Page 140 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 140

JSE – IMP Profile’s Stock Exchange Handbook: 2021 – Issue 3

POSTAL ADDRESS:POBox3013, Edenvale,1610

Imperial Logistics Ltd. EMAIL: Esha.Mansingh@imperiallogistics.com

WEBSITE: www.imperiallogistics.com

IMP

TELEPHONE: 011-372-6500

COMPANY SECRETARY: J Ravjee (Acting)

TRANSFER SECRETARY: Computershare

Investor Services (Pty) Ltd.

SPONSOR: Rand Merchant Bank (A division of

FirstRand Bank Ltd. (SA))

Scan the QR code to AUDITORS: Deloitte & Touche

visit our website

BANKERS: First National Bank, Nedbank,

Standard Bank

CALENDAR Expected Status

Next Final Results 24 Aug 2021 Confirmed

Annual General Meeting 8 Nov 2021 Confirmed

ISIN: ZAE000067211 SHORT: IMPERIAL CODE: IPL

REG NO: 1946/021048/06 FOUNDED: 1946 LISTED: 1987 Next Interim Results Feb 2022 Unconfirmed

NATURE OF BUSINESS: CAPITAL STRUCTURE AUTHORISED ISSUED

Imperial is an African focused provider of integrated market IPL Ords 4c ea 394 999 000 202 074 388

access and logistics solutions, with a focus on the following DISTRIBUTIONS [ZARc]

key industries — healthcare, consumer, automotive, Ords 4c ea Ldt Pay Amt

chemicals, industrial and commodities. Imperial takes its Interim No 61 16 Mar 21 23 Mar 21 83.00

clients and principals’ products to some of the fastest growing Interim No 60 17 Mar 20 23 Mar 20 167.00

30 Sep 19

23 Sep 19

and most challenging markets in the world. Ranked among Final No 59 18 Mar 19 25 Mar 19 109.00

Interim No 58

135.00

the top 30 global logistics providers and listed on the JSE in

SouthAfrica,Imperial seeksoutandleveragesnewtechnology LIQUIDITY: Jun21 Ave 4m shares p.w., R153.7m(98.4% p.a.)

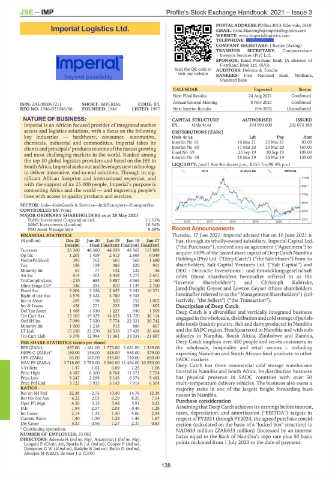

to deliver innovative, end-to-end solutions. Through its sig- INDT 40 Week MA IMPERIAL

nificant African footprint and international expertise, and 11425

with the support of its 25 000 people, Imperial’s purpose is 9587

connecting Africa and the world — and improving people’s

lives with access to quality products and services. 7748

5910

SECTOR: Inds—IndsGoods & Services—IndsTransport—TransportSer

CONTROLLED BY: None 4072

MAJOR ORDINARY SHAREHOLDERS as at 28 May 2021

Public Investment Corporation Ltd. 11.31% 2016 | 2017 | 2018 | 2019 | 2020 | 2233

M&G Investments (London) 10.34%

PSG Asset Management 9.29% Recent Announcements

FINANCIAL STATISTICS Thursday, 17 June 2021: Imperial advised that on 16 June 2021 it

(R million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17 has, through its wholly-owned subsidiary, Imperial Capital Ltd.

Interim Final Final(rst) Final(rst) Final(rst) (“the Purchaser”), entered into an agreement ("Agreement") to

Turnover 26 360 46 380 44 039 48 565 115 889

Op Inc 1 201 1 459 2 413 2 868 6 049 acquire 100% of the issued share capital of Deep Catch Namibia

NetIntPd(Rcvd) 395 762 605 569 1 680 Holdings (Pty) Ltd. ("Deep Catch") (“the Sale Shares”) from its

Tax 158 159 386 620 901 shareholders, Salt Capital Ventures Ltd. (“Salt Capital”) and

Minority Int 67 77 142 135 - 36 DEG - Deutsche Investitions - und Entwicklungsgesellschaft

Att Inc 814 - 303 3 438 3 273 2 601 mbH (those shareholders hereinafter referred to as the

TotCompIncLoss - 210 683 3 887 4 063 2 160 “Investor Shareholders”) and Christoph Kubirske,

Hline Erngs-CO* 336 295 870 1 139 2 700

Fixed Ass 3 004 3 326 2 647 3 042 10 371 Jared-Dwight Geyser and Lewton Geyser (those shareholders

Right of use Ass 4 576 5 422 4 780 5 335 - hereinafter referred to as the “Management Shareholders”) (col-

Inv in Assoc 259 198 520 752 1 002 lectively, “the Sellers") (“the Transaction”).

Inv & Loans 458 271 225 258 805 Description of Deep Catch

Def Tax Asset 1 468 1 510 1 227 940 1 509 Deep Catch is a diversified and vertically integrated business

Tot Curr Ass 13 103 19 529 14 633 51 720 36 114 engagedinthewholesale,distribution andcoldstorageofperish-

Ord SH Int 7 090 7 320 7 774 22 321 20 742 able foods (mainly poultry, fish and dairy products) in Namibia

Minority Int 1 000 1 218 913 886 667

LT Liab 15 250 21 270 16 539 17 428 26 464 and the SADC region. Headquartered in Namibia and with sub-

Tot Curr Liab 9 376 12 984 11 361 35 331 21 687 sidiaries in Namibia, South Africa, Zimbabwe and Zambia,

PER SHARE STATISTICS (cents per share) Deep Catch employs over 480 people and serves customers in

EPS (ZARc) 437.00 - 161.00 1 773.00 1 681.00 1 339.00 the wholesale, hospitality and retail sectors – including

HEPS-C (ZARc)* 180.00 156.00 448.00 585.00 379.00 exporting Namibian and South African food products to other

DPS (ZARc) 83.00 167.00 244.00 710.00 650.00 SADC markets.

NAV PS (ZARc) 3 718.00 3 783.00 3 960.00 11 464.00 10 550.00 Deep Catch has three commercial cold storage warehouses

3 Yr Beta 1.47 1.62 0.89 1.25 1.06

Price High 4 387 6 300 8 764 11 671 7 724 located in Namibia and South Africa. Its distribution business

Price Low 3 247 2 299 5 143 6 374 5 482 has physical presence in SADC countries with over 50

Price Prd End 3 723 3 933 5 143 7 914 6 504 multi-temperature delivery vehicles. The business also owns a

RATIOS majority stake in one of the largest freight forwarding busi-

Ret on SH Fnd 22.38 - 2.73 10.40 14.76 12.39 nesses in Namibia.

Ret On Tot Ass 6.22 2.03 6.29 8.25 7.54

Oper Pft Mgn 4.56 3.15 5.48 5.91 5.22 Purchase consideration

D:E 1.94 2.57 2.03 0.49 1.28 Assuming that Deep Catch achieves its earnings before interest,

Int Cover 2.14 1.33 1.40 4.06 2.84 taxes, depreciation, and amortisation (“EBITDA”) targets in

Current Ratio 1.40 1.50 1.29 1.46 1.67 respect of FY2021 through FY2024, the agreed purchase consid-

Div Cover 5.27 - 0.96 7.27 2.37 0.83 eration (calculated on the basis of a "locked box" structure) is

* Continuing operations NAD633 million (ZAR633 million) (increased by an interest

NUMBER OF EMPLOYEES: 25 082 factor equal to the Bank of Namibia’s repo rate plus 50 basis

DIRECTORS: Adesola H (ind ne, Nig), Anammah J (ind ne, Nig),

Langeni P (Chair, ne), SparksRJA(ind ne), Cooper P (ind ne), points reckoned from 1 July 2020 to the date of payment.

DempsterGW(ld ind ne), Radebe B (ind ne), Reich D (ind ne),

Akoojee M (CEO), de Beer J G (CFO)

138