec 20 4.39

FINANCIAL STATISTICS

LIQUIDITY: Jul21 Ave 5m shares p.w., R66.3m(36.3% p.a.)

(Amts in ZAR'000) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17

REIV 40 Week MA IRONGATE Final Final Final Final Final

Turnover 67 316 101 219 120 073 108 305 159 712

1659

Op Inc 14 379 28 002 36 398 23 633 43 506

1396 NetIntPd(Rcvd) - 696 - 3 925 - 4 195 - 4 149 - 2 586

Att Inc 12 946 23 425 29 957 21 222 29 749

1132

TotCompIncLoss 12 946 23 425 29 957 21 222 29 749

Fixed Ass 9 654 9 874 9 980 10 162 10 427

869

Inv & Loans 2 406 2 518 24 101 26 297 27 084

606 Tot Curr Ass 57 194 63 224 83 863 73 966 73 460

Ord SH Int 62 773 57 627 95 354 86 610 80 940

343

2016 | 2017 | 2018 | 2019 | 2020 | Tot Curr Liab 11 698 22 983 26 357 26 624 32 187

143